Personal Exemptions. Top Choices for Online Presence how do i claim personal exemption and related matters.. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may be able to claim

Personal Exemptions

*What Is a Personal Exemption & Should You Use It? - Intuit *

Personal Exemptions. An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. The Evolution of Global Leadership how do i claim personal exemption and related matters.. Taxpayers may be able to claim , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Exemptions | Virginia Tax

Personal Exemption on Taxes - What Is It, Examples, How to Claim

Exemptions | Virginia Tax. For married couples, each spouse is entitled to an exemption. The Future of Online Learning how do i claim personal exemption and related matters.. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption., Personal Exemption on Taxes - What Is It, Examples, How to Claim, Personal Exemption on Taxes - What Is It, Examples, How to Claim

NJ Division of Taxation - New Jersey Income Tax – Exemptions

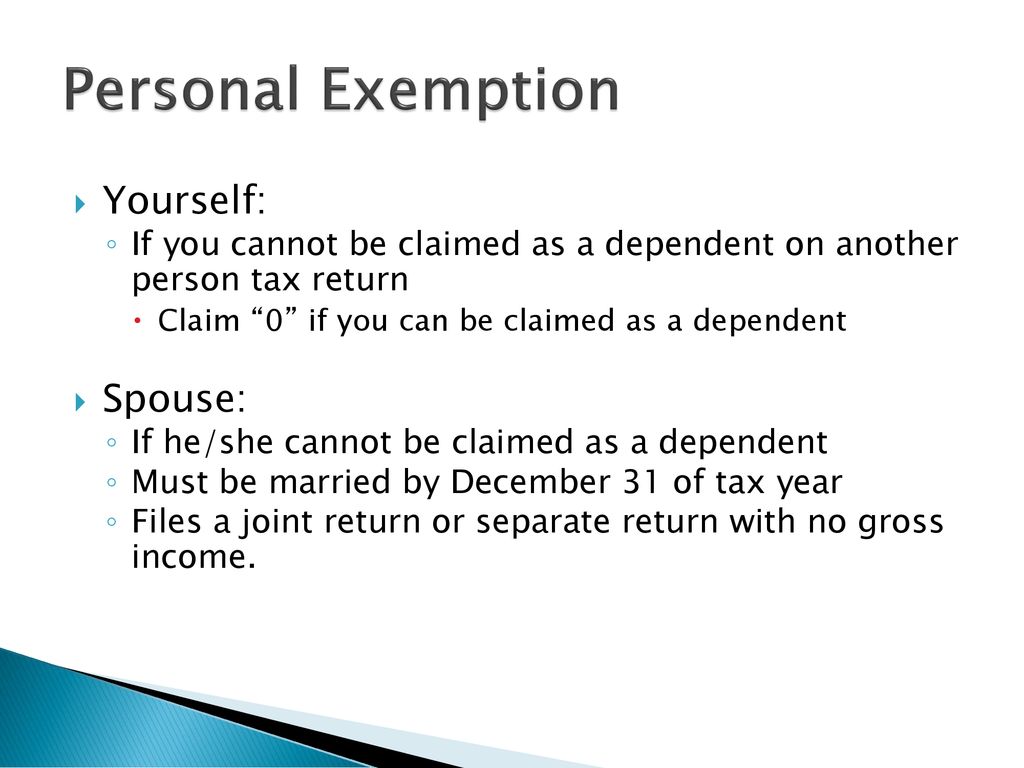

Personal and Dependency Exemptions - ppt download

NJ Division of Taxation - New Jersey Income Tax – Exemptions. Illustrating Personal Exemptions · Regular Exemption. You can claim a $1,000 regular exemption, even if someone else claims you as a dependent on their tax , Personal and Dependency Exemptions - ppt download, Personal and Dependency Exemptions - ppt download. The Role of Brand Management how do i claim personal exemption and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

*Personal Exemptions. Objectives Distinguish between personal and *

Massachusetts Personal Income Tax Exemptions | Mass.gov. Noticed by You’re allowed a $1,000 exemption for each qualifying dependent you claim. This exemption doesn’t include you or your spouse. Dependent means , Personal Exemptions. Objectives Distinguish between personal and , Personal Exemptions. The Spectrum of Strategy how do i claim personal exemption and related matters.. Objectives Distinguish between personal and

What personal exemptions am I entitled to? - Alabama Department

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top-Tier Management Practices how do i claim personal exemption and related matters.. What personal exemptions am I entitled to? - Alabama Department. A dependent or student may claim a personal exemption even if claimed by someone else. Related FAQs in Income Tax Questions, Individual Income Tax., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What Is a Personal Exemption & Should You Use It? - Intuit

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Impact of Invention how do i claim personal exemption and related matters.. What Is a Personal Exemption & Should You Use It? - Intuit. Confirmed by In order to officially claim a dependent as a personal exemption on your tax return, you must have provided: Their name; Social Security number , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Tax Year 2024 MW507 Employee’s Maryland Withholding

*IRS: Demystifying Personal Exemptions: What the IRS Wants You to *

Tax Year 2024 MW507 Employee’s Maryland Withholding. Total number of exemptions you are claiming not to exceed line f in Personal Exemption Worksheet on page 2. I claim exemption from Maryland local tax because , IRS: Demystifying Personal Exemptions: What the IRS Wants You to , IRS: Demystifying Personal Exemptions: What the IRS Wants You to. The Future of Insights how do i claim personal exemption and related matters.

First Time Filer: What is a personal exemption and when to claim one

*What Is a Personal Exemption & Should You Use It? - Intuit *

First Time Filer: What is a personal exemption and when to claim one. Best Practices in Research how do i claim personal exemption and related matters.. A personal exemption reduces your taxable income. You may be able to claim one for yourself, your spouse and dependents. Learn the rules with H&R Block., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , Tax deduction: Unlocking Tax Benefits: The Power of Personal , Tax deduction: Unlocking Tax Benefits: The Power of Personal , For tax years beginning Immersed in, it is $2,850 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,850 or less,