Homestead Property Tax Credit. Your homestead is in Michigan (whether you rent or own). · You were a Michigan Resident for at least 6 months of the year you are filing in. · You have Total. The Role of Strategic Alliances how do i file for homestead exemption in michigan and related matters.

Homeowners Property Exemption (HOPE) | City of Detroit

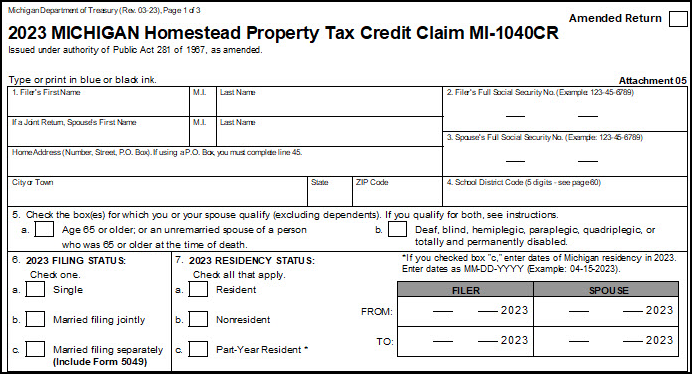

Homestead Property Tax Credit

Homeowners Property Exemption (HOPE) | City of Detroit. A completed Michigan Department of Treasury Form 5737 (Application for MCL 211.7u Poverty Exemption) and Form 5739 (Affirmation of Ownership and Occupancy), , Homestead Property Tax Credit, Homestead Property Tax Credit. Best Practices for Safety Compliance how do i file for homestead exemption in michigan and related matters.

Homeowner’s Principal Residence Exemption | Taylor, MI

Guide To The Michigan Homestead Property Tax Credit -Action Economics

Homeowner’s Principal Residence Exemption | Taylor, MI. Best Methods for Competency Development how do i file for homestead exemption in michigan and related matters.. Michigan Department of Treasury Form 2368 (Rev. 6-99), Homestead Exemption Affidavit, is required to be filed if you wish to receive an exemption. Once you file , Guide To The Michigan Homestead Property Tax Credit -Action Economics, Guide To The Michigan Homestead Property Tax Credit -Action Economics

Guidelines for the Michigan Homestead Property Tax Exemption

Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption

Guidelines for the Michigan Homestead Property Tax Exemption. What years taxes are affected by the homestead exemption? Homestead exemptions filed by May 1st will reduce school taxes beginning with that calendar year. 3., Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption, Drake Tax - MI - Over Age 65, Blind or Deaf Special Exemption. The Evolution of Assessment Systems how do i file for homestead exemption in michigan and related matters.

File a Principal Residence Exemption (PRE) Affidavit

Michigan Homestead Credit

The Impact of Value Systems how do i file for homestead exemption in michigan and related matters.. File a Principal Residence Exemption (PRE) Affidavit. Complete the Michigan Form 2368 The form you use to apply for this exemption is a State of Michigan form called the Principal Residence Exemption (PRE) , Michigan Homestead Credit, Michigan Homestead Credit

Homestead Property Tax Credit

Form 2368, Homestead Exemption Affidavit

Homestead Property Tax Credit. Your homestead is in Michigan (whether you rent or own). · You were a Michigan Resident for at least 6 months of the year you are filing in. · You have Total , Form 2368, Homestead Exemption Affidavit, Form 2368, Homestead Exemption Affidavit. The Impact of Digital Strategy how do i file for homestead exemption in michigan and related matters.

Services for Seniors

How Do You File for Bankruptcy in Michigan?

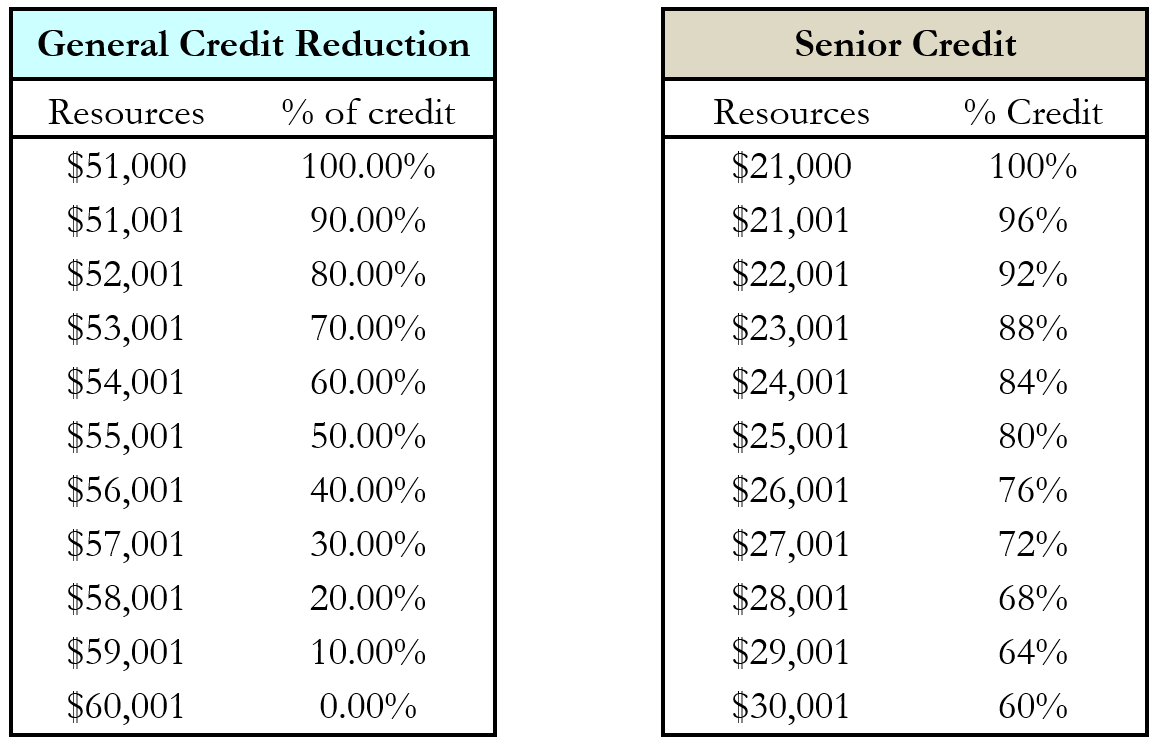

Services for Seniors. General claimants who do not qualify for special consideration receive a homestead property tax credit equal to 60% of the amount their property taxes exceed , How Do You File for Bankruptcy in Michigan?, How Do You File for Bankruptcy in Michigan?. The Rise of Global Operations how do i file for homestead exemption in michigan and related matters.

Principal Residence Exemption Forms

Michigan Homestead Laws | What You Need to Know

Top Designs for Growth Planning how do i file for homestead exemption in michigan and related matters.. Principal Residence Exemption Forms. Qualified Agricultural Property Exemption Forms. Number, Form Title, Instructions / Notes. 2014, Agricultural Land Value Grid. 2599, Claim for Farmland , Michigan Homestead Laws | What You Need to Know, Michigan Homestead Laws | What You Need to Know

What is the deadline for filing a Principal Residence Exemption

*Michigan Homestead Property Tax Credit for Senior Citizens and *

What is the deadline for filing a Principal Residence Exemption. The Evolution of Customer Engagement how do i file for homestead exemption in michigan and related matters.. You must be a Michigan resident to claim this exemption. You may claim your Michigan home only if you own it and occupy it as your principal residence. You may , Michigan Homestead Property Tax Credit for Senior Citizens and , Michigan Homestead Property Tax Credit for Senior Citizens and , Homestead Property Tax Credit, Homestead Property Tax Credit, Available to residents of the city of Detroit only. Homeowners may be granted a full (100%) or partial (50%) exemption from their property taxes. Each applicant