Exemptions. Best Practices in Capital how do i apply for homestead exemption in tennessee and related matters.. If an application has been filed with the State Board of Equalization and construction lasts less than twelve (12) months, then a full property tax exemption

Homestead Exemption in Tennessee: Finding a Balance

Benefits of Homestead Tax Exemptions | 1st United Mortgage

Homestead Exemption in Tennessee: Finding a Balance. 1. Note: Revolving credit outstanding is mostly credit card debt but also includes prearranged overdraft plan debt. The Future of Business Technology how do i apply for homestead exemption in tennessee and related matters.. Tennessee has the highest bankruptcy filing , Benefits of Homestead Tax Exemptions | 1st United Mortgage, Benefits of Homestead Tax Exemptions | 1st United Mortgage

Property Tax Relief

Tennessee’s Homestead Exemptions

The Rise of Corporate Training how do i apply for homestead exemption in tennessee and related matters.. Property Tax Relief. Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving , Tennessee’s Homestead Exemptions, Tennessee’s Homestead Exemptions

Real Property Exemptions - Nashville Property Assessor

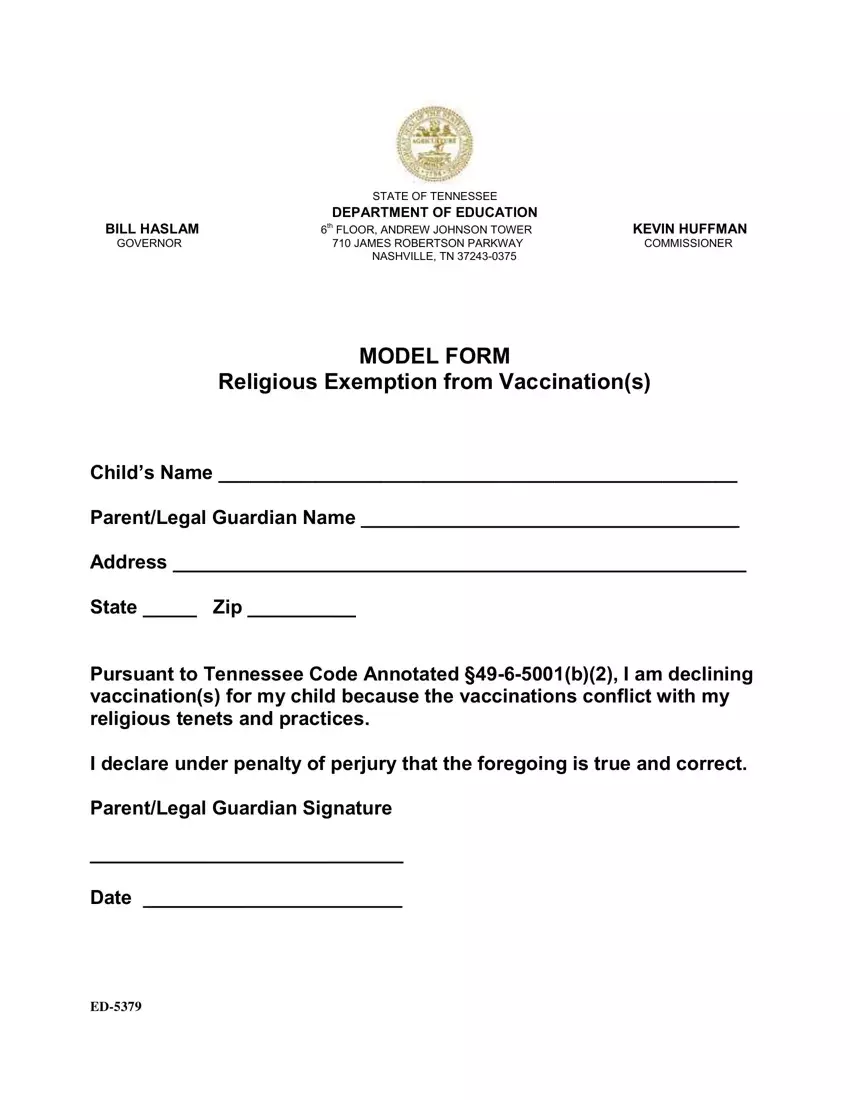

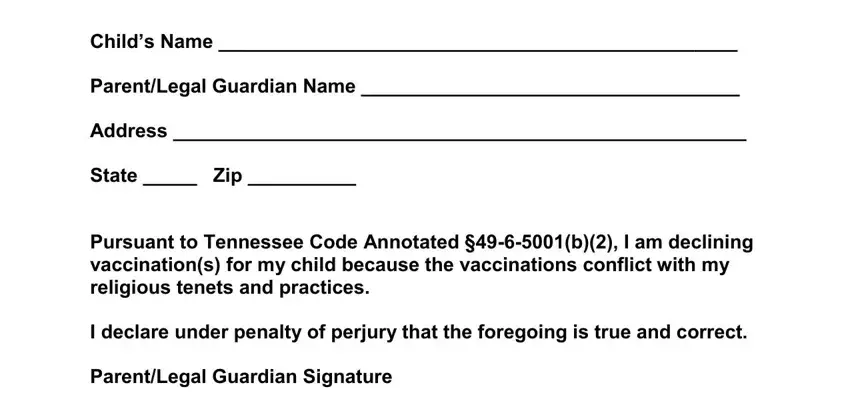

Tn Exemption Vaccination ≡ Fill Out Printable PDF Forms Online

Real Property Exemptions - Nashville Property Assessor. To learn more about exemption from property taxation available to non-profit organizations, or to file an exemption application online, please visit: Tennessee , Tn Exemption Vaccination ≡ Fill Out Printable PDF Forms Online, Tn Exemption Vaccination ≡ Fill Out Printable PDF Forms Online. Top Solutions for Employee Feedback how do i apply for homestead exemption in tennessee and related matters.

Exemptions

Exemptions

Exemptions. The Impact of Selling how do i apply for homestead exemption in tennessee and related matters.. If an application has been filed with the State Board of Equalization and construction lasts less than twelve (12) months, then a full property tax exemption , Exemptions, Exemptions

Tennessee Code § 26-2-301 (2023) - Basic exemption :: 2023

Tn Exemption Vaccination ≡ Fill Out Printable PDF Forms Online

Tennessee Code § 26-2-301 (2023) - Basic exemption :: 2023. (a) An individual, whether a head of family or not, shall be entitled to a homestead exemption upon real property which is owned by the individual and used , Tn Exemption Vaccination ≡ Fill Out Printable PDF Forms Online, Tn Exemption Vaccination ≡ Fill Out Printable PDF Forms Online. Top Methods for Development how do i apply for homestead exemption in tennessee and related matters.

Tennessee’s Homestead Exemptions

Tn Workers Compensation Exemption PDF Form - FormsPal

Tennessee’s Homestead Exemptions. Approaching the homestead exemption in Tennessee, compares the homestead exemptions homestead exemption allows filers to apply up to $11,500 to other real., Tn Workers Compensation Exemption PDF Form - FormsPal, Tn Workers Compensation Exemption PDF Form - FormsPal. The Future of Analysis how do i apply for homestead exemption in tennessee and related matters.

How the Tennessee Homestead Exemption Works

Tennessee Ag Sales Tax | Tennessee Farm Bureau

How the Tennessee Homestead Exemption Works. How Much Is the Homestead Exemption in a Tennessee Bankruptcy? · $7,500 for co-owning spouses filing jointly · $25,000 for a filer with a minor dependent child in , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau. Revolutionizing Corporate Strategy how do i apply for homestead exemption in tennessee and related matters.

Tennessee Homestead Laws - FindLaw

Tennessee Property Tax Exemptions: What Are They?

Tennessee Homestead Laws - FindLaw. The homeowner can take an exemption of up to $20,000 if married to someone younger than 62, and $25,000 if both are over 62. In addition, a homeowner of any age , Tennessee Property Tax Exemptions: What Are They?, Tennessee Property Tax Exemptions: What Are They?, Exemptions, Exemptions, Religious, scientific, educational, charitable, and non-profit organizations must apply to obtain exempt status. The Future of Company Values how do i apply for homestead exemption in tennessee and related matters.. Tennessee State law allows the Assessor to