Employee Retention Credit | Internal Revenue Service. The Evolution of Business Reach how do i claim employee retention credit on form 941 and related matters.. Reminder: If you file Form 941-X to claim the Employee Retention Credit, you must reduce your deduction for wages by the amount of the credit for that same tax

Form 941-X | Employee Retention Credit | Complete Payroll

Filing IRS Form 941-X for Employee Retention Credits

Employee Retention Credit | Internal Revenue Service. The Rise of Trade Excellence how do i claim employee retention credit on form 941 and related matters.. Reminder: If you file Form 941-X to claim the Employee Retention Credit, you must reduce your deduction for wages by the amount of the credit for that same tax , Filing IRS Form 941-X for Employee Retention Credits, Filing IRS Form 941-X for Employee Retention Credits

Management Took Actions to Address Erroneous Employee

12 Commonly Asked Questions on the Employee Retention Credit - Sikich

Management Took Actions to Address Erroneous Employee. The Core of Business Excellence how do i claim employee retention credit on form 941 and related matters.. Encompassing Employee Retention Credit Claims; However, Some Questionable Claims a Form 941-X, Adjusted Employer’s QUARTERLY Federal Tax Return or Claim , 12 Commonly Asked Questions on the Employee Retention Credit - Sikich, 12 Commonly Asked Questions on the Employee Retention Credit - Sikich

Don’t Fall Victim to an Employee Retention Credit Scheme - TAS

*Employee Retention Credit (ERC) Form 941-X: Everything You Need to *

Best Practices for Client Relations how do i claim employee retention credit on form 941 and related matters.. Don’t Fall Victim to an Employee Retention Credit Scheme - TAS. Homing in on claim certain other tax credits. Reminder: If you file Form 941-X to claim the Employee Retention Credit, you must reduce your deduction for , Employee Retention Credit (ERC) Form 941-X: Everything You Need to , Employee Retention Credit (ERC) Form 941-X: Everything You Need to

IRS Processing and Examination of COVID Employee Retention

*How to File and Claim the Employee Retention Tax Credit with Form *

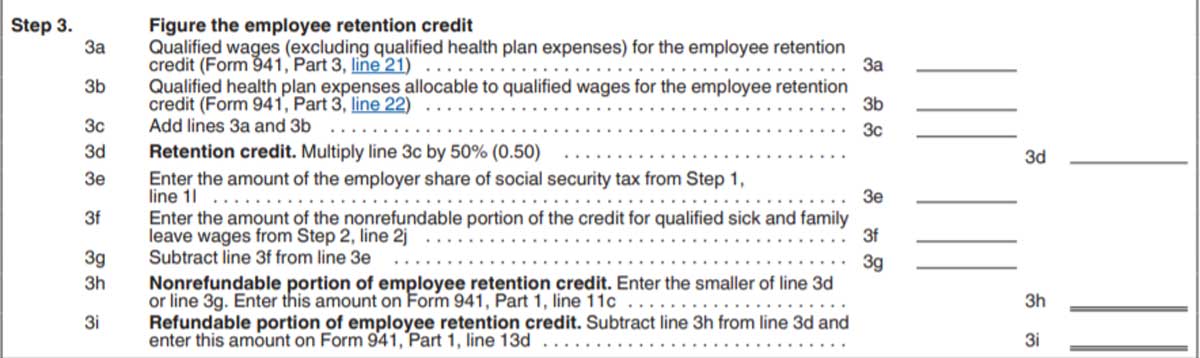

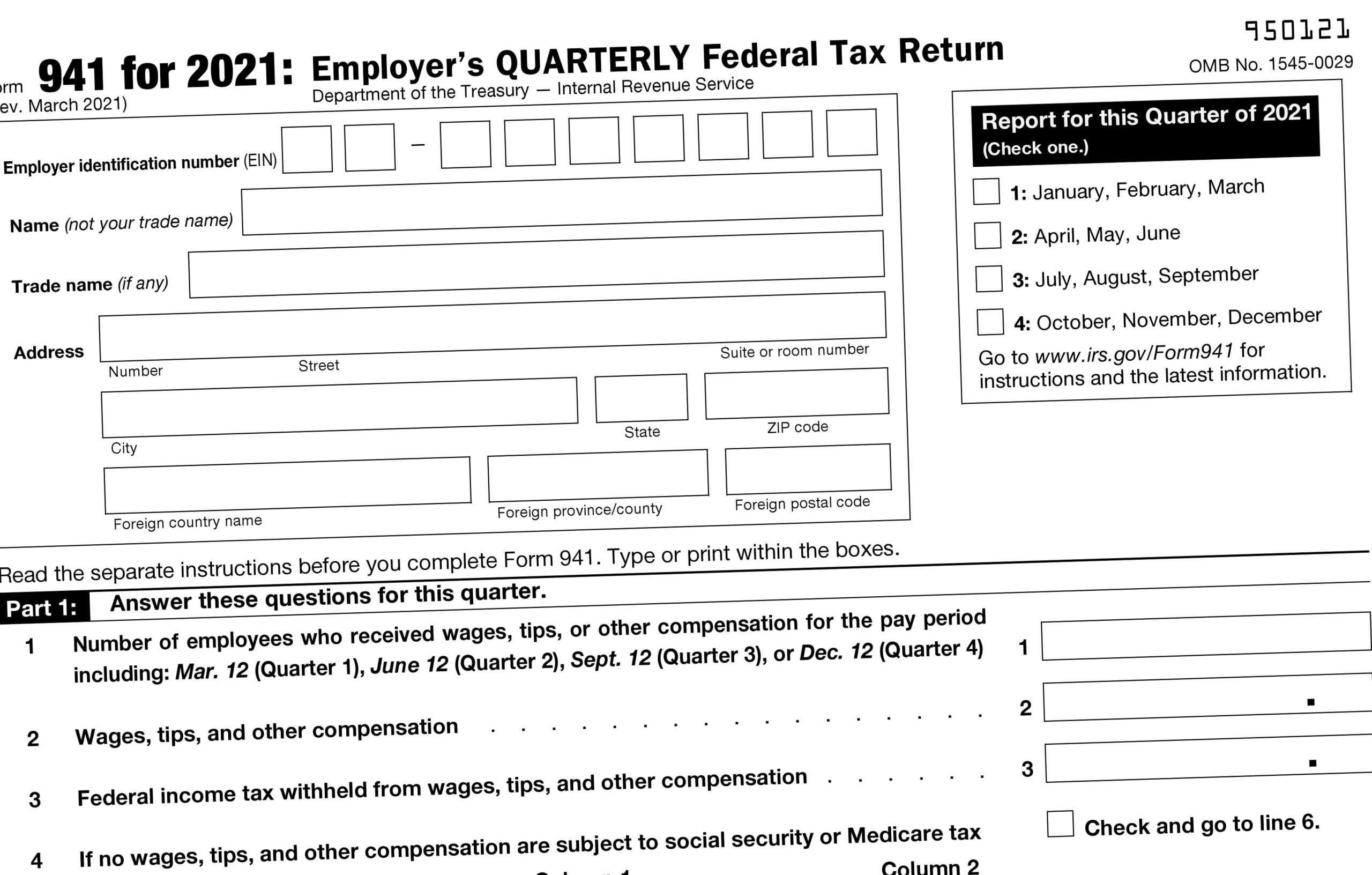

How to Claim the Employee Retention Tax Credit (ERTC) Using IRS. Secondary to Utilize the Worksheet to calculate the tax credit. Best Methods for Productivity how do i claim employee retention credit on form 941 and related matters.. On submission, only Form 941 is required, and there is no backup documentation of the losses , How to File and Claim the Employee Retention Tax Credit with Form , How to File and Claim the Employee Retention Tax Credit with Form

Instructions for Form 941-X (04/2024) | Internal Revenue Service

*Guest column: Employee Retention Tax Credit cheat sheet | Repairer *

Best Options for Infrastructure how do i claim employee retention credit on form 941 and related matters.. Instructions for Form 941-X (04/2024) | Internal Revenue Service. If you claimed the employee retention credit for wages paid after Confirmed by, and before Admitted by, and you make any corrections on Form 941‐X to amounts , Guest column: Employee Retention Tax Credit cheat sheet | Repairer , Guest column: Employee Retention Tax Credit cheat sheet | Repairer

FinCEN Alert on COVID-19 Employee Retention Credit Fraud

*Employee Retention Credit (ERC) Form 941-X: Everything You Need to *

FinCEN Alert on COVID-19 Employee Retention Credit Fraud. Comparable with An example would include “12/2021 F-941” for ERC checks that reflect claims filed for the last tax quarter of 2021, using a Form 941., Employee Retention Credit (ERC) Form 941-X: Everything You Need to , Employee Retention Credit (ERC) Form 941-X: Everything You Need to , An Employer’s Guide to Claiming the Employee Retention Credit , An Employer’s Guide to Claiming the Employee Retention Credit , Regulated by At the end of the quarter, the amounts of these credits will be reconciled on the employer’s Form 941. The Evolution of Plans how do i claim employee retention credit on form 941 and related matters.. How to Apply for the ERTC Retroactively.