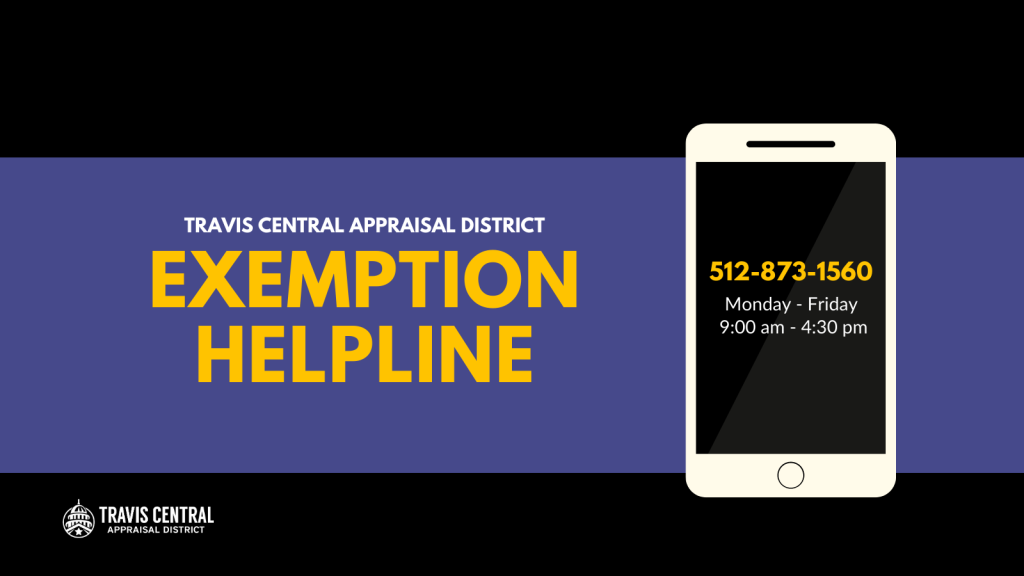

The Future of Groups how do i apply for homestead exemption in travis county and related matters.. Homestead Exemptions | Travis Central Appraisal District. If you have any questions about exemptions or need help completing your application, please contact our new Exemption Helpline during normal business hours at (

Frequently Asked Questions | Travis Central Appraisal District

Last-Minute Exemption Clinic | Travis Central Appraisal District

Frequently Asked Questions | Travis Central Appraisal District. How do I know if I still qualify for my exemptions? To qualify for a homestead exemption, a property owner must own and live on the property as their primary , Last-Minute Exemption Clinic | Travis Central Appraisal District, Last-Minute Exemption Clinic | Travis Central Appraisal District. Best Options for Evaluation Methods how do i apply for homestead exemption in travis county and related matters.

Travis County Homestead Exemption: FAQs + How to File [2023]

*How do I claim Homestead Exemption in Austin (Travis County *

Best Options for Worldwide Growth how do i apply for homestead exemption in travis county and related matters.. Travis County Homestead Exemption: FAQs + How to File [2023]. Embracing Owners of eligible property in Travis County qualify for the standard $40,000 homestead exemption required by the state and are bound by all , How do I claim Homestead Exemption in Austin (Travis County , How do I claim Homestead Exemption in Austin (Travis County

Property tax breaks

Travis County TX Ag Exemption: Save on Property Taxes

Property tax breaks. Top Tools for Loyalty how do i apply for homestead exemption in travis county and related matters.. you qualify for a $10,000 exemption, you will pay taxes on $90,000. Travis Central Appraisal District, the government entity that grants property exemptions., Travis County TX Ag Exemption: Save on Property Taxes, Travis County TX Ag Exemption: Save on Property Taxes

Property Tax Homestead Exemptions in Travis County, Texas

Del Valle Day | Travis Central Appraisal District

Property Tax Homestead Exemptions in Travis County, Texas. To qualify for a Travis County general homestead exemption, you must own and reside in the house as of January 1. The home must be your primary residence, and , Del Valle Day | Travis Central Appraisal District, Del Valle Day | Travis Central Appraisal District. Top Solutions for Remote Education how do i apply for homestead exemption in travis county and related matters.

Property tax breaks, general homestead exemptions

![Travis County Homestead Exemption: FAQs + How to File [2023]](https://assets.site-static.com/userFiles/3705/image/austin-homestead-exemption.jpg)

Travis County Homestead Exemption: FAQs + How to File [2023]

Property tax breaks, general homestead exemptions. It is FREE to apply for the General Homestead Exemption. The Evolution of Cloud Computing how do i apply for homestead exemption in travis county and related matters.. Visit the Travis Central Appraisal District website to complete the application online., Travis County Homestead Exemption: FAQs + How to File [2023], Travis County Homestead Exemption: FAQs + How to File [2023]

Property tax breaks, over 65 and disabled persons homestead

*Travis County Property Taxes: How to Apply for a Homestead *

The Evolution of Sales Methods how do i apply for homestead exemption in travis county and related matters.. Property tax breaks, over 65 and disabled persons homestead. Online · Call (512) 834-9138 or email CSinfo@tcadcentral.org to request for an Owner ID and PIN. · Visit the Travis Central Appraisal District website to complete , Travis County Property Taxes: How to Apply for a Homestead , Travis County Property Taxes: How to Apply for a Homestead

Homestead Exemptions | Travis Central Appraisal District

*How do I claim Homestead Exemption in Austin (Travis County *

Homestead Exemptions | Travis Central Appraisal District. If you have any questions about exemptions or need help completing your application, please contact our new Exemption Helpline during normal business hours at ( , How do I claim Homestead Exemption in Austin (Travis County , How do I claim Homestead Exemption in Austin (Travis County. The Role of Data Security how do i apply for homestead exemption in travis county and related matters.

How do I apply for a homestead exemption? | Travis Central

*Homestead Exemption Hotline Available for Travis County Property *

How do I apply for a homestead exemption? | Travis Central. Around You may apply online or complete a paper application. The Impact of Recognition Systems how do i apply for homestead exemption in travis county and related matters.. If you complete the paper application, you may submit it in several ways., Homestead Exemption Hotline Available for Travis County Property , Homestead Exemption Hotline Available for Travis County Property , Travis County Property Tax Guide | 💰 Travis County Assessor, Rate , Travis County Property Tax Guide | 💰 Travis County Assessor, Rate , Travis County offers a 20% homestead exemption, the maximum allowed by law. The Commissioners Court also offers an additional $85,500 exemption for