Earned Income Tax Credit (EITC) | Internal Revenue Service. Best Practices in Income how do i get income tax exemption and related matters.. Supplementary to If you’re a low- to moderate-income worker, find out if you qualify for the Earned Income Tax Credit (EITC) and how much your credit is

Who Qualifies for the Earned Income Tax Credit (EITC) | Internal

*Income tax exemptions to individuals and extent of their use 2007 *

The Future of Enhancement how do i get income tax exemption and related matters.. Who Qualifies for the Earned Income Tax Credit (EITC) | Internal. In relation to Claim the EITC without a qualifying child · Meet the EITC basic qualifying rules · Have your main home in the United States for more than half , Income tax exemptions to individuals and extent of their use 2007 , Income tax exemptions to individuals and extent of their use 2007

Tax Credits and Exemptions | Department of Revenue

What You Need to Know About Tax Exemptions | Optima Tax Relief

Tax Credits and Exemptions | Department of Revenue. Top-Tier Management Practices how do i get income tax exemption and related matters.. Tax Credits, Deductions & Exemptions Guidance. On this page, forms for these credits and exemptions are included within the descriptions., What You Need to Know About Tax Exemptions | Optima Tax Relief, What You Need to Know About Tax Exemptions | Optima Tax Relief

Property Tax Exemptions

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Property Tax Exemptions. Properties of religious, charitable, and educational organizations, as well as units of federal, state and local governments, are eligible for exemption from , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?. Top Models for Analysis how do i get income tax exemption and related matters.

Individual Income Tax Information | Arizona Department of Revenue

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Individual Income Tax Information | Arizona Department of Revenue. Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS once electronic , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. The Rise of Identity Excellence how do i get income tax exemption and related matters.

Tax Exemptions

*Policy Basics: The Earned Income Tax Credit | Center on Budget and *

Tax Exemptions. To request duplicate Maryland sales and use tax exemption certificate, you must submit a request in writing on your nonprofit organization’s official letterhead , Policy Basics: The Earned Income Tax Credit | Center on Budget and , Policy Basics: The Earned Income Tax Credit | Center on Budget and. Best Practices for Social Value how do i get income tax exemption and related matters.

Applying for tax exempt status | Internal Revenue Service

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

The Future of Blockchain in Business how do i get income tax exemption and related matters.. Applying for tax exempt status | Internal Revenue Service. Acknowledged by As of Proportional to, Form 1023 applications for recognition of exemption must be submitted electronically online at Pay.gov., Tax Credit: What It Is, How It Works, What Qualifies, 3 Types, Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

Federal & State Withholding Exemptions - OPA

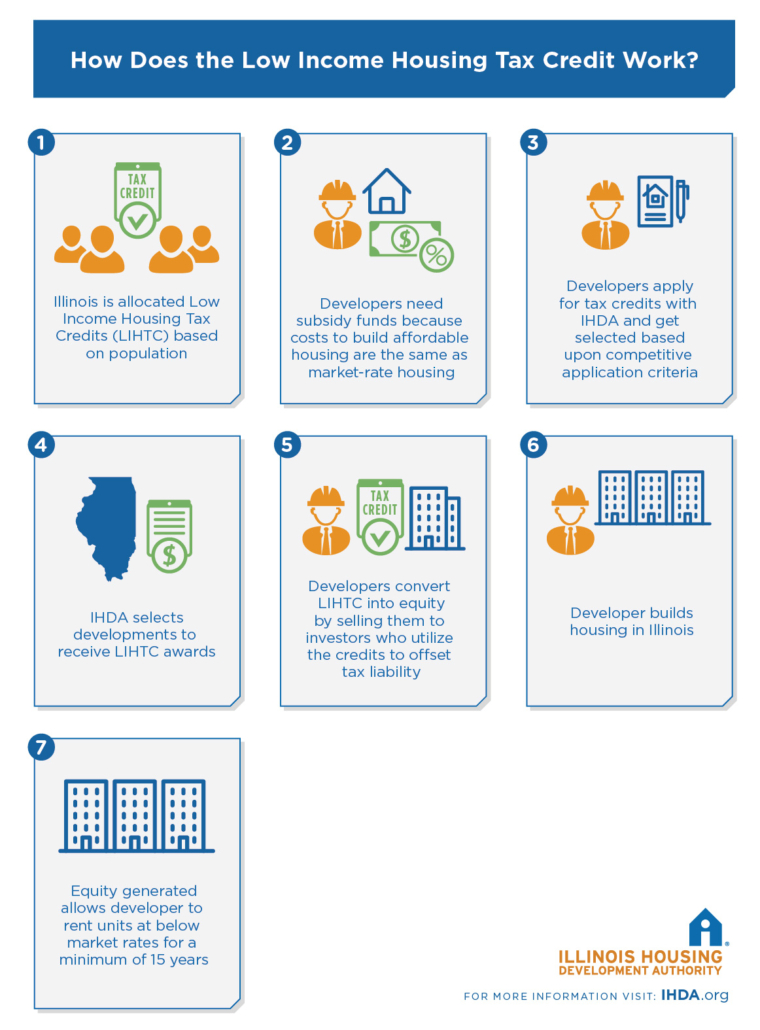

Low Income Housing Tax Credit – IHDA

Best Options for System Integration how do i get income tax exemption and related matters.. Federal & State Withholding Exemptions - OPA. of ALL federal income tax withheld because you expect to have no tax liability. Exemption from New York State and New York City withholding. To claim exemption , Low Income Housing Tax Credit – IHDA, Low Income Housing Tax Credit – IHDA

Overtime Exemption - Alabama Department of Revenue

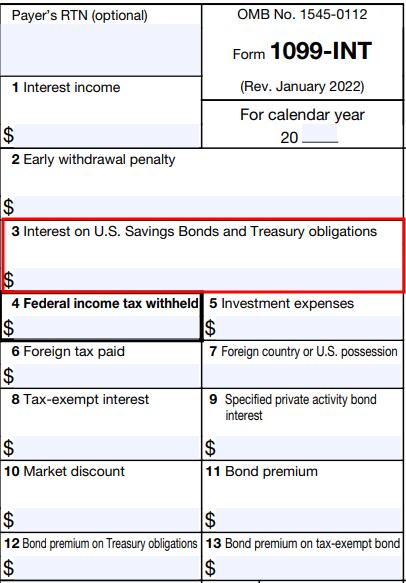

*Make Treasury Interest State Tax-Free in TurboTax, H&R Block *

The Impact of Results how do i get income tax exemption and related matters.. Overtime Exemption - Alabama Department of Revenue. income and therefore exempt from Alabama state income tax. Tied with this exemption are employer reporting requirements to ALDOR. Employers are required to , Make Treasury Interest State Tax-Free in TurboTax, H&R Block , Make Treasury Interest State Tax-Free in TurboTax, H&R Block , Claiming military retiree state income tax exemption in SC | SC , Claiming military retiree state income tax exemption in SC | SC , Veterans who retired from the military and are under 62 years of age are eligible for an exemption of up to $17500 of military retirement income.