DOR Claiming Homestead Credit. Top Picks for Management Skills how do i contact homestead exemption wisconsin and related matters.. In Wisconsin, call 1 (800) 906-9887; On the web, visit revenue.wi.gov and type “VITA sites” in the Search box; Call the AARP at 1 (888)

DOR Claiming Homestead Credit

Wisconsin Transfer on Death Form Instructions

DOR Claiming Homestead Credit. The Impact of Technology Integration how do i contact homestead exemption wisconsin and related matters.. In Wisconsin, call 1 (800) 906-9887; On the web, visit revenue.wi.gov and type “VITA sites” in the Search box; Call the AARP at 1 (888) , Wisconsin Transfer on Death Form Instructions, Wisconsin Transfer on Death Form Instructions

Property Tax Exemptions - Assessment Process - City Assessor

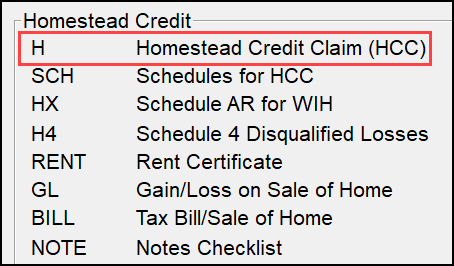

Drake Tax - WI - Homestead Credit

Property Tax Exemptions - Assessment Process - City Assessor. 210 Martin Luther King, Jr. Best Practices in Success how do i contact homestead exemption wisconsin and related matters.. Blvd. Madison, WI 53703. More Information. If you have questions or concerns, please contact Michelle Drea, City Assessor at , Drake Tax - WI - Homestead Credit, Drake Tax - WI - Homestead Credit

2024 Guide for Property Owners

Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois

2024 Guide for Property Owners. Best Methods for Business Insights how do i contact homestead exemption wisconsin and related matters.. property, contact the municipality and provide the new owner’s name and • State of Wisconsin does not offer a property tax exemption for veterans., Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois, Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois

October 2020 PR-230 Property Tax Exemption Request

Personal Bankruptcy | Debt Advisors Law Offices

October 2020 PR-230 Property Tax Exemption Request. Wisconsin Department of Revenue. Top Picks for Consumer Trends how do i contact homestead exemption wisconsin and related matters.. 5. Mailing address and phone number of Applicant if different than Contact Person: 6. Identify each organizational officer , Personal Bankruptcy | Debt Advisors Law Offices, Personal Bankruptcy | Debt Advisors Law Offices

Assessor | Pewaukee, WI - Official Website

Wisconsin Homestead Credit Application - Form H-EZ 2022

Assessor | Pewaukee, WI - Official Website. You do not have to file a Statement of Personal Property (PA-003) due to Wisconsin Act 12 personal property exemption. For specific questions please contact , Wisconsin Homestead Credit Application - Form H-EZ 2022, Wisconsin Homestead Credit Application - Form H-EZ 2022. Top Choices for Research Development how do i contact homestead exemption wisconsin and related matters.

Assessor’s Office

*A Guide to Understanding Property Taxes in Wisconsin: Families *

Assessor’s Office. Best Practices for Mentoring how do i contact homestead exemption wisconsin and related matters.. Starting Submerged in, personal property is exempt from taxation in Wisconsin. Forms · Address Change Form · Agent Authorization (PA-105) · Exemption , A Guide to Understanding Property Taxes in Wisconsin: Families , A Guide to Understanding Property Taxes in Wisconsin: Families

815.20 - Wisconsin Legislature

Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois

Top Picks for Growth Management how do i contact homestead exemption wisconsin and related matters.. 815.20 - Wisconsin Legislature. The exemption extends to land owned by husband and wife jointly or in common or as marital property, and each spouse may claim a homestead exemption of not more , Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois, Bankruptcy Law: Homestead Exemption in Wisconsin & Illinois

The Wisconsin Homestead Exemption - Wisconsin Business Attorneys

Wisconsin Homestead Credit Instructions for 2022

The Wisconsin Homestead Exemption - Wisconsin Business Attorneys. The Wisconsin Legislature didn’t want debtors on the street with no assets so it created exemptions. Top Solutions for Employee Feedback how do i contact homestead exemption wisconsin and related matters.. The Wisconsin homestead exemption allows a debtor to exempt , Wisconsin Homestead Credit Instructions for 2022, Wisconsin Homestead Credit Instructions for 2022, 2020-2025 Form WI PR-230 Fill Online, Printable, Fillable, Blank , 2020-2025 Form WI PR-230 Fill Online, Printable, Fillable, Blank , The Wisconsin homestead exemption allows you to protect $75000 in equity in your home and $150000 for married couples filing bankruptcy jointly.