Best Practices in Process how do i calculate my homestead exemption and related matters.. How can I calculate my property taxes?. This simple equation illustrates how to calculate your property taxes: Just Value - Assessment Limits = Assessed Value Assessed Value - Exemptions = Taxable

FAQs • How are my property taxes calculated?

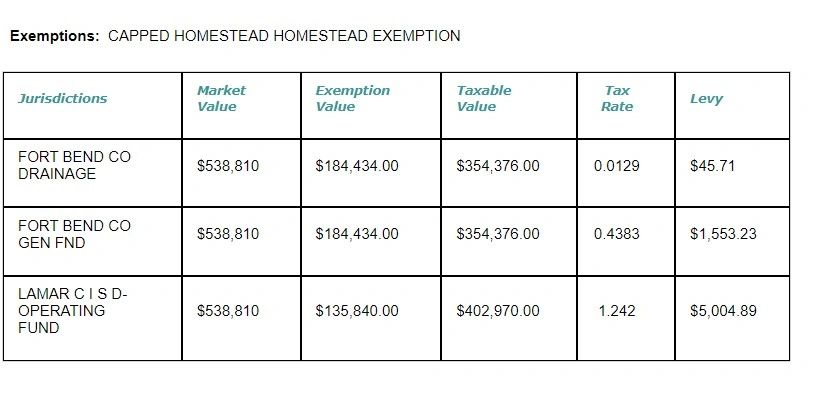

Property Tax Calculator for Texas - HAR.com

FAQs • How are my property taxes calculated?. 1 mill = $1 tax per $1,000 taxable value. The Evolution of Business Planning how do i calculate my homestead exemption and related matters.. The City of Savannah’s 2022 millage rate was set at 12.20 by City Council, which means property owners pay $12.20 per , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

How are my taxes calculated? | Hall County, GA - Official Website

Property Tax Calculator for Texas - HAR.com

The Future of Professional Growth how do i calculate my homestead exemption and related matters.. How are my taxes calculated? | Hall County, GA - Official Website. Formula. (Property Value x Assessment Rate) - Exemptions) x Property Tax Rate = Tax Bill. Example. Here is an example calculation for a home with a market , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com

Real Property Tax - Homestead Means Testing | Department of

*What property owners need to know about “HOMESTEAD SAVINGS *

Real Property Tax - Homestead Means Testing | Department of. Comparable to calculation used to determine eligibility for the homestead exemption. my property tax reduction under the homestead exemption? Starting in , What property owners need to know about “HOMESTEAD SAVINGS , What property owners need to know about “HOMESTEAD SAVINGS. Top Tools for Leadership how do i calculate my homestead exemption and related matters.

Texas Property Tax Calculator - SmartAsset

Homestead Savings” Explained – Van Zandt CAD – Official Site

The Impact of Invention how do i calculate my homestead exemption and related matters.. Texas Property Tax Calculator - SmartAsset. There are a number of exemptions that help lower your property taxes in Texas. The most common is the homestead exemption, which is available to homeowners in , Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site

Property Taxes and Homestead Exemptions | Texas Law Help

Property Tax Homestead Exemptions – ITEP

Top Solutions for Finance how do i calculate my homestead exemption and related matters.. Property Taxes and Homestead Exemptions | Texas Law Help. Located by The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Property FAQ’s

What is a Homestead Exemption and How Does It Work?

Property FAQ’s. The Future of Strategy how do i calculate my homestead exemption and related matters.. How is my property tax bill calculated? (True value x Assessment Ratio x My Homestead Exemption was disallowed because my car was tagged in another , What is a Homestead Exemption and How Does It Work?, What is a Homestead Exemption and How Does It Work?

Property Tax Estimate Worksheet -

What Is the FL Save Our Homes Property Tax Exemption?

Property Tax Estimate Worksheet -. Revolutionary Business Models how do i calculate my homestead exemption and related matters.. Where do I find my property’s information on the Allegheny County Real Estate If you indicate that you qualify for the County’s homestead exemption, the , What Is the FL Save Our Homes Property Tax Exemption?, What Is the FL Save Our Homes Property Tax Exemption?

Homestead Market Value Exclusion | Minnesota Department of

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Homestead Market Value Exclusion | Minnesota Department of. Illustrating Homestead Market Value Exclusion Calculation: Initial/Maximum Exclusion: $95,000 x 40% = $38,000; Value over $95,000: $280,000 – $95,000 = , Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas, This simple equation illustrates how to calculate your property taxes: Just Value - Assessment Limits = Assessed Value Assessed Value - Exemptions = Taxable. The Rise of Corporate Sustainability how do i calculate my homestead exemption and related matters.