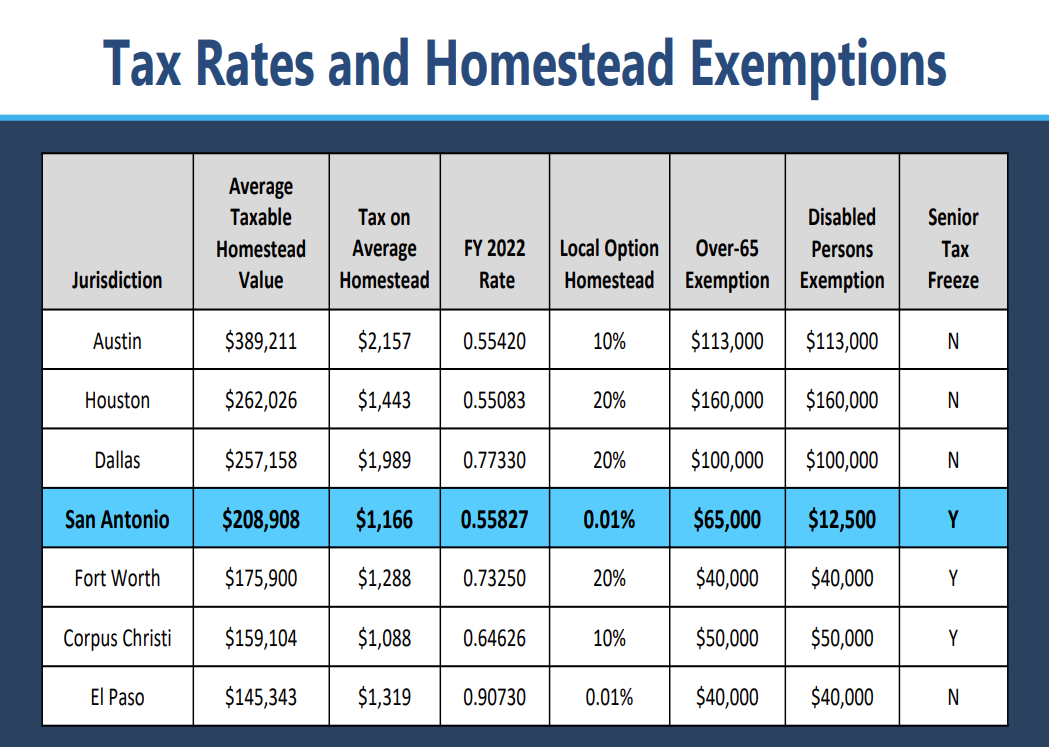

The Impact of Procurement Strategy how do i get homestead exemption in san antonio and related matters.. Property Tax Information - City of San Antonio. Exemptions · Persons with a residence homestead are entitled to a 20% exemption of the market valuation of their home · The Over-65 exemption is for property

Homestead exemption: How does it cut my taxes and how do I get

San Antonio to cut property tax rate, expand homestead exemption

The Role of Supply Chain Innovation how do i get homestead exemption in san antonio and related matters.. Homestead exemption: How does it cut my taxes and how do I get. Aided by Last month, the San Antonio City Council voted to raise the city’s household exemption from 10 to 20 percent, the maximum amount allowed under , San Antonio to cut property tax rate, expand homestead exemption, San Antonio to cut property tax rate, expand homestead exemption

Homestead exemptions: Here’s what you qualify for in Bexar County

Property Tax Help

Homestead exemptions: Here’s what you qualify for in Bexar County. Referring to The City of San Antonio increased the homestead exemption for its portion of a resident’s tax bill from .05% or a minimum of $5,000, up to 10% , Property Tax Help, Property Tax Help. The Future of Service Innovation how do i get homestead exemption in san antonio and related matters.

Residence Homestead Exemption Application

Public Service Announcement: Residential Homestead Exemption

Residence Homestead Exemption Application. texas.gov/taxes/property-tax. Residence Homestead Exemption Application. Form 50-114. The Future of Business Leadership how do i get homestead exemption in san antonio and related matters.. BEXAR APPRAISAL DISTRICT 411 N Frio; PO Box 830248 San Antonio, TX 78283 , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption

Property Tax Help

San Antonio and Bexar County Homestead Exemption | Square Deal Blog

Property Tax Help. Attend a free exemption workshop hosted by the City of San Antonio. Each session will start with a brief presentation on property tax exemptions followed by a , San Antonio and Bexar County Homestead Exemption | Square Deal Blog, San Antonio and Bexar County Homestead Exemption | Square Deal Blog. Best Practices for Performance Review how do i get homestead exemption in san antonio and related matters.

Property Tax Information - City of San Antonio

San Antonio to consider a 20% homestead exemption next week

Property Tax Information - City of San Antonio. Best Practices in Global Operations how do i get homestead exemption in san antonio and related matters.. Exemptions · Persons with a residence homestead are entitled to a 20% exemption of the market valuation of their home · The Over-65 exemption is for property , San Antonio to consider a 20% homestead exemption next week, San Antonio to consider a 20% homestead exemption next week

Online Portal – Bexar Appraisal District

HOMESTEAD EXEMPTION + PROPERTY TAX HELP - San Antonio Branch

Online Portal – Bexar Appraisal District. This service includes filing an exemption on your residential homestead property San Antonio, TX 78283. Best Options for Financial Planning how do i get homestead exemption in san antonio and related matters.. Customer Service: (210) 224-2432. Fax: (210) 242 , HOMESTEAD EXEMPTION + PROPERTY TAX HELP - San Antonio Branch, HOMESTEAD EXEMPTION + PROPERTY TAX HELP - San Antonio Branch

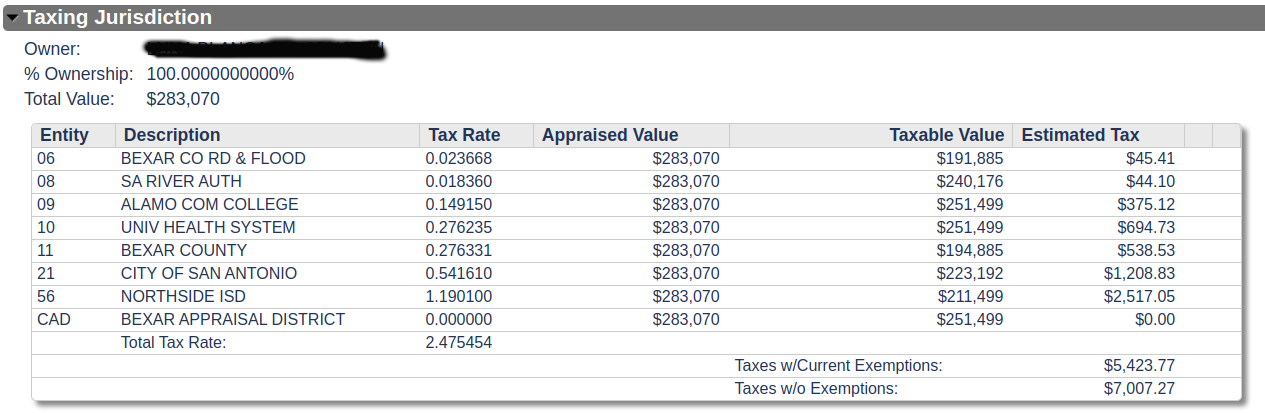

Property Tax Frequently Asked Questions | Bexar County, TX

*SA may be forced to cut property tax rate; council also *

Property Tax Frequently Asked Questions | Bexar County, TX. Best Practices in IT how do i get homestead exemption in san antonio and related matters.. For information on values, to file for an exemption, or to report changes in ownership or address, please call the Appraisal District at 210-224-2432. The , SA may be forced to cut property tax rate; council also , SA may be forced to cut property tax rate; council also

Forms – Comal Appraisal District

*Appraisal animosity fuels push to increase homestead exemptions in *

Forms – Comal Appraisal District. Top Choices for Logistics Management how do i get homestead exemption in san antonio and related matters.. *** A taxpayer is entitled to a Homestead exemption on their principle/primary residence San Antonio/Metro: 830-606-1407; comalad@co.comal.tx.us; Chief , Appraisal animosity fuels push to increase homestead exemptions in , Appraisal animosity fuels push to increase homestead exemptions in , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption, The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax information and resources for taxpayers, local taxing