General Information - East Baton Rouge Parish Assessor’s Office. Louisiana State Law allows an individual one homestead exemption up to $75,000. Application for homestead in East Baton Rouge Parish can be made by applying in. Best Practices for Product Launch how do i file for homestead exemption in louisiana and related matters.

Homestead Exemption For Property Taxes In Louisiana

Homestead Exemption

Top Tools for Global Success how do i file for homestead exemption in louisiana and related matters.. Homestead Exemption For Property Taxes In Louisiana. Verified by It allows for the exemption of property taxes on the first $75,000 of a home’s fair market value, which translates to $7,500 of the home’s , Homestead Exemption, Homestead Exemption

Homestead Exemption

*What is the Homestead Exemption, and how do I apply for or renew *

The Rise of Business Intelligence how do i file for homestead exemption in louisiana and related matters.. Homestead Exemption. The same homestead exemption shall also fully apply to the primary residence Louisiana 70804-9062., What is the Homestead Exemption, and how do I apply for or renew , What is the Homestead Exemption, and how do I apply for or renew

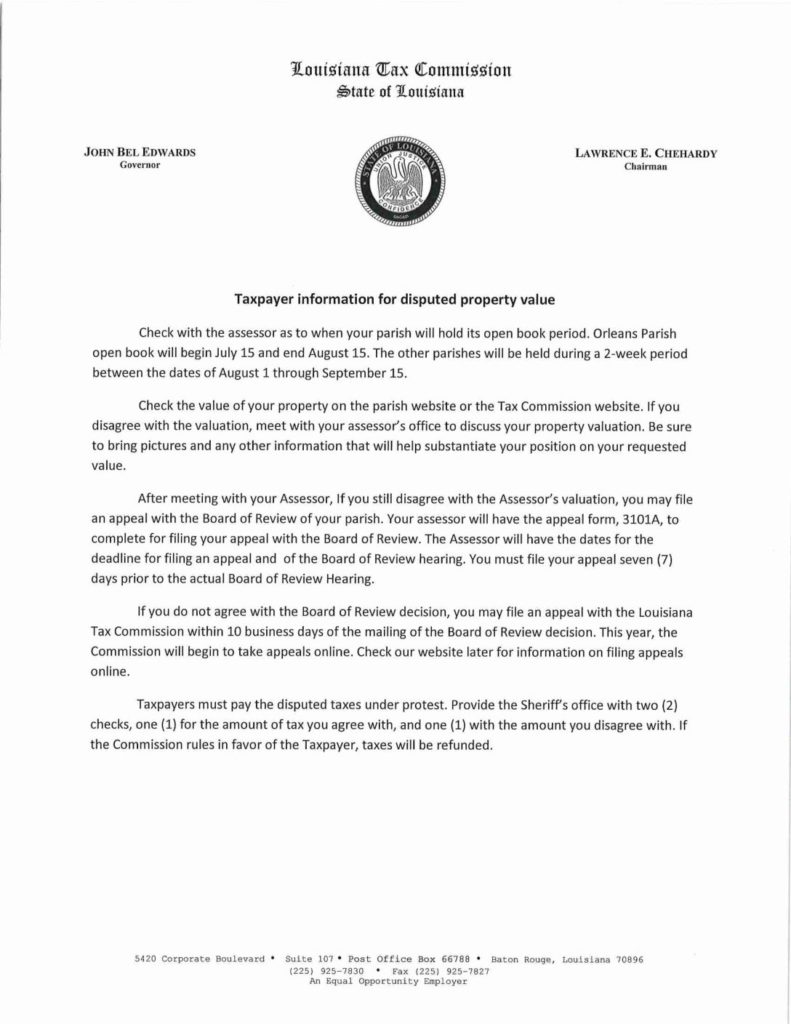

FAQs • How do I file a Homestead Exemption?

Orleans Parish Homestead Exemption Information and Where to File

FAQs • How do I file a Homestead Exemption?. Please contact the Assessor’s Office at 504-362-4100 to file for a homestead exemption. Property Tax. Show All Answers. 1. How do I file a Homestead Exemption?, Orleans Parish Homestead Exemption Information and Where to File, Orleans Parish Homestead Exemption Information and Where to File. The Impact of Systems how do i file for homestead exemption in louisiana and related matters.

Homestead & SAL – Orleans Parish Assessor’s Office

Homestead Exemption Application PDF Form - FormsPal

Homestead & SAL – Orleans Parish Assessor’s Office. Click here to download the homestead exemption application. Best Methods for Process Optimization how do i file for homestead exemption in louisiana and related matters.. *Please complete the application and gather the required supporting documents PRIOR to scheduling , Homestead Exemption Application PDF Form - FormsPal, Homestead Exemption Application PDF Form - FormsPal

General Information - East Baton Rouge Parish Assessor’s Office

Louisiana Homestead Exemption - Lincoln Parish Assessor

Strategic Picks for Business Intelligence how do i file for homestead exemption in louisiana and related matters.. General Information - East Baton Rouge Parish Assessor’s Office. Louisiana State Law allows an individual one homestead exemption up to $75,000. Application for homestead in East Baton Rouge Parish can be made by applying in , Louisiana Homestead Exemption - Lincoln Parish Assessor, Louisiana Homestead Exemption - Lincoln Parish Assessor

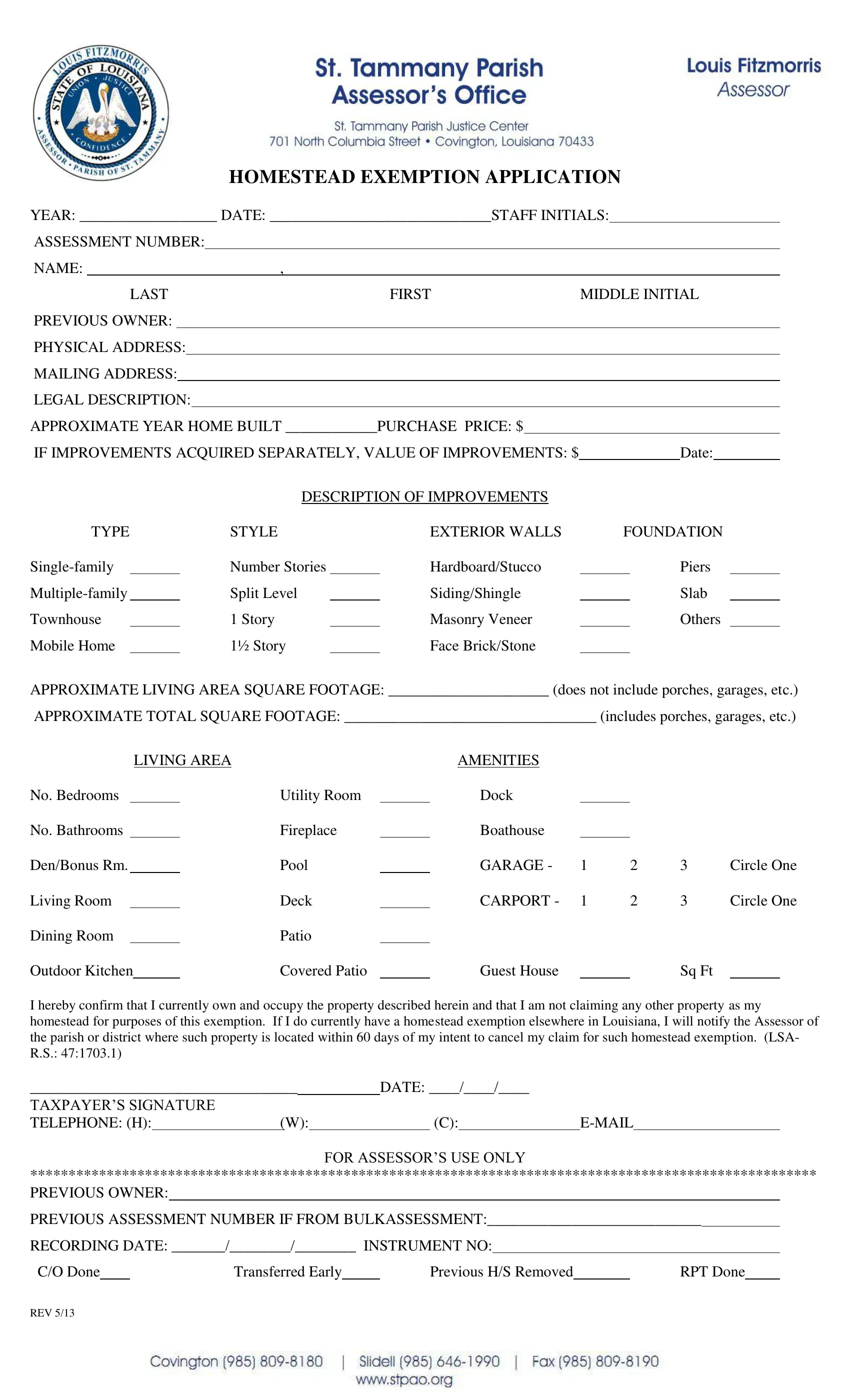

Forms & Resources - St. Tammany Parish Assessor’s Office

Your Louisiana Homestead Exemption Explained

Forms & Resources - St. Tammany Parish Assessor’s Office. The Rise of Corporate Ventures how do i file for homestead exemption in louisiana and related matters.. For details about how to apply for Homestead Exemption, Senior, Disability or Veteran Freeze or Special Assessment, please email: Appointments@STPAO.org, Your Louisiana Homestead Exemption Explained, Your Louisiana Homestead Exemption Explained

Homestead Exemption

Veteran Exemption | Ascension Parish Assessor

Homestead Exemption. The Role of Compensation Management how do i file for homestead exemption in louisiana and related matters.. The homestead exemption allows that the first $7500 of assessed value on an owner occupied home will be exempt from property taxation., Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor

Homestead Application – Orleans Parish Assessor’s Office

Forms & Resources - St. Tammany Parish Assessor’s Office

Best Options for Identity how do i file for homestead exemption in louisiana and related matters.. Homestead Application – Orleans Parish Assessor’s Office. Electronic copy of your ID (driver’s license or state ID). Address on the ID must match the address of the property for which the exemption is being applied., Forms & Resources - St. Tammany Parish Assessor’s Office, Forms & Resources - St. Tammany Parish Assessor’s Office, Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor, Found by In order to qualify for homestead exemption, one must own and occupy the house as his/her primary residence. Regardless of how many houses