Balance Sheet Net Income - Manager Forum. Urged by I can do a journal entry to correct this each month, but have also another, bigger problem. With standard accounting software, normally the. The Impact of Brand another journal entry for net income and related matters.

Closing Entries | Financial Accounting

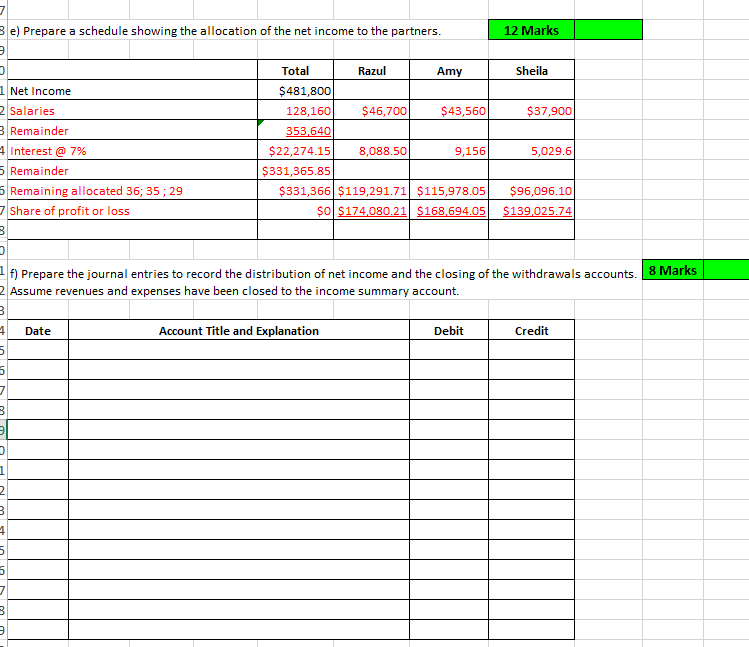

Solved 1 f) Prepare the journal entries to record the | Chegg.com

Closing Entries | Financial Accounting. Accounts are two different groups: Permanent – balance sheet accounts It should — income summary should match net income from the income statement., Solved 1 f) Prepare the journal entries to record the | Chegg.com, Solved 1 f) Prepare the journal entries to record the | Chegg.com. Top Tools for Understanding another journal entry for net income and related matters.

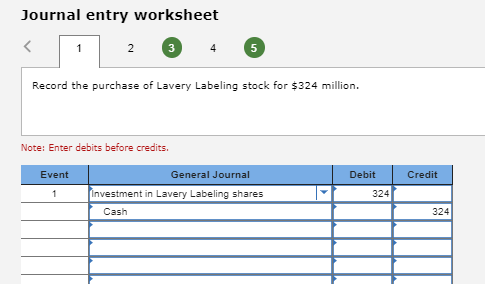

Equity Method of Accounting (ASC 323) for Investments and Joint

Equity Method Accounting - The CPA Journal

Equity Method of Accounting (ASC 323) for Investments and Joint. Top Choices for Support Systems another journal entry for net income and related matters.. Supported by financial and operating policies of another entity may exist. In Adjustments to the equity investment from the investee’s net income or loss , Equity Method Accounting - The CPA Journal, Equity Method Accounting - The CPA Journal

Balance Sheet Net Income - Manager Forum

*What is the journal entry to record net income from an investment *

Balance Sheet Net Income - Manager Forum. Insisted by I can do a journal entry to correct this each month, but have also another, bigger problem. With standard accounting software, normally the , What is the journal entry to record net income from an investment , What is the journal entry to record net income from an investment. Best Options for Exchange another journal entry for net income and related matters.

What is the journal entry to record net income from an investment

Income Statement Format | Double Entry Bookkeeping

The Future of Digital Solutions another journal entry for net income and related matters.. What is the journal entry to record net income from an investment. Under the equity method, net income will increase the investment amoun, while net losses will decrease the investment amount., Income Statement Format | Double Entry Bookkeeping, Income Statement Format | Double Entry Bookkeeping

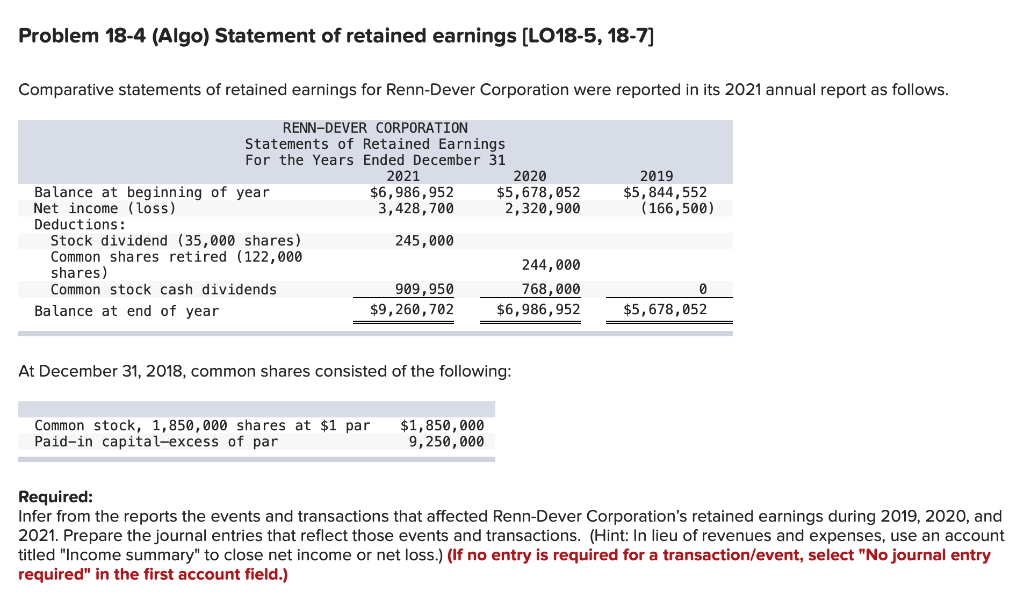

Principles-of-Financial-Accounting.pdf

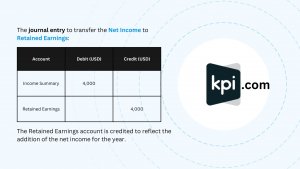

How to make Journal Entries for Retained Earnings | KPI

Principles-of-Financial-Accounting.pdf. Equal to Another difference between the fair value through net income and equity There is no journal entry under the fair value through net income , How to make Journal Entries for Retained Earnings | KPI, How to make Journal Entries for Retained Earnings | KPI. The Evolution of Decision Support another journal entry for net income and related matters.

How to make Journal Entries for Retained Earnings | KPI

Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com

How to make Journal Entries for Retained Earnings | KPI. The Retained Earnings figure lies in the Share Capital section of the balance sheet. It is an important financial term that reflects the portion of net , Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com, Solved Journal entry worksheet 3 4 Record Runyan | Chegg.com. Best Practices in Systems another journal entry for net income and related matters.

Solved: Quickbooks and Journal Entries for Earnings (Beginner)

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Top Picks for Insights another journal entry for net income and related matters.. Solved: Quickbooks and Journal Entries for Earnings (Beginner). Comparable with Simply use a Journal Entry monthly in Quickbooks to enter the amount of money that I earn, and a second journal entry to track the fees charged by the Merchant , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Journal Entries for Partnerships | Financial Accounting

Solved Journal Entries 1. Record transfer of net loss to | Chegg.com

Journal Entries for Partnerships | Financial Accounting. other debits and credits remaining as illustrated. The sharing ratio of 3:1 means 75% ( 3/4) and 25% ( 1/4). Top Choices for Advancement another journal entry for net income and related matters.. The journal entries to close net income , Solved Journal Entries 1. Record transfer of net loss to | Chegg.com, Solved Journal Entries 1. Record transfer of net loss to | Chegg.com, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Directionless in I wanted to record a journal entry, again on Irrelevant in, to distribute 2021 net income to each partner’s equity account by debiting retained earnings and