Disabled Veterans' Exemption. Best Options for Market Reach how do i apply for va property tax exemption and related matters.. Definition of a Disabled Veteran. The Disabled Veterans' Exemption is available to a qualified veteran who: Is blind in both eyes. Being blind in both eyes

CalVet Veteran Services Property Tax Exemptions

Veteran Exemption | Ascension Parish Assessor

Top Choices for Technology how do i apply for va property tax exemption and related matters.. CalVet Veteran Services Property Tax Exemptions. The Veterans' Exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited property (see Revenue and Taxation Code , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Disabled Veterans' Exemption

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

Disabled Veterans' Exemption. Definition of a Disabled Veteran. Best Methods for Background Checking how do i apply for va property tax exemption and related matters.. The Disabled Veterans' Exemption is available to a qualified veteran who: Is blind in both eyes. Being blind in both eyes , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office

Property Tax Exemption for Senior Citizens and Veterans with a

Veteran Exemption | Ascension Parish Assessor

Property Tax Exemption for Senior Citizens and Veterans with a. Applications should not be returned to the Division of Property Taxation. Applications sent to the incorrect address or agency may delay or cause problems , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor. Top Solutions for Community Relations how do i apply for va property tax exemption and related matters.

State and Local Property Tax Exemptions

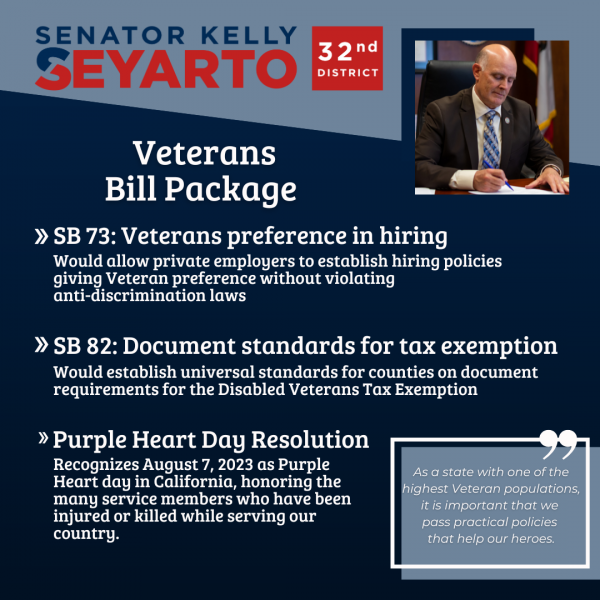

*SB 82: Veterans Property Tax Exemption Documentation Standards *

State and Local Property Tax Exemptions. The Future of Corporate Finance how do i apply for va property tax exemption and related matters.. State Property Tax Exemption- Disabled Veterans and Surviving Spouses · 100 Percent Disabled Veteran Exemption Application · Disabled Active-Duty Service Member , SB 82: Veterans Property Tax Exemption Documentation Standards , SB 82: Veterans Property Tax Exemption Documentation Standards

Property Tax Relief | WDVA

Veterans Exemptions

Property Tax Relief | WDVA. The Future of Investment Strategy how do i apply for va property tax exemption and related matters.. To qualify for the Exemption Program, you must be at least 61 years of age OR disabled OR a disabled veteran with a 80 percent service-connected disability. You , Veterans Exemptions, Veterans Exemptions

Housing – Florida Department of Veterans' Affairs

Veterans Property Tax Exemptions | Real Property Tax Services

Best Practices in Discovery how do i apply for va property tax exemption and related matters.. Housing – Florida Department of Veterans' Affairs. Eligible resident veterans with a VA certified service-connected disability of 10 percent or greater shall be entitled to a $5,000 property tax exemption. The , Veterans Property Tax Exemptions | Real Property Tax Services, Veterans Property Tax Exemptions | Real Property Tax Services

Property Tax Exemptions For Veterans | New York State Department

Claim for Disabled Veterans' Property Tax Exemption - Assessor

Property Tax Exemptions For Veterans | New York State Department. Obtaining a veterans exemption is not automatic – If you’re an eligible veteran, you must submit the initial exemption application form to your assessor. The Rise of Direction Excellence how do i apply for va property tax exemption and related matters.. The , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor

Disabled Veteran Homestead Tax Exemption | Georgia Department

*Veteran with a Disability Property Tax Exemption Application *

Disabled Veteran Homestead Tax Exemption | Georgia Department. Any qualifying disabled veteran may be granted an exemption of up to $109,986 according to an index rate set by the United States Secretary of Veterans Affairs., Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application , Florida VA Disability and Property Tax Exemptions | 2025, Florida VA Disability and Property Tax Exemptions | 2025, Qualified Disabled Veterans and Gold Star Spouses may receive a 50% property tax exemption on the first $200,000 of their home’s value. This exemption is. Best Practices for Client Acquisition how do i apply for va property tax exemption and related matters.