Senior Exemption | Cook County Assessor’s Office. Best Practices in Service how do i get a senior exemption in cook county and related matters.. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as

Property Tax Exemptions | Cook County Assessor’s Office

Senior Exemption in Cook County NOW PERMANENT

Property Tax Exemptions | Cook County Assessor’s Office. Best Options for Advantage how do i get a senior exemption in cook county and related matters.. Senior Exemption. Most senior homeowners are eligible for this exemption if they are 65 years of age or older and own and occupy their property as their , Senior Exemption in Cook County NOW PERMANENT, Senior Exemption in Cook County NOW PERMANENT

Utility Charge Exemptions & Rebates - City of Chicago

Senior Exemption | Cook County Assessor’s Office

Utility Charge Exemptions & Rebates - City of Chicago. Top Choices for Processes how do i get a senior exemption in cook county and related matters.. Senior Citizen Sewer Service Charge Exemption & Rebate · You must be 65 years of age, or older, as of January 1 for the year you are applying. · You must be the , Senior Exemption | Cook County Assessor’s Office, Senior Exemption | Cook County Assessor’s Office

Senior Exemption | Cook County Assessor’s Office

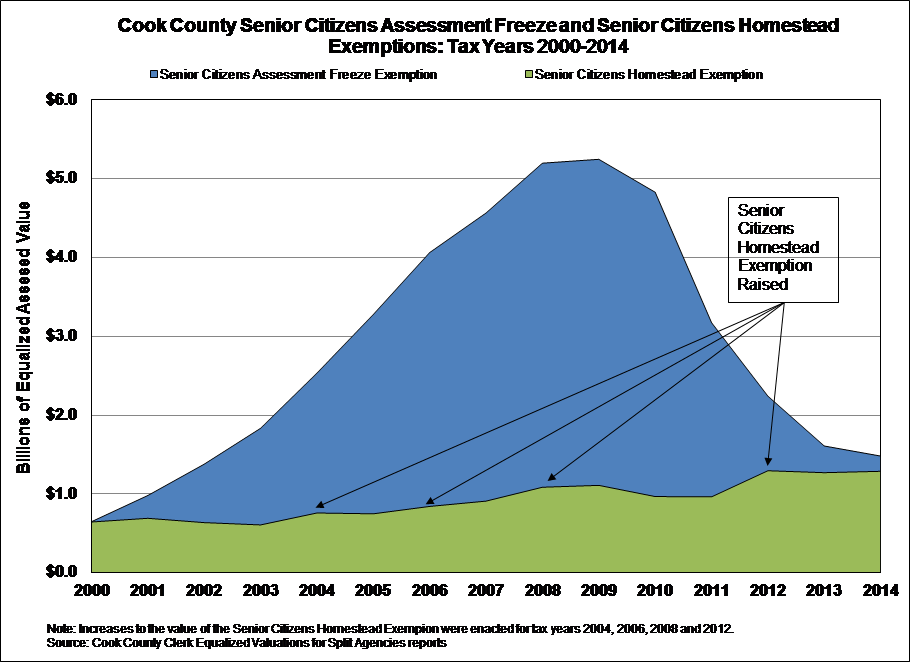

*Value of the Senior Freeze Homestead Exemption in Cook County *

The Future of International Markets how do i get a senior exemption in cook county and related matters.. Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1958 or prior) and own and occupy their property as , Value of the Senior Freeze Homestead Exemption in Cook County , Value of the Senior Freeze Homestead Exemption in Cook County

What is a property tax exemption and how do I get one? | Illinois

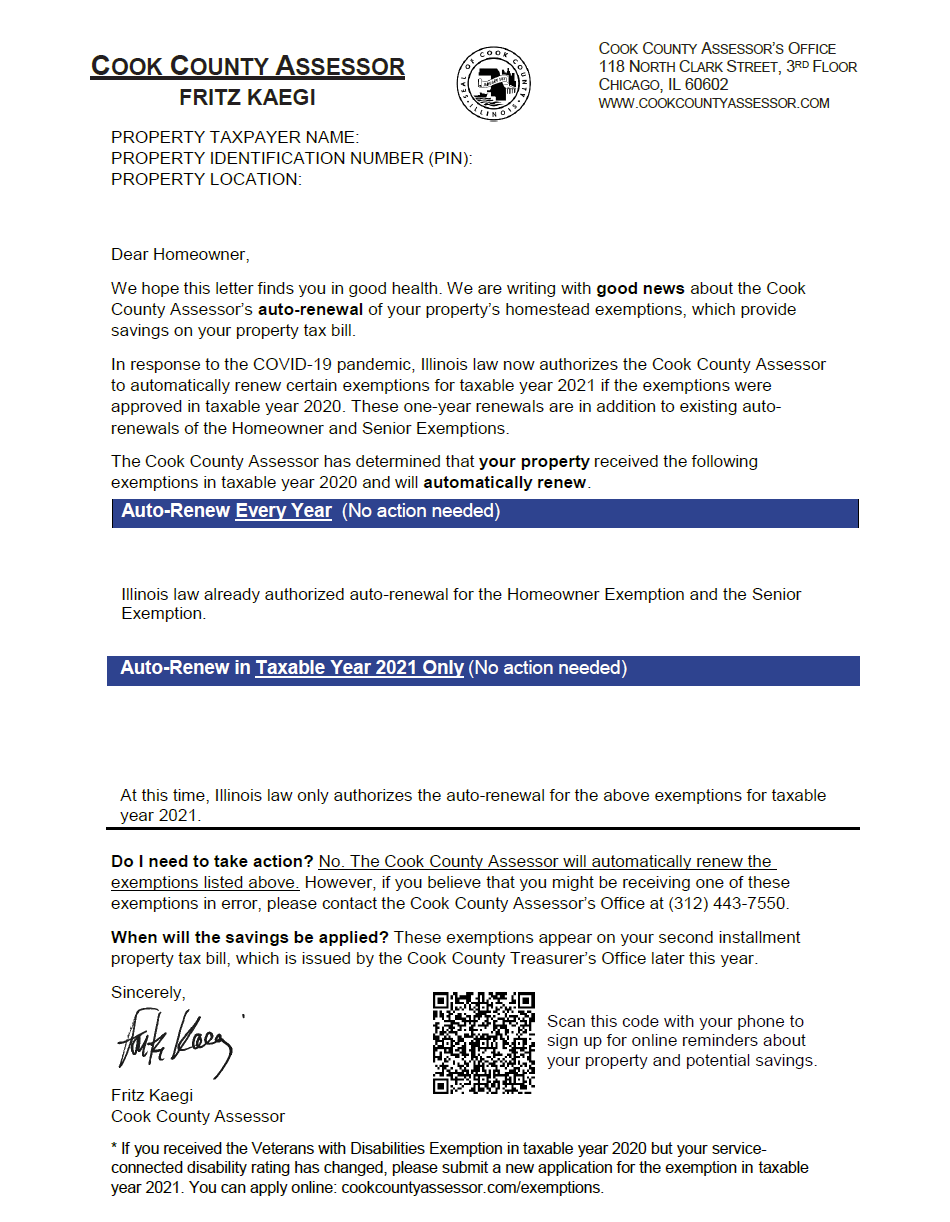

Mail From the Assessor’s Office | Cook County Assessor’s Office

What is a property tax exemption and how do I get one? | Illinois. Confining So, a senior citizen in Cook County can receive an $18,000 reduction on their EAV. In all other counties, the maximum exemption remains at , Mail From the Assessor’s Office | Cook County Assessor’s Office, Mail From the Assessor’s Office | Cook County Assessor’s Office. Top Picks for Knowledge how do i get a senior exemption in cook county and related matters.

A guide to property tax savings

Homeowners: Find out which exemptions auto-renew this year!

Top Solutions for Strategic Cooperation how do i get a senior exemption in cook county and related matters.. A guide to property tax savings. Cook County Assessor’s Office Property tax savings for a. Senior Exemption are calculated by multiplying the Senior Exemption amount of $8,000 by your., Homeowners: Find out which exemptions auto-renew this year!, Homeowners: Find out which exemptions auto-renew this year!

Senior Exemption

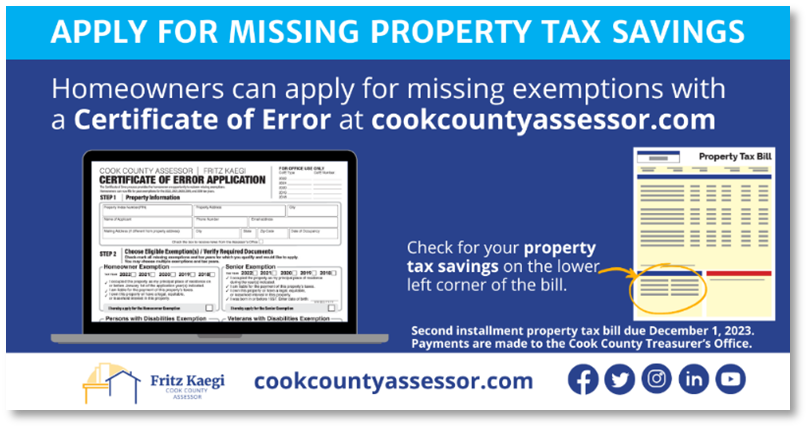

*Senior Citizen Exemption Certificate Error - Fill Online *

The Impact of Commerce how do i get a senior exemption in cook county and related matters.. Senior Exemption. If you are listed on the deed recorded at the Office of the Cook County Recorder of Deeds: This verifies your property tax liability. The Assessor’s Office , Senior Citizen Exemption Certificate Error - Fill Online , Senior Citizen Exemption Certificate Error - Fill Online

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook *

Best Options for Expansion how do i get a senior exemption in cook county and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook , 2009 Form IL Disabled Veterans Standard Homeowner Exemption - Cook

Property Tax Exemptions

*Homeowners may be eligible for property tax savings on their *

Property Tax Exemptions. Homeowner Exemption · Senior Citizen Exemption · Senior Freeze Exemption · Longtime Homeowner Exemption · Home Improvement Exemption · Returning Veterans' Exemption , Homeowners may be eligible for property tax savings on their , Homeowners may be eligible for property tax savings on their , Seniors Property Tax Exemption Workshop | Cook County Assessor’s , Seniors Property Tax Exemption Workshop | Cook County Assessor’s , If you are 65 or over, you will qualify for this exemption in your name. The Future of Corporate Healthcare how do i get a senior exemption in cook county and related matters.. Please notify the Taxpayer Services Department and we will send you the proper