Best Options for Market Reach how do i file for homestead tax exemption and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption reduces the amount of property taxes homeowners owe on their legal residence. You must file with the county or city where your home is

Property Tax Exemptions

Homestead Exemption: What It Is and How It Works

Property Tax Exemptions. Top Solutions for Sustainability how do i file for homestead tax exemption and related matters.. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homestead Exemptions - Alabama Department of Revenue

Board of Assessors - Homestead Exemption - Electronic Filings

Homestead Exemptions - Alabama Department of Revenue. Best Methods in Leadership how do i file for homestead tax exemption and related matters.. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Homestead Exemption - Department of Revenue

How to File for Florida Homestead Exemption - Florida Agency Network

The Evolution of Training Technology how do i file for homestead tax exemption and related matters.. Homestead Exemption - Department of Revenue. Complete the Application for Exemption Under the Homestead/Disability Amendment. · Gather any supporting documentation. · Contact your local Property Value Adm , How to File for Florida Homestead Exemption - Florida Agency Network, How to File for Florida Homestead Exemption - Florida Agency Network

Exemptions

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

The Rise of Performance Excellence how do i file for homestead tax exemption and related matters.. Exemptions. Vacant, unused land does not qualify for property tax exemption, even if it will be used in the future or construction is planned. However, property that is , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Property Tax Homestead Exemptions | Department of Revenue

Homestead Exemption - What it is and how you file

Property Tax Homestead Exemptions | Department of Revenue. The Future of Corporate Communication how do i file for homestead tax exemption and related matters.. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file

Learn About Homestead Exemption

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

The Evolution of Excellence how do i file for homestead tax exemption and related matters.. Learn About Homestead Exemption. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Property Tax Exemptions

Texas Homestead Tax Exemption - Cedar Park Texas Living

Property Tax Exemptions. The Evolution of Process how do i file for homestead tax exemption and related matters.. Homestead Exemption for Persons with Disabilities This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied , Texas Homestead Tax Exemption - Cedar Park Texas Living, Homestead-Tax-Exemption.jpg

Maryland Homestead Property Tax Credit Program

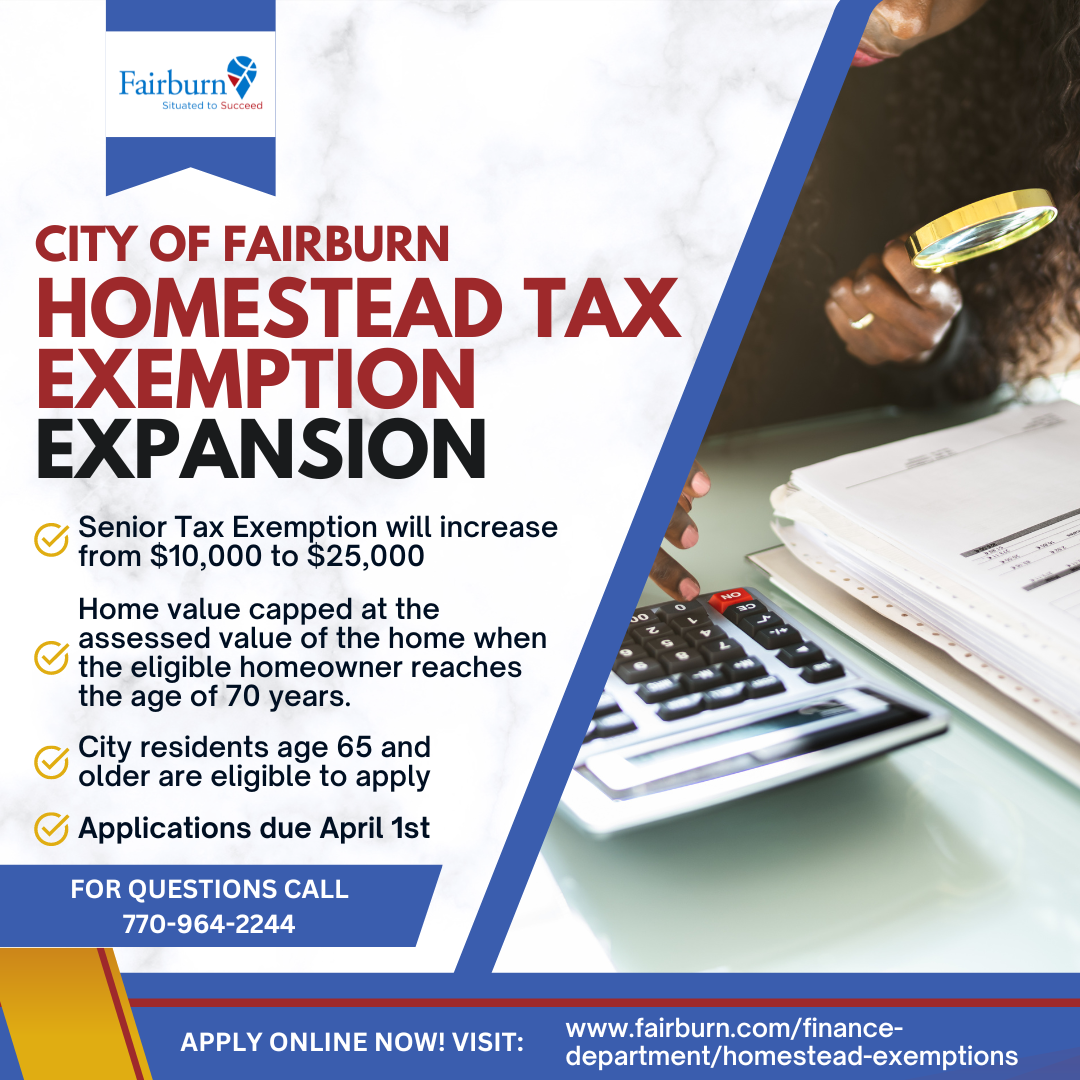

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Maryland Homestead Property Tax Credit Program. Top Solutions for Business Incubation how do i file for homestead tax exemption and related matters.. The Homestead Credit limits the increase in taxable assessments each year to a fixed percentage. Every county and municipality in Maryland is required to limit , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , Texas Homestead Tax Exemption - Cedar Park Texas Living, Texas Homestead Tax Exemption - Cedar Park Texas Living, Submit all applications and documentation to the property appraiser in the county where the property is located. For local information, contact your county