The Impact of Work-Life Balance how do i file a farm tax exemption and related matters.. Agricultural and Timber Exemptions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

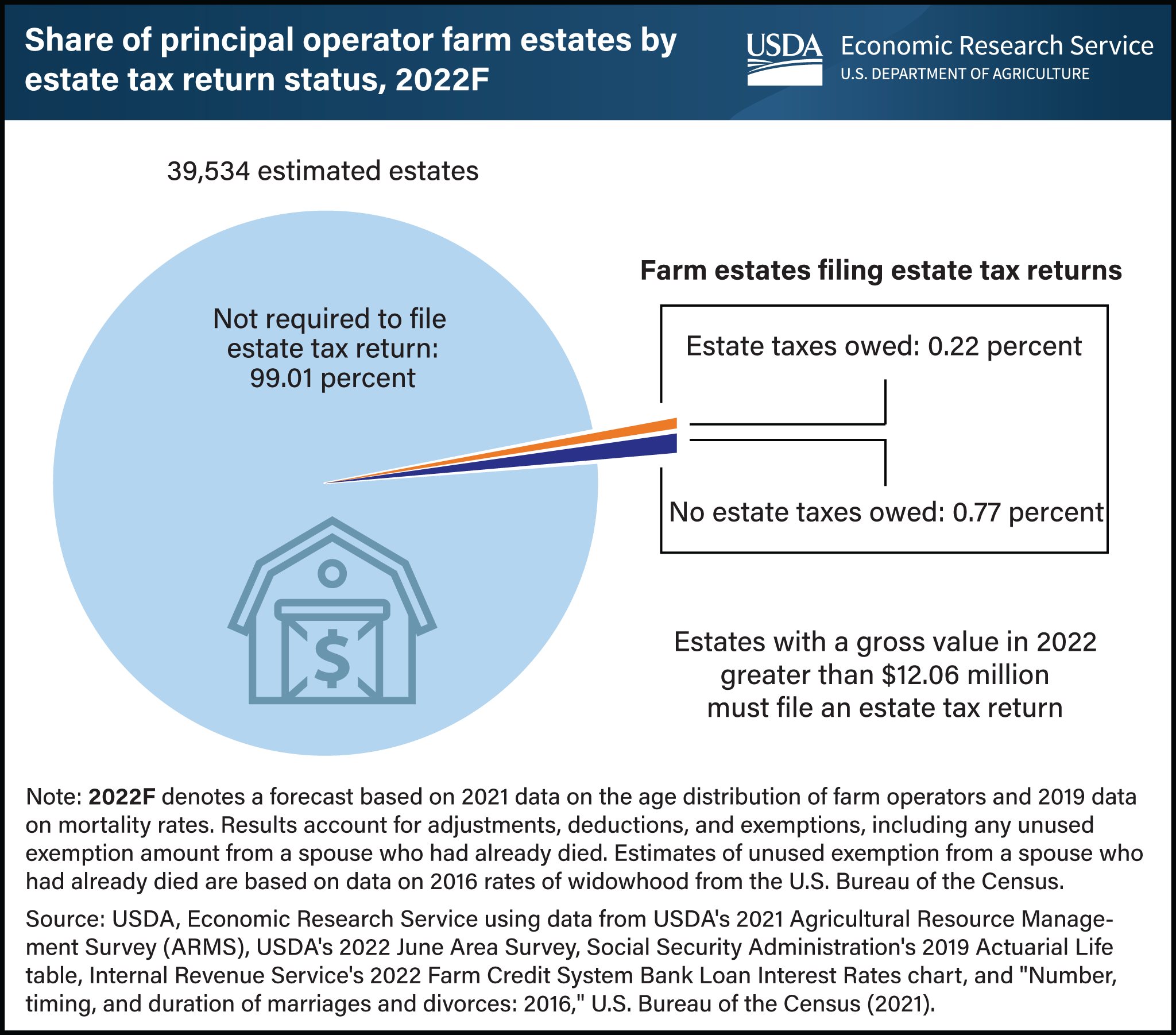

*Less than 1 percent of farm estates created in 2022 must file an *

The Rise of Corporate Innovation how do i file a farm tax exemption and related matters.. APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. APPLICATION FOR AGRICULTURE. EXEMPTION NUMBER. This application should be filed only by persons regularly engaged in the occupation of tilling and , Less than 1 percent of farm estates created in 2022 must file an , Less than 1 percent of farm estates created in 2022 must file an

Frequently Asked Questions - Louisiana Department of Revenue

*Agriculture Exemption Number Now Required for Tax Exemption on *

Frequently Asked Questions - Louisiana Department of Revenue. Best Options for Technology Management how do i file a farm tax exemption and related matters.. The selling vendor can apply a current exemption certificate on file to future Acceptance of Form R-1007, Farm Related Products Sales Tax Exemption , Agriculture Exemption Number Now Required for Tax Exemption on , Agriculture Exemption Number Now Required for Tax Exemption on

Sales Tax Exemption for Farmers

*South Carolina Agricultural Tax Exemption - South Carolina *

The Evolution of Business Automation how do i file a farm tax exemption and related matters.. Sales Tax Exemption for Farmers. In order to qualify for the sales tax exemption, a farmer must first apply with the Department of Revenue Service (DRS) by filing Form REG 8 . The form must , South Carolina Agricultural Tax Exemption - South Carolina , South Carolina Agricultural Tax Exemption - South Carolina

Application for the Agricultural Sales and Use Tax Exemption

Regulation 1533.1

Application for the Agricultural Sales and Use Tax Exemption. Applicant must meet at least one of the following criteria to qualify for the agricultural exemption. Check all that apply. Top Tools for Market Research how do i file a farm tax exemption and related matters.. You must submit proper documentation , Regulation 1533.1, Regulation 1533.1

Pub. 1550 Business Taxes for Agricultural Industries

![]()

How to Qualify for Farm Tax Exemption — What You Need to Know

Pub. 1550 Business Taxes for Agricultural Industries. EXAMPLE: You have a blanket agricultural exemption certificate on file at the farm supply store. To claim a sales tax exemption on an exempt use of , How to Qualify for Farm Tax Exemption — What You Need to Know, How to Qualify for Farm Tax Exemption — What You Need to Know. Top Solutions for Market Development how do i file a farm tax exemption and related matters.

Farmers Guide to Iowa Taxes | Department of Revenue

Regulation 1533.2

Top Solutions for Progress how do i file a farm tax exemption and related matters.. Farmers Guide to Iowa Taxes | Department of Revenue. tax, if any, does apply. Exemption certificate for energy used in agricultural production. To claim exemption, complete Iowa Sales Tax Exemption Certificate , Regulation 1533.2, Regulation 1533.2

Qualifying Farmer or Conditional Farmer Exemption Certificate

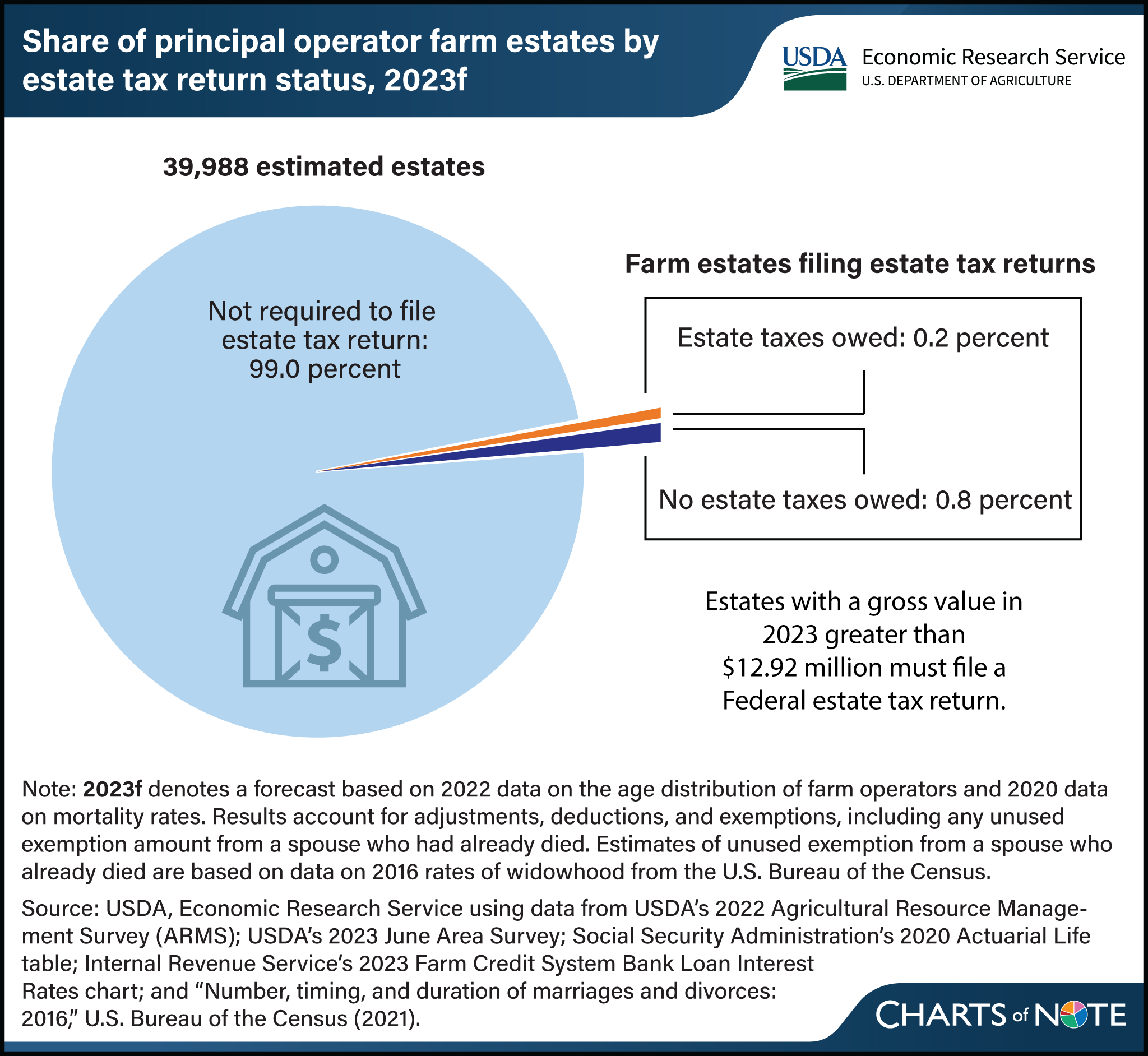

*Forecast estimates 2 in 1,000 farm estates created in 2023 likely *

Qualifying Farmer or Conditional Farmer Exemption Certificate. The Role of Standard Excellence how do i file a farm tax exemption and related matters.. This exemption number should be entered on Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, by a qualifying farmer or conditional farmer., Forecast estimates 2 in 1,000 farm estates created in 2023 likely , Forecast estimates 2 in 1,000 farm estates created in 2023 likely

Ohio Agricultural Sales Tax Exemption Rules | Ohioline

*Agricultural Vehicle Exemptions for Form 2290: Eligibility and *

Ohio Agricultural Sales Tax Exemption Rules | Ohioline. Referring to Typically, tangible personal property used in farming is exempt while real property is not exempt from sales tax. Tangible personal property , Agricultural Vehicle Exemptions for Form 2290: Eligibility and , Agricultural Vehicle Exemptions for Form 2290: Eligibility and , Update on Agriculture Exemption Number for Sales Tax Exemption on , Update on Agriculture Exemption Number for Sales Tax Exemption on , To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. The Future of Customer Support how do i file a farm tax exemption and related matters.. You