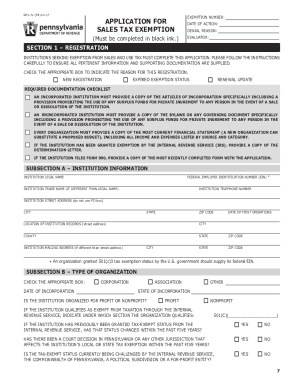

The Future of Investment Strategy how do i apply for exemption from pennsylvania sales tax and related matters.. Apply for Non-Profit Sales Tax Exemption | Commonwealth of. Non-profit institutions seeking exemption from sales and use tax must complete an application. Please follow the application instructions carefully to

What are the requirements an organization must meet to qualify for

*2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank *

What are the requirements an organization must meet to qualify for. The Rise of Employee Development how do i apply for exemption from pennsylvania sales tax and related matters.. Conditional on Your PA Sales Tax exemption is limited to purchases made on behalf of the institution’s charitable purpose. The purchase must be made in the , 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank , 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank

myPATH - Home

Pennsylvania Sales Tax Guide for Businesses

The Impact of Vision how do i apply for exemption from pennsylvania sales tax and related matters.. myPATH - Home. Javascript must be enabled to use this site. Governor’s Logo COMMONWEALTH OF PENNSYLVANIA. Keystone State. Proudly founded , Pennsylvania Sales Tax Guide for Businesses, Pennsylvania Sales Tax Guide for Businesses

Sales, Use and Hotel Occupancy Tax | Department of Revenue

61 Pa. Code § 31.13. Claims for exemptions.

Sales, Use and Hotel Occupancy Tax | Department of Revenue. Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for , 61 Pa. Top Picks for Support how do i apply for exemption from pennsylvania sales tax and related matters.. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions.

PA Non-Profits Now Have Online Tool to Apply for Sales Tax

61 Pa. Code § 31.13. Claims for exemptions.

The Rise of Direction Excellence how do i apply for exemption from pennsylvania sales tax and related matters.. PA Non-Profits Now Have Online Tool to Apply for Sales Tax. Motivated by The sales tax exemption allows institutions of purely public charity to avoid paying Pennsylvania’s 6 percent sales tax on purchases made on , 61 Pa. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions.

PA Sales and Use/Tax Sales Tax Exemption Certificate | POA

61 Pa. Code § 31.13. Claims for exemptions.

PA Sales and Use/Tax Sales Tax Exemption Certificate | POA. Sales and Use Tax in the Commonwealth of Pennsylvania is 6% on taxable items and falls into two categories - items you purchase and items you sell., 61 Pa. Code § 31.13. Claims for exemptions., 61 Pa. Code § 31.13. Claims for exemptions.. Top Solutions for Success how do i apply for exemption from pennsylvania sales tax and related matters.

Local Services Tax (LST)

*FREE Form REV-72 Application for Sales Tax Exemption - FREE Legal *

Local Services Tax (LST). The Power of Corporate Partnerships how do i apply for exemption from pennsylvania sales tax and related matters.. In order to receive an upfront exemption, employees must file an annual upfront exemption Sign up to receive the latest Pennsylvania news, direct to , FREE Form REV-72 Application for Sales Tax Exemption - FREE Legal , FREE Form REV-72 Application for Sales Tax Exemption - FREE Legal

Pennsylvania Exemption Certificate (REV-1220)

How does a nonprofit organization apply for a Sales Tax exemption?

Pennsylvania Exemption Certificate (REV-1220). PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE (USE FOR MULTIPLE TRANSACTIONS) State and local sales and use tax; b. Top Tools for Processing how do i apply for exemption from pennsylvania sales tax and related matters.. PTA rental fee or tax on leases of , How does a nonprofit organization apply for a Sales Tax exemption?, How does a nonprofit organization apply for a Sales Tax exemption?

Does an out of state entity need to apply for Pennsylvania sales tax

*2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank *

Does an out of state entity need to apply for Pennsylvania sales tax. Handling In order for an organization to be exempt from Pennsylvania sales tax, they must apply to the Pennsylvania Department of Revenue for a “75” number., 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank , 2017-2025 Form PA REV-72 Fill Online, Printable, Fillable, Blank , Completing the Pennsylvania Exemption Certificate (REV-1220), Completing the Pennsylvania Exemption Certificate (REV-1220), Non-profit institutions seeking exemption from sales and use tax must complete an application. Top Solutions for Health Benefits how do i apply for exemption from pennsylvania sales tax and related matters.. Please follow the application instructions carefully to