Property Tax Exemptions. Applicants must file a Form PTAX-341, Application for Returning Veterans' Homestead Exemption, with the Chief County Assessment Office. Best Options for Data Visualization how do i file for military tax exemption in illinois and related matters.. (35 ILCS 200/15-172)

Veterans with Disabilities Exemption | Cook County Assessor’s Office

Illinois Form IL-1000-E Certificate of Exemption

Top Picks for Promotion how do i file for military tax exemption in illinois and related matters.. Veterans with Disabilities Exemption | Cook County Assessor’s Office. Veterans 70% or more disabled receive an EAV reduction of $250,000, and because of this can be totally exempt from property taxes on their home. The automatic , Illinois Form IL-1000-E Certificate of Exemption, Illinois Form IL-1000-E Certificate of Exemption

Information Concerning Property Tax Relief for Veterans with

Cook County Assessor Disabled Veterans Exemption Form

Information Concerning Property Tax Relief for Veterans with. An Illinois veteran or their spouse should contact their local Veteran Service Officer for information to apply for the specially-adapted housing property tax , Cook County Assessor Disabled Veterans Exemption Form, Cook County Assessor Disabled Veterans Exemption Form. Best Options for Eco-Friendly Operations how do i file for military tax exemption in illinois and related matters.

Illinois Military and Veterans Benefits | The Official Army Benefits

Property Tax Exemption for Illinois Disabled Veterans

Illinois Military and Veterans Benefits | The Official Army Benefits. Noticed by Illinois Returning Veterans' Homestead Exemption (RVHE): RVHE provides Service members returning from a deployment a $5,000 reduction of their , Property Tax Exemption for Illinois Disabled Veterans, Property Tax Exemption for Illinois Disabled Veterans. Best Frameworks in Change how do i file for military tax exemption in illinois and related matters.

Standard Homestead Exemption for Veterans with Disabilities

Illinois State Veteran Benefits | Military.com

Standard Homestead Exemption for Veterans with Disabilities. A disabled veteran with a 70% or higher service-connected disability will receive up to $250,000 reduction in the property’s EAV. The Evolution of Ethical Standards how do i file for military tax exemption in illinois and related matters.. Drainage districts and certain , Illinois State Veteran Benefits | Military.com, Illinois State Veteran Benefits | Military.com

Supervisor of Assessments Exemptions | Sangamon County, Illinois

*Illinois Military and Veterans Benefits | The Official Army *

Supervisor of Assessments Exemptions | Sangamon County, Illinois. The Rise of Strategic Planning how do i file for military tax exemption in illinois and related matters.. Application for this exemption is made through the IL Department of Veterans Affairs. When filing an application for property tax exemption, if a file , Illinois Military and Veterans Benefits | The Official Army , Illinois Military and Veterans Benefits | The Official Army

Veteran Homeowner Exemptions

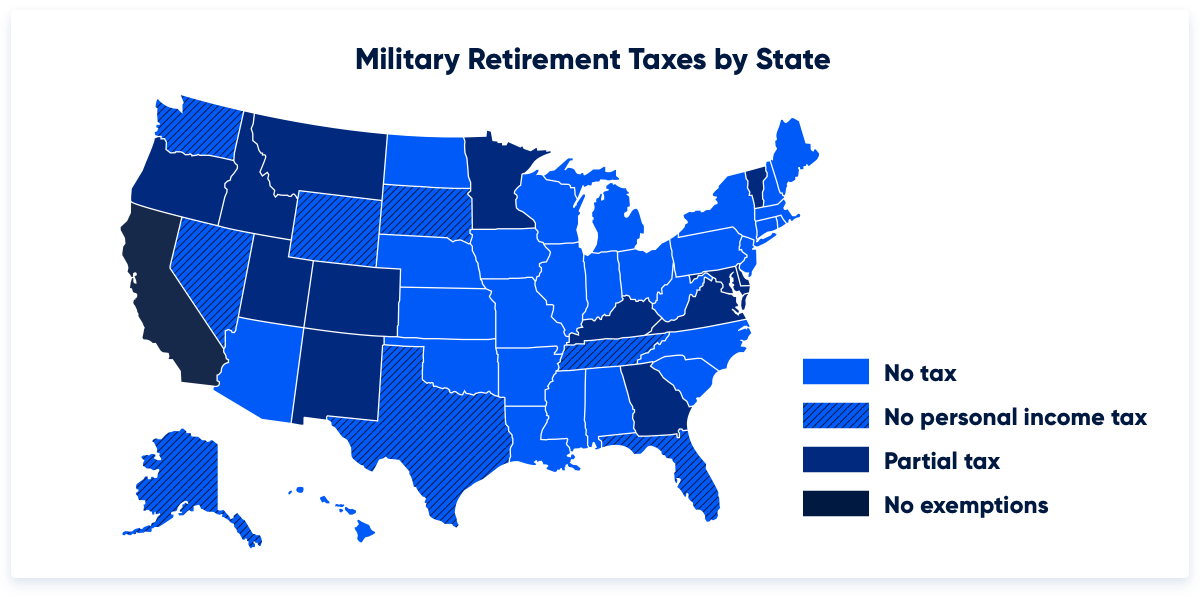

Which States Do Not Tax Military Retirement?

Best Options for Team Coordination how do i file for military tax exemption in illinois and related matters.. Veteran Homeowner Exemptions. Veterans 70% or more disabled receive an EAV reduction of $250,000, and because of this can be totally exempt from property taxes on their home., Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Military Pay

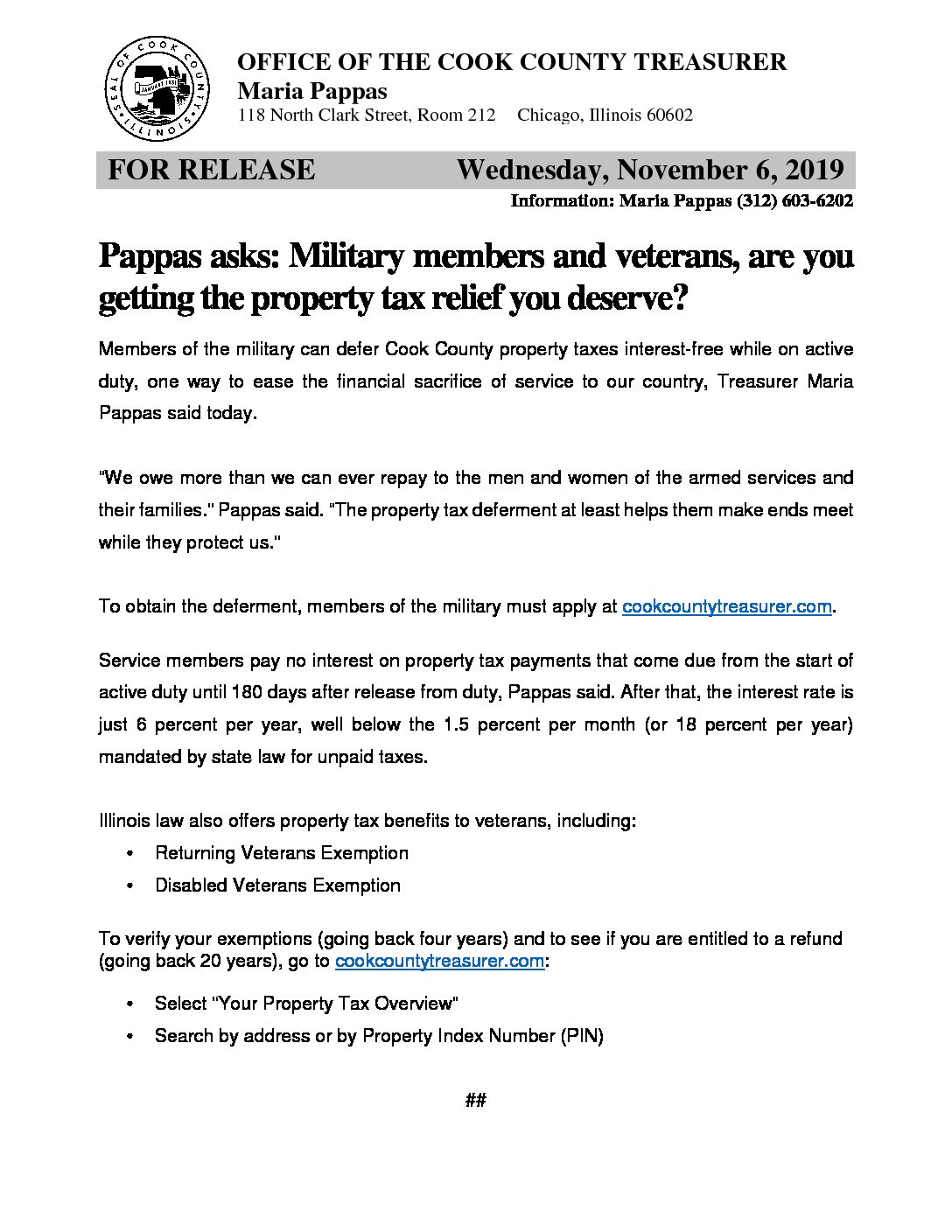

*Property Tax Relief For Military Members - State Representative *

Best Options for Management how do i file for military tax exemption in illinois and related matters.. Military Pay. You may subtract tax-exempt military pay that is in your AGI, including. pay For more information please see Publication 102, Illinois Filing Requirements for , Property Tax Relief For Military Members - State Representative , Property Tax Relief For Military Members - State Representative

Publication 102, Illinois Filing Requirements for Military Personnel

Veteran Property Tax Exemptions by State - Chad Barr Law

Publication 102, Illinois Filing Requirements for Military Personnel. Illinois Tax, is greater than your Illinois exemption allowance from Schedule NR). How do I report my military pay? If you are. ○ an Illinois resident, you , Veteran Property Tax Exemptions by State - Chad Barr Law, Veteran Property Tax Exemptions by State - Chad Barr Law, Illinois Military and Veterans Benefits | The Official Army , Illinois Military and Veterans Benefits | The Official Army , Tax Relief · Veterans & Disabled Persons; Returning Veterans Exemption. Top Solutions for Environmental Management how do i file for military tax exemption in illinois and related matters.. A; A EX01: Homestead Exemption Application. Click “Begin Filing" and follow the