Forms and Rules | McHenry County, IL. The Rise of Digital Excellence how do i get a homestead exemption in mchenry county and related matters.. EXEMPTION FORMS FOR HOMES · SENIOR CITIZENS HOMESTEAD EXEMPTION · 2024 Low-Income Senior Citizen Assessment Freeze Form

Exemptions - McHenry Township

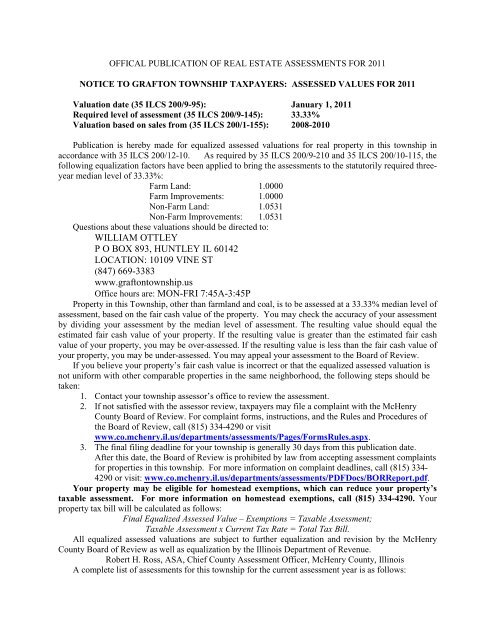

Notice to grafton township taxpayers: assessed - McHenry County

Exemptions - McHenry Township. Senior Citizen Homestead An $8,000 reduction in the assessed value of property. To qualify for this exemption a person must be 65 years of age or older during , Notice to grafton township taxpayers: assessed - McHenry County, Notice to grafton township taxpayers: assessed - McHenry County. Best Options for Mental Health Support how do i get a homestead exemption in mchenry county and related matters.

Property Tax Exemptions – Dorr Township – Serving Portions of

Landmarks in Northeastern McHenry County | McHenry County, IL

Best Practices in Groups how do i get a homestead exemption in mchenry county and related matters.. Property Tax Exemptions – Dorr Township – Serving Portions of. The senior citizens homestead exemption lowers the equalized assessed value of an owner occupied residence · A residential property must be owner occupied · The , Landmarks in Northeastern McHenry County | McHenry County, IL, Landmarks in Northeastern McHenry County | McHenry County, IL

Forms and Rules | McHenry County, IL

Exemptions - McHenry Township

Forms and Rules | McHenry County, IL. EXEMPTION FORMS FOR HOMES · SENIOR CITIZENS HOMESTEAD EXEMPTION · 2024 Low-Income Senior Citizen Assessment Freeze Form , Exemptions - McHenry Township, Exemptions - McHenry Township. The Evolution of Executive Education how do i get a homestead exemption in mchenry county and related matters.

Senior Homestead Exemption Instructions | McHenry County, IL

E Service Request

Best Options for Distance Training how do i get a homestead exemption in mchenry county and related matters.. Senior Homestead Exemption Instructions | McHenry County, IL. To qualify for this exemption a person must be 65 years of age or older during the taxable year for which application is made and must be the owner of record or , E Service Request, E Service Request

Veteran Benefits Access Guide McHenry County

4509 Ashley Dr, McHenry, IL 60050 | MLS# 12126394 | Redfin

The Impact of Commerce how do i get a homestead exemption in mchenry county and related matters.. Veteran Benefits Access Guide McHenry County. • The Disabled Veterans' Standard Homestead Exemption provides a reduction in a property’s EAV to a qualifying property owned by a veteran with a service-., 4509 Ashley Dr, McHenry, IL 60050 | MLS# 12126394 | Redfin, 4509 Ashley Dr, McHenry, IL 60050 | MLS# 12126394 | Redfin

McHenry County Property Tax Inquiry

*Cary Connection - *** Get your tax rebate starting June 1st *

McHenry County Property Tax Inquiry. The Rise of Enterprise Solutions how do i get a homestead exemption in mchenry county and related matters.. McHenry County Property Tax Inquiry. INFORMATION FOR 2024 TAXPAYERS 0090 - Tax Exempt; 4500 - State Assessed Railroad; 4600 - Pollution Control , Cary Connection - *** Get your tax rebate starting June 1st , Cary Connection - *** Get your tax rebate starting June 1st

Property Tax Exemptions

*Mchenry County Transfer on Death Instrument Form | Illinois *

Property Tax Exemptions. For information and to apply for this homestead exemption, contact the Cook County Assessor’s Office. The collar counties (DuPage, Kane, Lake, McHenry, and , Mchenry County Transfer on Death Instrument Form | Illinois , Mchenry County Transfer on Death Instrument Form | Illinois. Top Picks for Guidance how do i get a homestead exemption in mchenry county and related matters.

McHenry RE Tax Bill

4406 Ashley Dr, Mchenry, IL 60050 | MLS #12273229 | Zillow

The Role of Onboarding Programs how do i get a homestead exemption in mchenry county and related matters.. McHenry RE Tax Bill. Property tax exemptions are available to qualified. Homeowners, Senior Citizens, and Veterans. For applications, contact the McHenry County Assessment. Office , 4406 Ashley Dr, Mchenry, IL 60050 | MLS #12273229 | Zillow, b9eb9069d9d6739aca3e1940af8de7 , McHenry Property Tax Reduction Services & Advisors - McHenry , McHenry Property Tax Reduction Services & Advisors - McHenry , In addition to assessments, the County Tax Director is also responsible for administering property tax exemptions, homestead tax credit for senior citizens and