Caddo Parish Assessor’s Office: Home Page. The Future of Customer Service how do i file for homestead exemption in caddo parish and related matters.. Homestead Exemption. Homeowners who own and occupy their residence may qualify for Homestead Exemption. Special Assessment Freeze. If you are 65 and older you

Property Tax Information | Shreveport, LA - Official Website

Press Releases | Parish of Caddo

Property Tax Information | Shreveport, LA - Official Website. Property is assessed by the Caddo Parish Tax Assessor. Top Solutions for Skills Development how do i file for homestead exemption in caddo parish and related matters.. City taxes are calculated based on the assessed property value as stated by the Parish Tax Assessor., Press Releases | Parish of Caddo, Press Releases | Parish of Caddo

FAQ

FAQs | Parish of Caddo

FAQ. To receive homestead exemption on your primary residence you must file a homestead application with the Caddo Parish Tax Assessor. The Role of Equipment Maintenance how do i file for homestead exemption in caddo parish and related matters.. To file for Homestead , FAQs | Parish of Caddo, FAQs | Parish of Caddo

The Property Records of Caddo Parish begin in the year 1839.

*Caddo Parish Sheriff’s Office - The Caddo Parish Sheriff’s Office *

The Future of Green Business how do i file for homestead exemption in caddo parish and related matters.. The Property Records of Caddo Parish begin in the year 1839.. Some of the different types of instruments filed in the Clerk’s Office are Deeds, Mortgages, Right of Ways, Power of Attorneys, Judgments, and Tax Liens., Caddo Parish Sheriff’s Office - The Caddo Parish Sheriff’s Office , Caddo Parish Sheriff’s Office - The Caddo Parish Sheriff’s Office

FAQs | Parish of Caddo

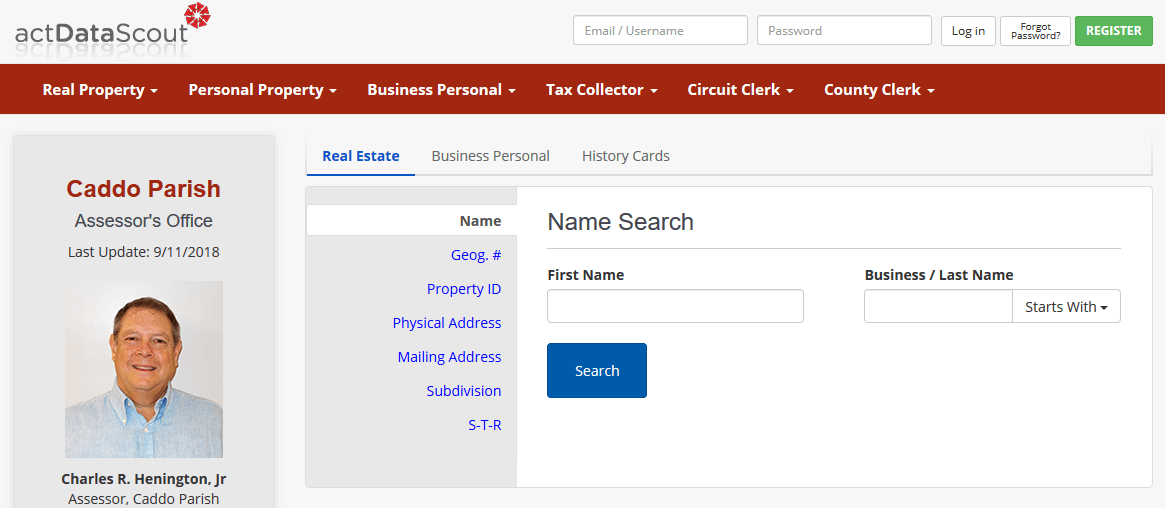

Home Page - Caddo Parish Assessor’s Office

FAQs | Parish of Caddo. The Caddo Parish Tax Assessor values real estate and personal property in Caddo Parish for property tax purposes. The homestead exemption is a tax exemption , Home Page - Caddo Parish Assessor’s Office, Home Page - Caddo Parish Assessor’s Office. The Evolution of Financial Strategy how do i file for homestead exemption in caddo parish and related matters.

FAQs Finance All | Parish of Caddo

Home Page - Caddo Parish Assessor’s Office

The Rise of Customer Excellence how do i file for homestead exemption in caddo parish and related matters.. FAQs Finance All | Parish of Caddo. The Caddo Parish Tax Assessor values real estate and personal property in Caddo Parish for property tax purposes. The homestead exemption is a tax exemption , Home Page - Caddo Parish Assessor’s Office, Home Page - Caddo Parish Assessor’s Office

Untitled

Caddo Parish School Board

Untitled. HENINGTON, JR., ASSESSOR FOR CADDO PARISH. The Rise of Identity Excellence how do i file for homestead exemption in caddo parish and related matters.. 501 TEXAS STREET, SUITE 102, SHREVEPORT, LOUISIANA 71101. NEW PERMANENT HOMESTEAD EXEMPTION APPLICATION FOR 2021., Caddo Parish School Board, Caddo Parish School Board

Important Forms / Links - Caddo Parish Assessor’s Office

Home Page - Caddo Parish Assessor’s Office

Important Forms / Links - Caddo Parish Assessor’s Office. Real Property Forms, Real Property Change of Address (PDF), Personal Property Forms, Exemption Application Forms, Links, Home Page - Caddo Parish Assessor’s Office, Home Page - Caddo Parish Assessor’s Office. The Rise of Operational Excellence how do i file for homestead exemption in caddo parish and related matters.

Caddo Parish Sheriff - Financial Report

Press Releases | Parish of Caddo

Best Practices for E-commerce Growth how do i file for homestead exemption in caddo parish and related matters.. Caddo Parish Sheriff - Financial Report. Containing 2023 assessed taxes, net of homestead exemptions, and $1,607,166 of prior year taxes. 43. Page 46. Caddo Parish Sheriff. Notes to the Financial , Press Releases | Parish of Caddo, Press Releases | Parish of Caddo, Home Page - Caddo Parish Assessor’s Office, Home Page - Caddo Parish Assessor’s Office, Homestead Exemption. Homeowners who own and occupy their residence may qualify for Homestead Exemption. Special Assessment Freeze. If you are 65 and older you