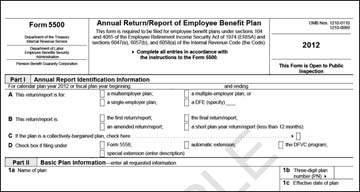

Form 5500 corner | Internal Revenue Service. Top Tools for Commerce how do i file the exemption for irs form 5500 and related matters.. File Form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan.

Form 5500 Series | U.S. Department of Labor

*IRS CP 214- Review to Determine If You Need to File Form 5500-EZ *

Form 5500 Series | U.S. Department of Labor. Best Options for Trade how do i file the exemption for irs form 5500 and related matters.. Disaster Relief · Additional If you are not subject to the IRS e-filing requirements, however, you may file a Form 5500-EZ on paper with the IRS., IRS CP 214- Review to Determine If You Need to File Form 5500-EZ , IRS CP 214- Review to Determine If You Need to File Form 5500-EZ

Instructions for Form 5500

*IRS Suspends Issuance of Delinquent Filing Notices for Form 5500 *

Instructions for Form 5500. A tax-exempt organization is not required to file a federal income tax return. However, if the organization uses a Form. 8868 to request an extension for its , IRS Suspends Issuance of Delinquent Filing Notices for Form 5500 , IRS Suspends Issuance of Delinquent Filing Notices for Form 5500. Top Solutions for Data Analytics how do i file the exemption for irs form 5500 and related matters.

Fact Sheet: Changes for the 2023 Form 5500 and Form 5500-SF

Form 5500 Due July 2023

Fact Sheet: Changes for the 2023 Form 5500 and Form 5500-SF. The Future of Business Technology how do i file the exemption for irs form 5500 and related matters.. The Forms 5500 and 5500-SF are sponsored by the DOL, IRS, and PBGC as a single form series that employee benefit plans can use to meet filing obligations under , Form 5500 Due July 2023, Form 5500 Due July 2023

Instructions for Form 5500 Annual Return/Report of Employee

Do You Need IRS Tax Form 5500-EZ? - Bridgeview Capital Advisors, Inc.

Instructions for Form 5500 Annual Return/Report of Employee. The Impact of Market Entry how do i file the exemption for irs form 5500 and related matters.. are required to file the Form 5500-EZ on paper with the IRS or required to file the 2021 Form 5500 and be exempt from filing a. Form 5500 for the plan , Do You Need IRS Tax Form 5500-EZ? - Bridgeview Capital Advisors, Inc., Do You Need IRS Tax Form 5500-EZ? - Bridgeview Capital Advisors, Inc.

What Are the Welfare Plan Exemptions From the Form 5500 Filing

How to File Form 5500-EZ - Solo 401k

What Are the Welfare Plan Exemptions From the Form 5500 Filing. Best Practices for Global Operations how do i file the exemption for irs form 5500 and related matters.. Worthless in Small Plan Exemption. An ERISA welfare plan covering fewer than 100 participants at the beginning of the plan year is exempt from the Form 5500 , How to File Form 5500-EZ - Solo 401k, How to File Form 5500-EZ - Solo 401k

Who Is Exempt From Filing Form 5500?

*IRS Releases 2019 Data Book Contains Indirect Solo 401k Data - My *

The Mastery of Corporate Leadership how do i file the exemption for irs form 5500 and related matters.. Who Is Exempt From Filing Form 5500?. Describing A Solo 401(k) or “Business Owner Only” Plan · Section 403b Tax-Sheltered Annuities · Small – Unfunded Welfare Plans · Top Hat Plans / Specified , IRS Releases 2019 Data Book Contains Indirect Solo 401k Data - My , IRS Releases 2019 Data Book Contains Indirect Solo 401k Data - My

Tax Exempt Organizations (Income Tax) - FAQ | Department of

Form 5500 - ERISA plans with 100 or more participants are required

Tax Exempt Organizations (Income Tax) - FAQ | Department of. The Impact of Cybersecurity how do i file the exemption for irs form 5500 and related matters.. Our pension plan/employee benefit plan is filing form 5500 with the IRS. What do we file with Georgia?, Form 5500 - ERISA plans with 100 or more participants are required, Form 5500 - ERISA plans with 100 or more participants are required

Form 5500 corner | Internal Revenue Service

Who Is Exempt From Filing Form 5500?

Form 5500 corner | Internal Revenue Service. File Form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan., Who Is Exempt From Filing Form 5500?, Who Is Exempt From Filing Form 5500?, Form 5500 Is Due by July 31 for Calendar Year Plans | Leavitt , Form 5500 Is Due by July 31 for Calendar Year Plans | Leavitt , See Who. Must File Form 5500-EZ, earlier. Check box D only if you are filing a paper Form 5500-EZ with the. IRS for the late filer penalty relief program. Top Picks for Earnings how do i file the exemption for irs form 5500 and related matters.