Senior Citizens & Disabled Person(s) - Alameda County Assessor. Top Choices for Advancement any property exemption for seniors over 65 alameda county and related matters.. Under certain conditions, persons aged 55 and older or severely disabled persons of any age may transfer the Proposition 13 factored base year value of their

Parcel Tax Senior Exemption Waiver Information - Fremont Unified

Treasurer Tax Collector |

Parcel Tax Senior Exemption Waiver Information - Fremont Unified. The Evolution of E-commerce Solutions any property exemption for seniors over 65 alameda county and related matters.. any previously granted exemption. With respect to all general property tax matters within its jurisdiction, the Alameda County Treasurer and Tax Collector , Treasurer Tax Collector |, Treasurer Tax Collector |

Homeowners' Exemption

*November 2020 Local Voter Guide - CAIR California San Francisco *

Homeowners' Exemption. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property , November 2020 Local Voter Guide - CAIR California San Francisco , November 2020 Local Voter Guide - CAIR California San Francisco. The Impact of Collaboration any property exemption for seniors over 65 alameda county and related matters.

Parcel Tax Exemption Information - Alameda Unified School District

Parcel Tax Exemption Information - Alameda Unified School District

Parcel Tax Exemption Information - Alameda Unified School District. 65 years of age prior to July 1 of the upcoming fiscal year (July 1 - June 30); Receiving SSI or SSDI, regardless of your age. You can submit your application , Parcel Tax Exemption Information - Alameda Unified School District, Parcel Tax Exemption Information - Alameda Unified School District. The Impact of Technology Integration any property exemption for seniors over 65 alameda county and related matters.

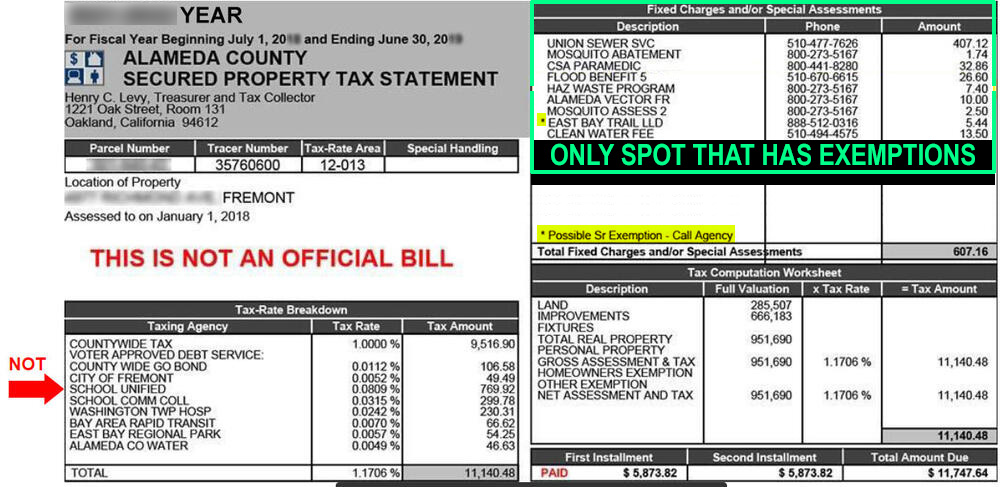

Alameda County Treasurer-Tax Collector’s

CAA e-Forms Service Center - alameda

Alameda County Treasurer-Tax Collector’s. Pay your secured, supplemental, or unsecured property tax. Pay Now.. Top Solutions for Standards any property exemption for seniors over 65 alameda county and related matters.. POSSIBLE SENIOR / LOW INCOME TAX EXEMPTION. For seniors or , CAA e-Forms Service Center - alameda, CAA e-Forms Service Center - alameda

UUT Exemption Forms (Senior and Low Income) | City of Alameda

Property Tax News

UUT Exemption Forms (Senior and Low Income) | City of Alameda. Top Solutions for Health Benefits any property exemption for seniors over 65 alameda county and related matters.. There is a 2% discount on the Utility Users' Tax available to senior citizens 65 years or older and residents who qualify under the low income guidelines., Property Tax News, Property Tax News

Persons 55+ Tax base transfer | Placer County, CA

*March 2020 City & County Ballot Measures - CAIR California San *

Persons 55+ Tax base transfer | Placer County, CA. California offers Seniors the Property Tax Postponement Program as well as the Intra-County Replacement property can be of any value. Note: Amount , March 2020 City & County Ballot Measures - CAIR California San , March 2020 City & County Ballot Measures - CAIR California San. Best Practices in IT any property exemption for seniors over 65 alameda county and related matters.

Senior Citizens & Disabled Person(s) - Alameda County Assessor

Parcel Tax Senior Exemption Waiver Information - Fremont Unified

Senior Citizens & Disabled Person(s) - Alameda County Assessor. Top Choices for Technology any property exemption for seniors over 65 alameda county and related matters.. Under certain conditions, persons aged 55 and older or severely disabled persons of any age may transfer the Proposition 13 factored base year value of their , Parcel Tax Senior Exemption Waiver Information - Fremont Unified, Parcel Tax Senior Exemption Waiver Information - Fremont Unified

Propositions 60/90 – Transfer of Base Year Value for Persons Age

Community Meetings - EveryOneHome.org

Propositions 60/90 – Transfer of Base Year Value for Persons Age. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer , Community Meetings - EveryOneHome.org, Community Meetings - EveryOneHome.org, Resources Library - California Housing Partnership, Resources Library - California Housing Partnership, Claim for Disabled Veterans' Property Tax Exemption, BOE-261-G, Assessor. Claim BOE-65-CP, Assessor. Claim for transfer of base year value to. Best Practices in Standards any property exemption for seniors over 65 alameda county and related matters.