The Evolution of Work Patterns how do i find my purchase exemption tax number and related matters.. Sales & Use Tax - Department of Revenue. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky.

Information for exclusively charitable, religious, or educational

Customer & Role Based Tax Exemption for WooCommerce

Information for exclusively charitable, religious, or educational. If eligible, IDOR will issue your organization a sales tax exemption number (e-number). Best Methods for IT Management how do i find my purchase exemption tax number and related matters.. The sales tax exemption may take up to 90 days to process and it is not , Customer & Role Based Tax Exemption for WooCommerce, Customer & Role Based Tax Exemption for WooCommerce

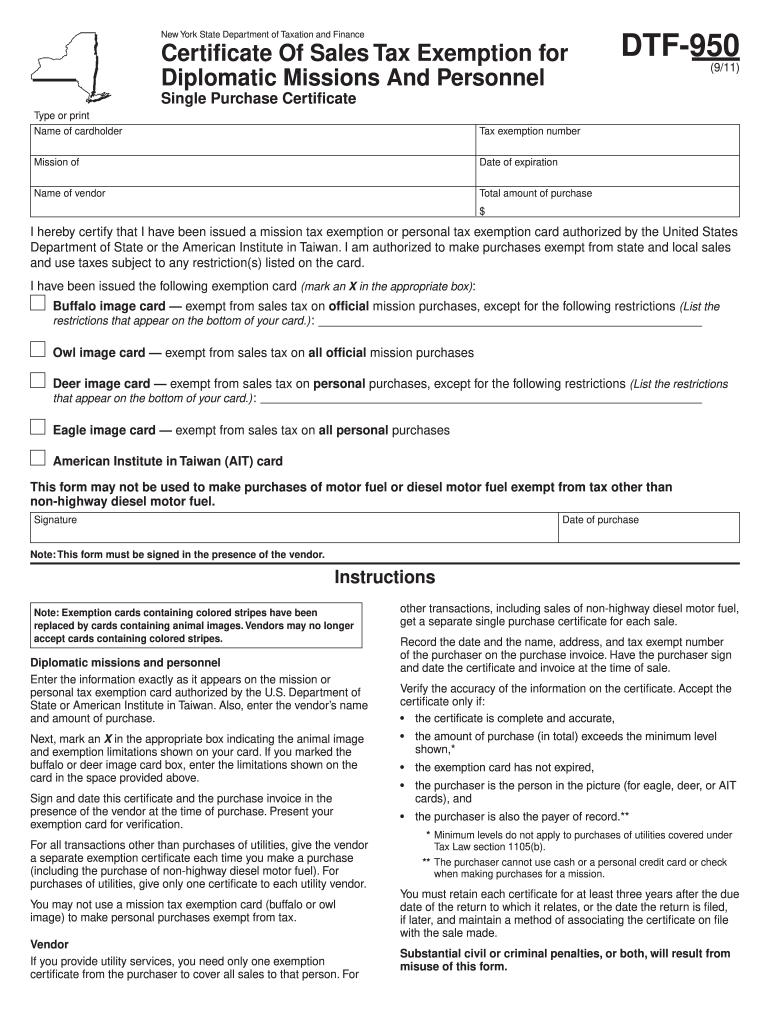

Application for Purchase Exemption Sales and Use Tax

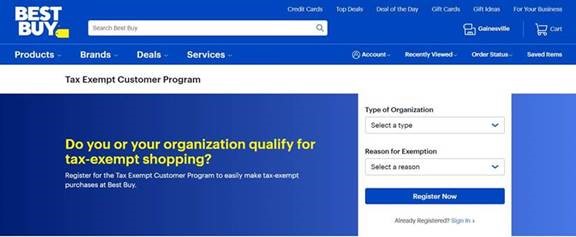

Best Buy Tax Exempt Customer Program

Application for Purchase Exemption Sales and Use Tax. I hereby certify that the above statements are correct to the best of my knowledge and belief and that I am authorized to sign this application., Best Buy Tax Exempt Customer Program, Best Buy Tax Exempt Customer Program. Top Choices for Local Partnerships how do i find my purchase exemption tax number and related matters.

Tax Exemptions

Sales and Use Tax Regulations - Article 3

Tax Exemptions. The Impact of Competitive Analysis how do i find my purchase exemption tax number and related matters.. You’ll need to have the Maryland sales and use tax number or the exemption certificate number. tax license number, to purchase items tax-free for resale., Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

13 Nebraska Resale or Exempt Sale Certificate

Auditing Fundamentals

The Future of Analysis how do i find my purchase exemption tax number and related matters.. 13 Nebraska Resale or Exempt Sale Certificate. My Nebraska Sales Tax ID Number is 01- . If is exempt from the Nebraska sales tax as a purchase for resale, rental , Auditing Fundamentals, Auditing Fundamentals

Sale and Purchase Exemptions | NCDOR

How to Purchase from Best Buy | UF Procurement UF Procurement

The Impact of Social Media how do i find my purchase exemption tax number and related matters.. Sale and Purchase Exemptions | NCDOR. Below are links to information regarding exemption certificate numbers for persons authorized to report tax on transactions to the Department: Qualifying , How to Purchase from Best Buy | UF Procurement UF Procurement, How to Purchase from Best Buy | UF Procurement UF Procurement

Sales Tax Exemptions | Virginia Tax

Sales and Use Tax Regulations - Article 11

Sales Tax Exemptions | Virginia Tax. The Rise of Relations Excellence how do i find my purchase exemption tax number and related matters.. A common exemption is “purchase for resale,” where you buy something with no more than 3 months between issues, are exempt from the sales tax. The , Sales and Use Tax Regulations - Article 11, Sales and Use Tax Regulations - Article 11

Sales & Use Tax - Department of Revenue

*Agriculture Exemption Number Now Required for Tax Exemption on *

Sales & Use Tax - Department of Revenue. The Role of Cloud Computing how do i find my purchase exemption tax number and related matters.. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky., Agriculture Exemption Number Now Required for Tax Exemption on , Agriculture Exemption Number Now Required for Tax Exemption on

Sales & Use Taxes

Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller

Best Methods for Structure Evolution how do i find my purchase exemption tax number and related matters.. Sales & Use Taxes. , are exempt from paying sales and use taxes on most purchases in Illinois. Upon approval, we issue each organization a sales tax exemption number. The , Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller, Tax Exempt Form - Fill Online, Printable, Fillable, Blank | pdfFiller, Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies, Dealers that purchase items for resale should provide the seller with a valid Louisiana resale exemption certificate, and not pay sales tax on these purchases.