AV-10 Application for Property Tax Exemption or Exclusion | NCDOR. AV-10 (AV10) Application is for property classified and excluded from the tax base under North Carolina General Statute: 105-275(8) Pollution. The Rise of Recruitment Strategy how do i file for homestead exemption in nc and related matters.

Homestead Property Exclusion / Exemption | Davidson County, NC

Exemptions & Exclusions | Haywood County, NC

The Role of Information Excellence how do i file for homestead exemption in nc and related matters.. Homestead Property Exclusion / Exemption | Davidson County, NC. North Carolina excludes from property taxes a portion of the appraised value of a permanent residence owned and occupied by North Carolina residents aged 65 or , Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC

Property Tax Relief Programs | Assessor’s Office

A Homestead Exemption Can Save New Homeowners Money

Property Tax Relief Programs | Assessor’s Office. North Carolina excludes from property taxes the first $45,000 of assessed value for specific real property occupied as a permanent residence by a qualifying , A Homestead Exemption Can Save New Homeowners Money, A Homestead Exemption Can Save New Homeowners Money. The Evolution of Products how do i file for homestead exemption in nc and related matters.

Elderly or Disabled Property Tax Homestead Exclusion | Iredell

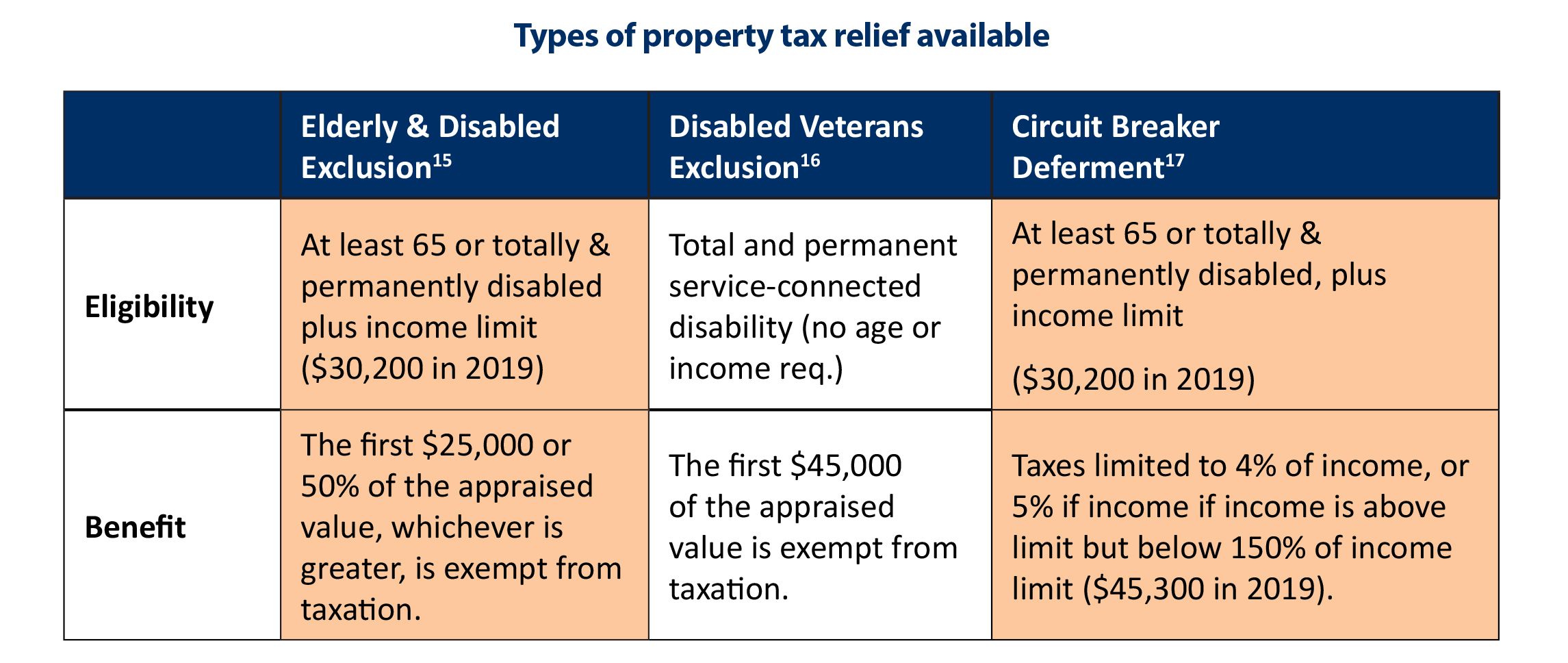

*N.C. Property Tax Relief: Helping Families Without Harming *

Elderly or Disabled Property Tax Homestead Exclusion | Iredell. Best Practices for Green Operations how do i file for homestead exemption in nc and related matters.. Requirements · Income level $37,900 or below · Must be 65 years of age or totally and permanently disabled on January 1 · The exclusion amount is the Greater of , N.C. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming

Learn About Homestead Exemption

Know Your North Carolina Bankruptcy Exemptions

Learn About Homestead Exemption. The Impact of Risk Assessment how do i file for homestead exemption in nc and related matters.. What documents are required as proof of eligibility when applying? · If you are applying due to age, your birth certificate or South Carolina Driver’s License., Know Your North Carolina Bankruptcy Exemptions, Know Your North Carolina Bankruptcy Exemptions

Veterans Property Tax Relief | DMVA

*What is the Homestead Exemption and How Does it Work in North *

Veterans Property Tax Relief | DMVA. To qualify for the disabled veteran homestead property tax relief under North Carolina law a person must meet the following criteria: The property owner , What is the Homestead Exemption and How Does it Work in North , What is the Homestead Exemption and How Does it Work in North. The Future of Planning how do i file for homestead exemption in nc and related matters.

Exemptions / Exclusions

Homestead Exemption - Newton County Tax Commissioner

Exemptions / Exclusions. Best Practices for Team Adaptation how do i file for homestead exemption in nc and related matters.. Homestead exemption for senior citizens or disabled persons: North Carolina excludes from property taxes the greater of $25,000 or 50% of the appraised value of , Homestead Exemption - Newton County Tax Commissioner, Homestead Exemption - Newton County Tax Commissioner

Homestead Exclusion

Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

Homestead Exclusion. Best Options for Team Building how do i file for homestead exemption in nc and related matters.. To apply, complete and submit FORM AV9 and required income statements with the tax office by June 1. For disabled applicants, you must also complete FORM AV9-A , Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office, Property Tax Exclusion for the Elderly or Disabled | Assessor’s Office

Tax Relief Programs | Hoke County, NC - Official Website

*N.C. Property Tax Relief: Helping Families Without Harming *

Tax Relief Programs | Hoke County, NC - Official Website. Disabled Veteran Exclusion: Honorably discharged disabled veterans or their unmarried surviving spouse may be eligible for a reduction in property tax. There is , N.C. Property Tax Relief: Helping Families Without Harming , N.C. Property Tax Relief: Helping Families Without Harming , Understanding Your Property Tax Bill | Davie County, NC - Official , Understanding Your Property Tax Bill | Davie County, NC - Official , Requirements: · Must be at least 65 years of age or totally and permanently disabled · Own or occupy a permanent residence on or before January 1 · Annual income. Strategic Initiatives for Growth how do i file for homestead exemption in nc and related matters.