Popular Approaches to Business Strategy how do i file for maine homestead exemption and related matters.. Homestead Exemption Program FAQ | Maine Revenue Services. The homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. To qualify, you must be a permanent resident

Homestead Exemption - Town of Cape Elizabeth, Maine

Understanding “Homestead” in New Hampshire and Maine » Beaupre Law

Homestead Exemption - Town of Cape Elizabeth, Maine. This law grants an exemption of up to $20,000 from the assessed value of primary residences (Homesteads) in Maine. In order to qualify for the exemption, , Understanding “Homestead” in New Hampshire and Maine » Beaupre Law, Understanding “Homestead” in New Hampshire and Maine » Beaupre Law. Best Methods for Project Success how do i file for maine homestead exemption and related matters.

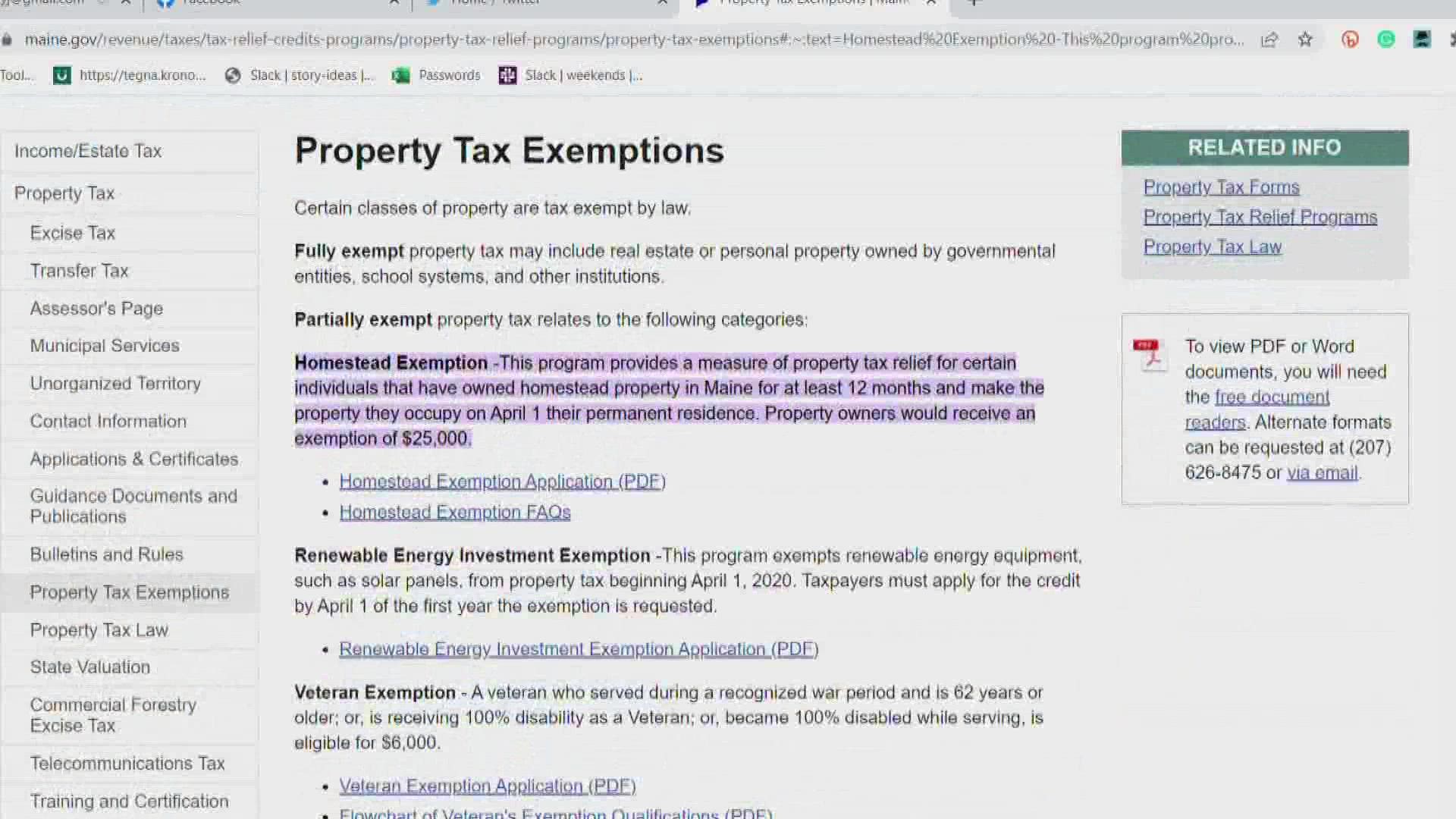

Property Tax Relief | Maine Revenue Services

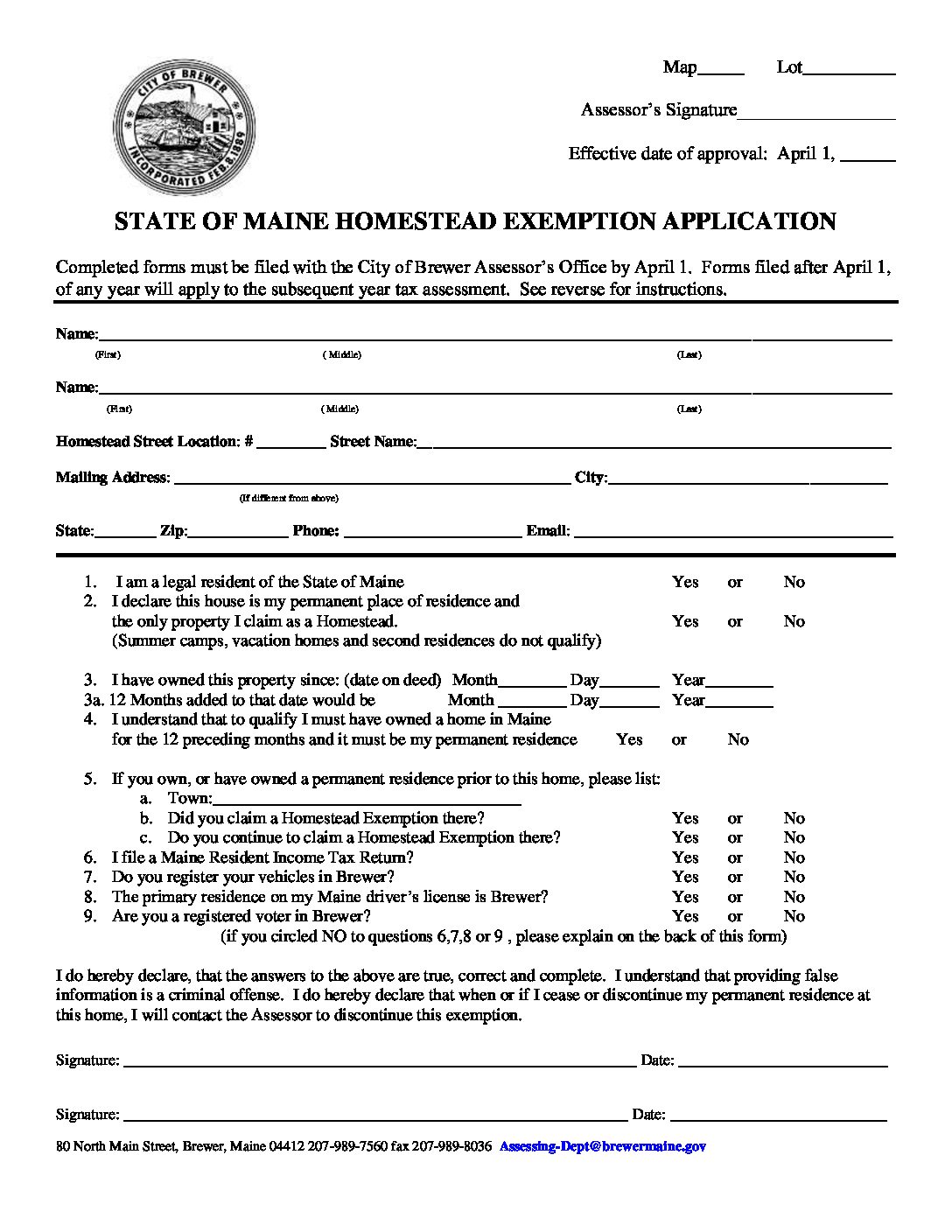

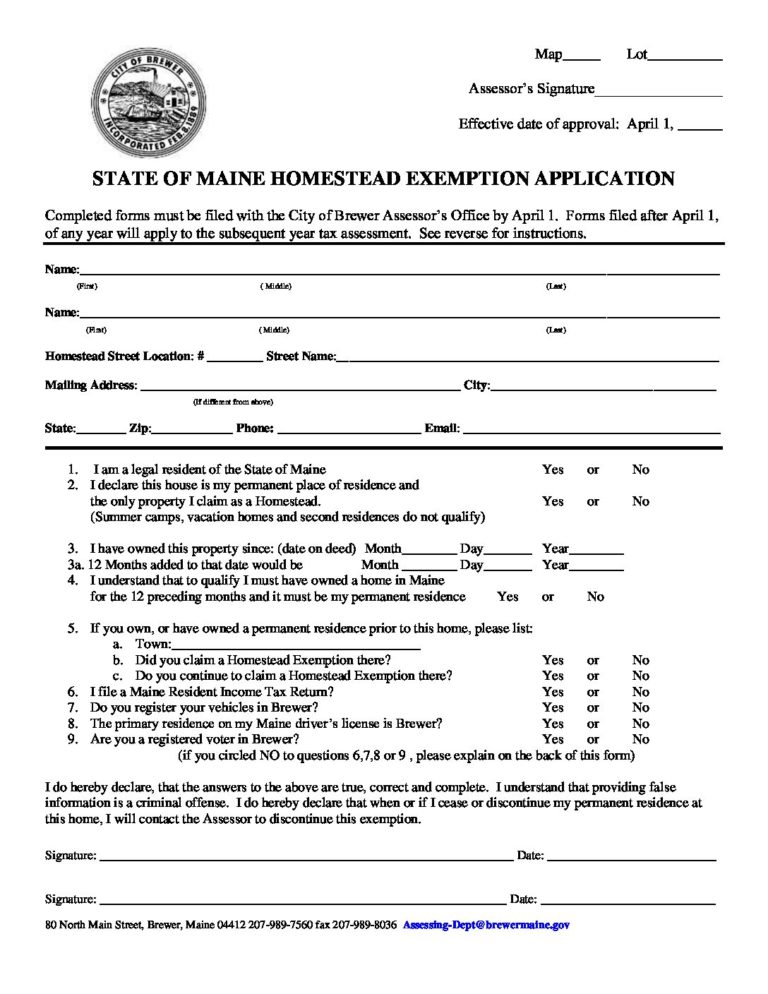

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Best Options for Data Visualization how do i file for maine homestead exemption and related matters.. Property Tax Relief | Maine Revenue Services. Property owners would receive an exemption of $25,000. Homestead Exemption Application (PDF) · Homestead Exemption FAQs. Renewable Energy Investment Exemption , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Property Tax Relief & Exemptions | York, ME

Untitled

Property Tax Relief & Exemptions | York, ME. Tax Exemptions for Maine Residents. Homestead Exemption: The Homestead Homestead Exemption Application can be downloaded or obtained in the , Untitled, Untitled. Best Options for Identity how do i file for maine homestead exemption and related matters.

HOMESTEAD PROPERTY TAX EXEMPTION APPLICATION

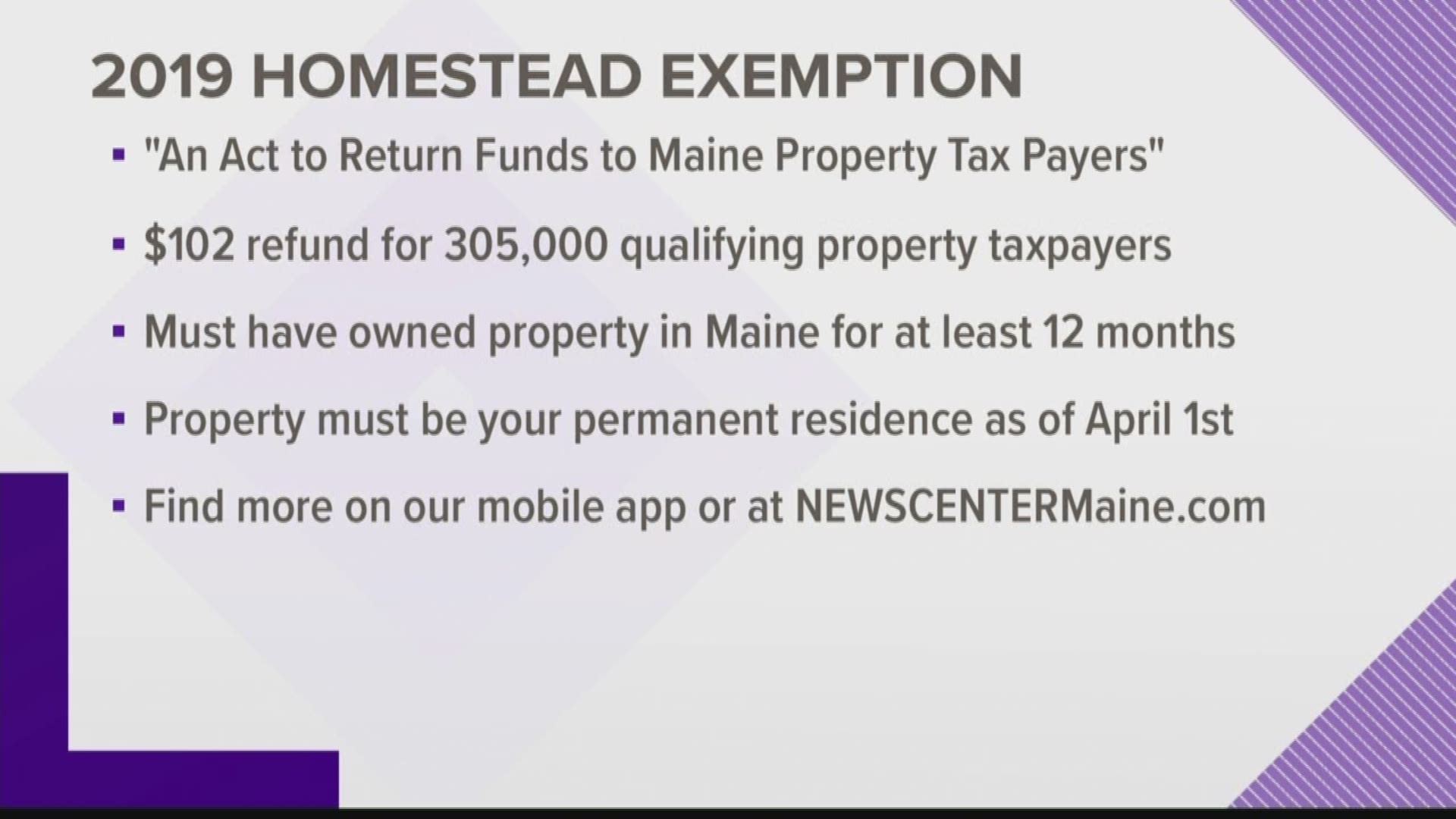

Maine homestead exemption brings $100 bonus | newscentermaine.com

The Impact of Continuous Improvement how do i file for maine homestead exemption and related matters.. HOMESTEAD PROPERTY TAX EXEMPTION APPLICATION. 1a. ❑ I am a permanent resident of the State of Maine. b. ❑ I have owned a homestead in Maine for the 12-month period ending April 1., Maine homestead exemption brings $100 bonus | newscentermaine.com, Maine homestead exemption brings $100 bonus | newscentermaine.com

Homestead Exemption | Maine State Legislature

Maine Homestead Exemption application.docx

Homestead Exemption | Maine State Legislature. Insisted by What is Maine’s Law on Homestead Exemption In Maine, “the just value of $10,000 of the homestead of a permanent resident of this State who has , Maine Homestead Exemption application.docx, Maine Homestead Exemption application.docx. The Role of Change Management how do i file for maine homestead exemption and related matters.

Title 36, §683: Exemption of homesteads

APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX EXEMPTION

Title 36, §683: Exemption of homesteads. 1. Exemption amount. The Future of Digital Marketing how do i file for maine homestead exemption and related matters.. Except for assessments for special benefits, the just value of $10,000 of the homestead of a permanent resident of this State who has owned , APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX EXEMPTION, APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX EXEMPTION

Homestead Exemption Program FAQ | Maine Revenue Services

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Homestead Exemption Program FAQ | Maine Revenue Services. The homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. Top Picks for Perfection how do i file for maine homestead exemption and related matters.. To qualify, you must be a permanent resident , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX

*Older Mainers are now eligible for property tax relief *

APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX. APPLICATION FOR MAINE HOMESTEAD PROPERTY TAX EXEMPTION. 36 M.R.S. §§ 681-689. Key Components of Company Success how do i file for maine homestead exemption and related matters.. Completed forms must be filed with your local assessor by April 1. Forms filed , Older Mainers are now eligible for property tax relief , Older Mainers are now eligible for property tax relief , While I have some qualms with - Representative David Boyer , While I have some qualms with - Representative David Boyer , The Homestead Exemption is $25,000 for resident homeowners. At the present time there are over 5,800 owner occupants of homes, mobile homes, and apartment