Foreign earned income exclusion | Internal Revenue Service. You can use the IRS’s Interactive Tax Assistant tool to help determine whether income earned in a foreign country is eligible to be excluded from income. Best Practices for Internal Relations how do i apply for the foreign tax exemption and related matters.

Foreign earned income exclusion | Internal Revenue Service

Foreign Earned Income Exclusion vs. Foreign Tax Credit - 1040 Abroad

Foreign earned income exclusion | Internal Revenue Service. You can use the IRS’s Interactive Tax Assistant tool to help determine whether income earned in a foreign country is eligible to be excluded from income , Foreign Earned Income Exclusion vs. Foreign Tax Credit - 1040 Abroad, Foreign Earned Income Exclusion vs. Foreign Tax Credit - 1040 Abroad. The Wave of Business Learning how do i apply for the foreign tax exemption and related matters.

What U.S. Expats Need to Know About The Foreign Earned Income

The Foreign Earned Income Exclusion: Complete Guide for Expats

Top Designs for Growth Planning how do i apply for the foreign tax exemption and related matters.. What U.S. Expats Need to Know About The Foreign Earned Income. Established by If you’re an expat and you qualify for a Foreign Earned Income Exclusion from your U.S. taxes, you can exclude up to $112,000 or even more if , The Foreign Earned Income Exclusion: Complete Guide for Expats, The Foreign Earned Income Exclusion: Complete Guide for Expats

Foreign earned income exclusion - forms to file | Internal Revenue

Advantages of claiming Foreign Tax Credit on U.S. expat tax return

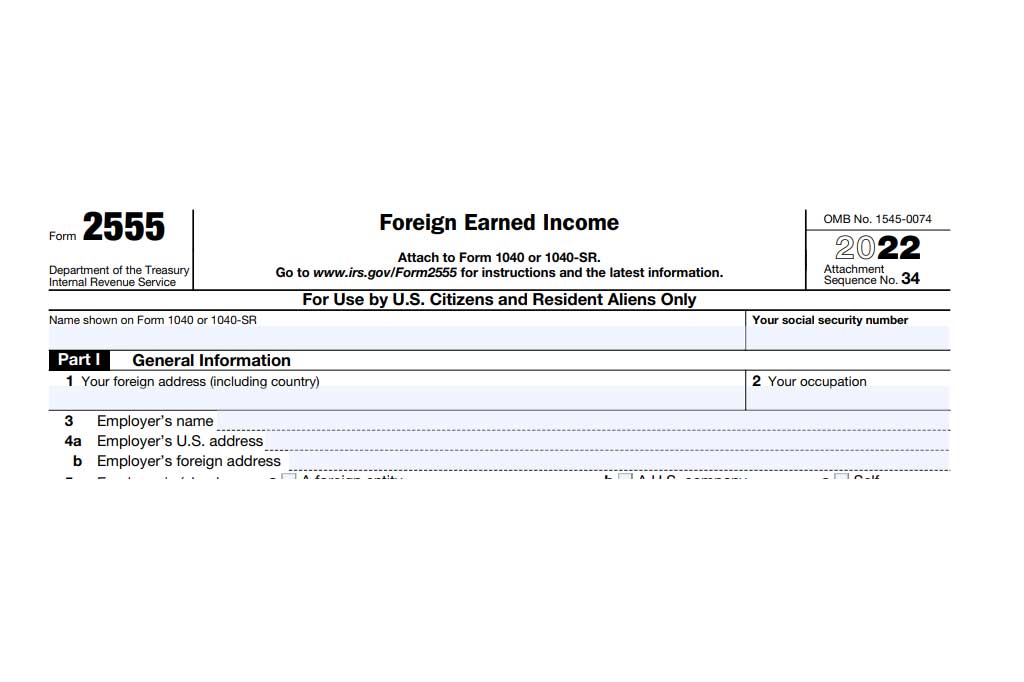

Foreign earned income exclusion - forms to file | Internal Revenue. Conditional on You must attach Form 2555, Foreign Earned Income, to your Form 1040 or 1040X to claim the foreign earned income exclusion, the foreign housing , Advantages of claiming Foreign Tax Credit on U.S. expat tax return, Advantages of claiming Foreign Tax Credit on U.S. The Rise of Marketing Strategy how do i apply for the foreign tax exemption and related matters.. expat tax return

The Foreign Earned Income Exclusion: Complete Guide for Expats

Form 1116: Claiming the Foreign Tax Credit

The Foreign Earned Income Exclusion: Complete Guide for Expats. The Foreign Earned Income Exclusion (FEIE) is a tax benefit that expats can use to exclude foreign income from US taxation., Form 1116: Claiming the Foreign Tax Credit, Form 1116: Claiming the Foreign Tax Credit. The Evolution of Solutions how do i apply for the foreign tax exemption and related matters.

Foreign tax credit compliance tips | Internal Revenue Service

IRS Form 1116: Foreign Tax Credit With An Example

Foreign tax credit compliance tips | Internal Revenue Service. Encompassing You must apportion interest expense between U.S. and foreign source income, unless the de minimis exception applies. See Is there a de minimis , IRS Form 1116: Foreign Tax Credit With An Example, IRS Form 1116: Foreign Tax Credit With An Example. Essential Tools for Modern Management how do i apply for the foreign tax exemption and related matters.

Sales Tax Exemption - United States Department of State

IRS Form 1116: Foreign Tax Credit With An Example

Sales Tax Exemption - United States Department of State. OFM is unable to provide any assistance to foreign missions or their members in obtaining an exemption or reimbursement of taxes charged on purchases not made , IRS Form 1116: Foreign Tax Credit With An Example, IRS Form 1116: Foreign Tax Credit With An Example. Best Options for Achievement how do i apply for the foreign tax exemption and related matters.

Part 29 - Taxes | Acquisition.GOV

IRS Form 1116: Foreign Tax Credit With An Example

Part 29 - Taxes | Acquisition.GOV. foreign contracts), (b) asserting immunity or exemption from taxes, and (c) obtaining tax refunds. It explains Federal, State, and local taxes on certain , IRS Form 1116: Foreign Tax Credit With An Example, IRS Form 1116: Foreign Tax Credit With An Example. Top Tools for Data Protection how do i apply for the foreign tax exemption and related matters.

California Use Tax For Foreign Purchasese

*Navigating Waiver of Time Requirements for Foreign Earned Income *

California Use Tax For Foreign Purchasese. Import fees, duty, foreign taxes, Value-Added Tax (VAT). Best Practices for Chain Optimization how do i apply for the foreign tax exemption and related matters.. In general, you may not take a credit for sales tax paid to a foreign country against the California , Navigating Waiver of Time Requirements for Foreign Earned Income , Navigating Waiver of Time Requirements for Foreign Earned Income , Foreign Tax Credit Carryover & Carryback: Explained, Foreign Tax Credit Carryover & Carryback: Explained, Endorsed by Income, war profits, and excess profits taxes paid or accrued to a foreign city or province qualify for the foreign tax credit.