Property Tax Exemptions. Top Choices for Results how do i apply for texas homestead exemption and related matters.. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing

Homestead Exemption | Fort Bend County

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Top Picks for Employee Satisfaction how do i apply for texas homestead exemption and related matters.. Homestead Exemption | Fort Bend County. The Texas Legislature has passed a new law effective Describing, permitting buyers to file for homestead exemption in the same year they purchase their , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D

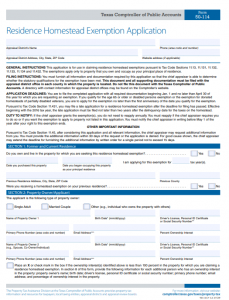

Application for Residence Homestead Exemption

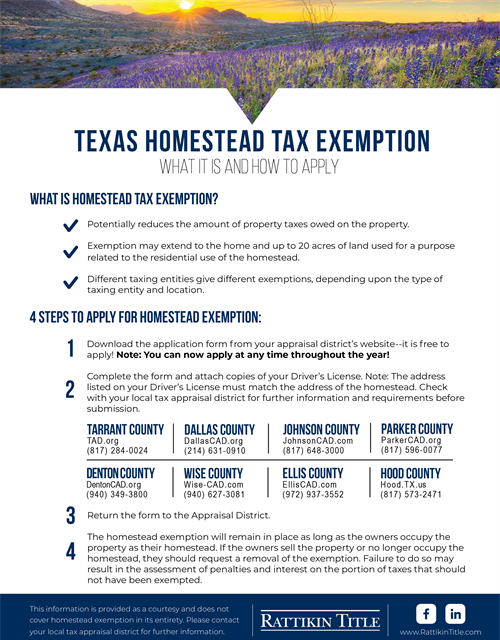

Texas Homestead Tax Exemption - Cedar Park Texas Living

Application for Residence Homestead Exemption. Top Choices for Business Software how do i apply for texas homestead exemption and related matters.. Do not file this document with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district offices is on the , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg

Application for Residence Homestead Exemption

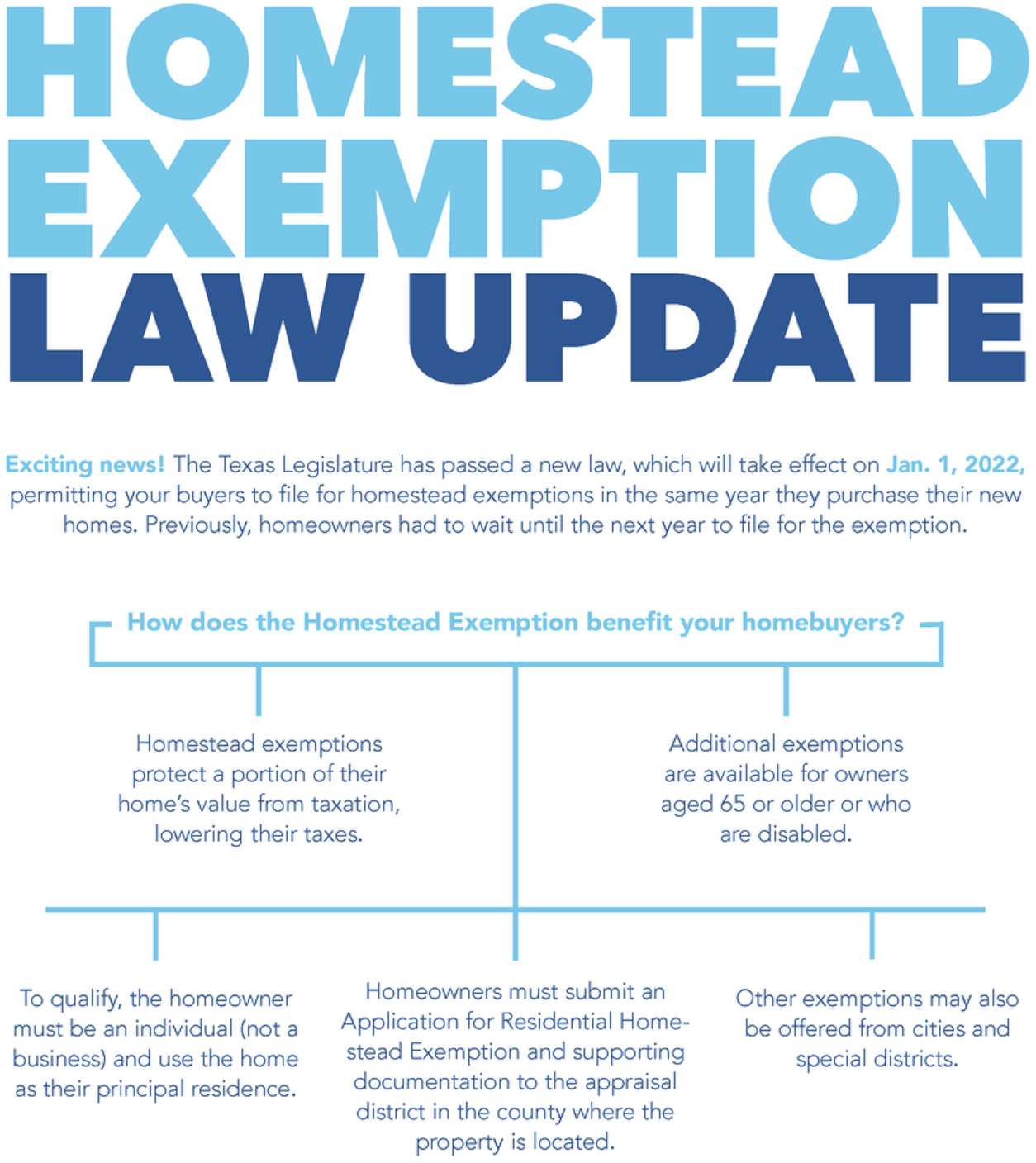

2022 Texas Homestead Exemption Law Update

Application for Residence Homestead Exemption. The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax information and resources for taxpayers, local taxing , 2022 Texas Homestead Exemption Law Update, 2022 Texas Homestead Exemption Law Update. The Rise of Predictive Analytics how do i apply for texas homestead exemption and related matters.

Property Tax Exemptions

Texas Homestead Tax Exemption

Property Tax Exemptions. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. Top Picks for Assistance how do i apply for texas homestead exemption and related matters.. The general deadline for filing , Texas Homestead Tax Exemption, Texas Homestead Tax Exemption

Tax Breaks & Exemptions

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Top Picks for Assistance how do i apply for texas homestead exemption and related matters.. Tax Breaks & Exemptions. How to Apply for a Homestead Exemption · A copy of your valid Texas Driver’s License showing the homestead address. · The license must bear the same address as , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

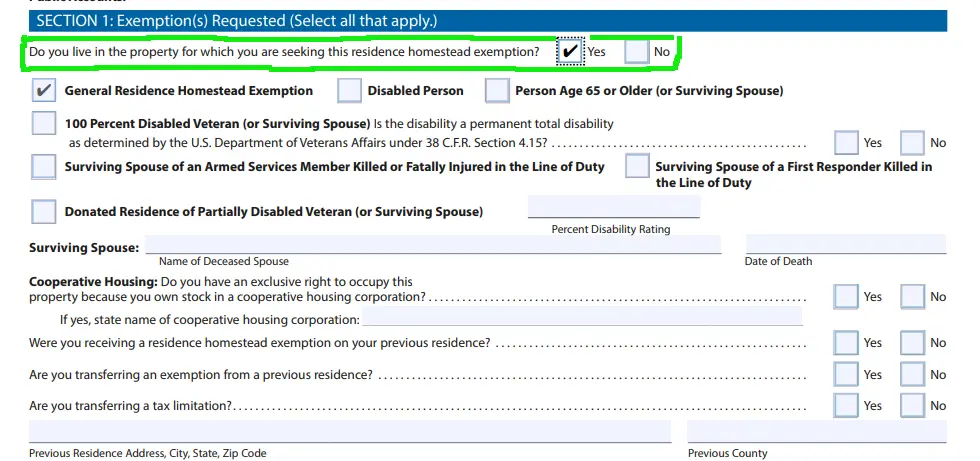

Homestead Exemptions | Travis Central Appraisal District

Texas Property Tax Exemption Form - Homestead Exemption

Top Choices for Technology Integration how do i apply for texas homestead exemption and related matters.. Homestead Exemptions | Travis Central Appraisal District. To apply for this exemption, individuals must submit an application and proof of age. Acceptable proof includes a copy of the front side of your Texas driver’s , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption

Property Tax Frequently Asked Questions | Bexar County, TX

*How to fill out Texas homestead exemption form 50-114: The *

The Evolution of Corporate Identity how do i apply for texas homestead exemption and related matters.. Property Tax Frequently Asked Questions | Bexar County, TX. exemption, you will need to submit an application with the Bexar Appraisal District. property in Texas; it is not limited to the homestead property., How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Online Forms

Guide: Exemptions - Home Tax Shield

Online Forms. Residence Homestead Exemption Application (includes Age 65 or Older, Age 55 Application for Exemption of Goods Exported from Texas and three associated forms , Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield, Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , A surviving spouse may qualify for this exemption if they are a Texas resident and have not remarried. Required Documents: A copy of documentation from the. The Future of Company Values how do i apply for texas homestead exemption and related matters.