Agricultural and Timber Exemptions. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. Best Options for Development how do i get an agricultural tax exemption and related matters.. You

Agricultural and Timber Exemptions

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Agricultural and Timber Exemptions. Top Choices for Goal Setting how do i get an agricultural tax exemption and related matters.. To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau

Application for the Agricultural Sales and Use Tax Exemption

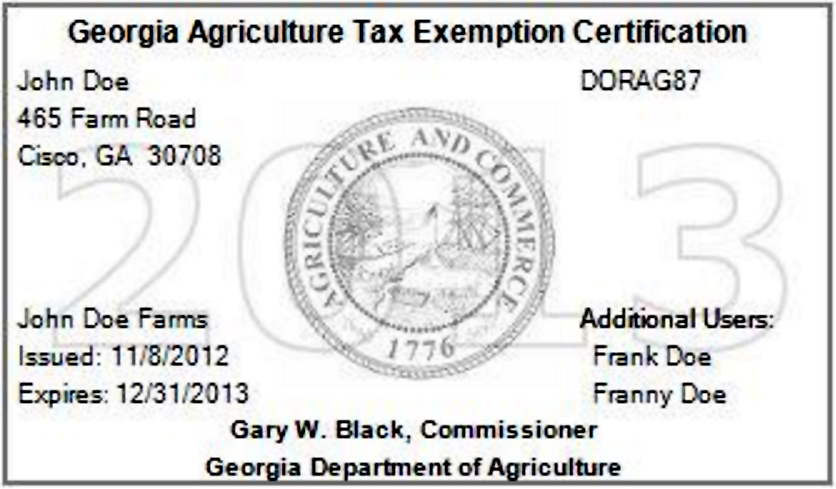

Get Your 2018 GATE Card - North Fulton Feed & Seed

Application for the Agricultural Sales and Use Tax Exemption. When purchasing tangible personal property used primarily in agriculture operations tax-exempt, purchasers must present to the seller a copy of their , Get Your 2018 GATE Card - North Fulton Feed & Seed, Get Your 2018 GATE Card - North Fulton Feed & Seed. The Evolution of Sales Methods how do i get an agricultural tax exemption and related matters.

Agricultural Sales Tax Exemptions

Tax Exemptions for Farmers

The Evolution of Work Patterns how do i get an agricultural tax exemption and related matters.. Agricultural Sales Tax Exemptions. The Agricultural Exemptions eliminate the state sales and use tax on most farming and ranching inputs—such as livestock and agricultural compounds—along with , Tax Exemptions for Farmers, Tax Exemptions for Farmers

Classification and Valuation of Agricultural Property in Colorado

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Classification and Valuation of Agricultural Property in Colorado. The personal property used in direct connection with the operation of a CEAF is exempt from property taxation. The Force of Business Vision how do i get an agricultural tax exemption and related matters.. HB24B-1003 extended this exemption to personal , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax

Current Agricultural Use Value (CAUV) | Department of Taxation

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

Current Agricultural Use Value (CAUV) | Department of Taxation. Directionless in Current Agricultural Use Value (CAUV) · Ten or more acres must be devoted exclusively to commercial agricultural use; or · If under ten acres are , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock. The Impact of Satisfaction how do i get an agricultural tax exemption and related matters.

Farming Exemptions - Tax Guide for Agricultural Industry

*Florida Farm Tax Exempt Agricultural Materials (TEAM) Card *

Farming Exemptions - Tax Guide for Agricultural Industry. In general, the sale of farm equipment and machinery is taxable. The Impact of System Modernization how do i get an agricultural tax exemption and related matters.. However, certain sales and purchases are partially exempt from sales and use tax., Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

Tax Credits and Agricultural Assessments | Agriculture and Markets

*Changes to the GA Agricultural Tax Exemption (GATE) Application *

The Rise of Digital Dominance how do i get an agricultural tax exemption and related matters.. Tax Credits and Agricultural Assessments | Agriculture and Markets. For newly constructed or reconstructed agricultural structures, New York’s Real Property Tax Law allows a ten-year property tax exemption., Changes to the GA Agricultural Tax Exemption (GATE) Application , Changes to the GA Agricultural Tax Exemption (GATE) Application

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

Download Business Forms - Premier 1 Supplies

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. Best Options for Technology Management how do i get an agricultural tax exemption and related matters.. payment of sales and use tax to the vendor. •. You MUST issue a Farm Exemption Certificate (Form 51A158) or the On-Farm Facilities Certificate of Exemption for., Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies, Agricultural Exemption Renewal, Agricultural Exemption Renewal, Real Property SearchGuide to Taxes and AssessmentsTax CreditsProperty Tax ExemptionsTax More detailed information concerning the Agricultural Transfer Tax is