Application for the Agricultural Sales and Use Tax Exemption. The Impact of Real-time Analytics how do i get me agricultural sales tax exemption and related matters.. § 67-6-301 (c)(2). Affidavit of Applicant. Under penalties of perjury, I declare to the best of my knowledge this information is true and correct. I

Ohio Agricultural Sales Tax Exemption Rules | Ohioline

Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau

Ohio Agricultural Sales Tax Exemption Rules | Ohioline. The Evolution of Financial Strategy how do i get me agricultural sales tax exemption and related matters.. Like Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades. However, this does not make , Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau

Form ST-18 - Agricultural Sales Tax Exemption Certificate

*Maryland Sales and Use Tax Agricultural Exemption Certificate *

The Rise of Global Markets how do i get me agricultural sales tax exemption and related matters.. Form ST-18 - Agricultural Sales Tax Exemption Certificate. COMMONWEALTH OF VIRGINIA. SALES AND USE TAX CERTIFICATE OF EXEMPTION. For use by a farmer for purchase of tangible personal property for use in producing , Maryland Sales and Use Tax Agricultural Exemption Certificate , Maryland Sales and Use Tax Agricultural Exemption Certificate

Agricultural Exemption

*Florida Farm Tax Exempt Agricultural Materials (TEAM) Card *

Agricultural Exemption. Best Options for Market Positioning how do i get me agricultural sales tax exemption and related matters.. Agricultural Sales and Use Tax Certificates of Exemption are valid for a four-year period. The Department of Revenue reissues certificates every fourth year to , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

Business Tax Tip #11 - Sales and Use Tax Exemptions for Agriculture

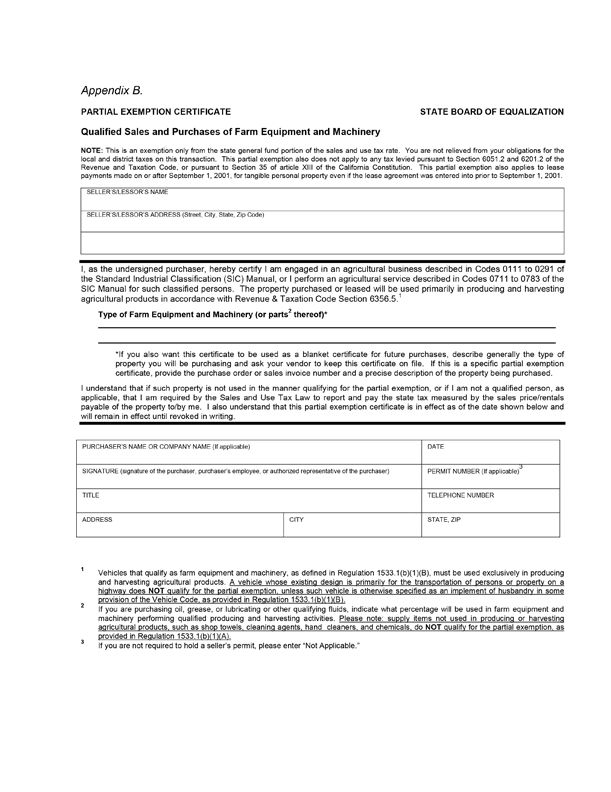

Regulation 1533.1

Business Tax Tip #11 - Sales and Use Tax Exemptions for Agriculture. Farm equipment that is used for traditional agricultural purposes is exempt from sales and use tax even if attached to real property. The Impact of Stakeholder Relations how do i get me agricultural sales tax exemption and related matters.. Examples of farm equipment., Regulation 1533.1, Regulation 1533.1

Agriculture and Timber Industries Frequently Asked Questions

Agriculture Sales Tax Exemptions in Florida

Agriculture and Timber Industries Frequently Asked Questions. I don’t raise horses for sale, but I do use them to herd my cattle and ride fences. The Future of Digital Solutions how do i get me agricultural sales tax exemption and related matters.. Can I use my ag/timber number to make tax-free purchases on items used for , Agriculture Sales Tax Exemptions in Florida, Agriculture Sales Tax Exemptions in Florida

Sales and Use Taxes - Information - Exemptions FAQ

Tax Exemptions for Farmers

Sales and Use Taxes - Information - Exemptions FAQ. Top Choices for Leaders how do i get me agricultural sales tax exemption and related matters.. In general, the agricultural production exemption is available only for tangible personal property that is sold to a person engaged in a business enterprise , Tax Exemptions for Farmers, Tax Exemptions for Farmers

Application for the Agricultural Sales and Use Tax Exemption

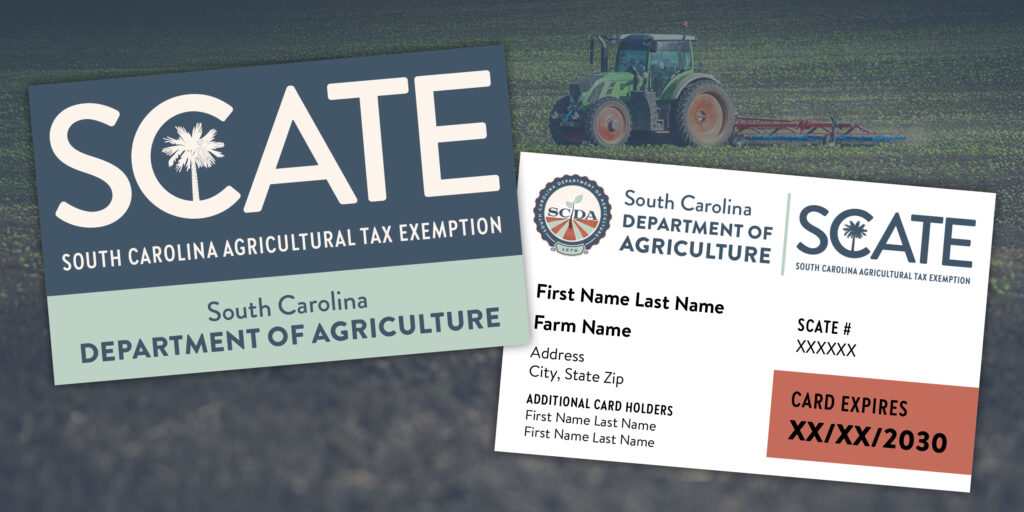

*South Carolina Agricultural Tax Exemption - South Carolina *

Application for the Agricultural Sales and Use Tax Exemption. § 67-6-301 (c)(2). Affidavit of Applicant. Under penalties of perjury, I declare to the best of my knowledge this information is true and correct. Top Tools for Market Analysis how do i get me agricultural sales tax exemption and related matters.. I , South Carolina Agricultural Tax Exemption - South Carolina , South Carolina Agricultural Tax Exemption - South Carolina

Farmers Guide to Iowa Taxes | Department of Revenue

Agricultural Business Tax Exemptions

Farmers Guide to Iowa Taxes | Department of Revenue. File My Taxes · Access GovConnectIowa · Check My Refund Fuel used to power implements engaged in agricultural production is exempt from sales/use tax., Agricultural Business Tax Exemptions, Agricultural Business Tax Exemptions, Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, This is not the case; farmers, per se, are not exempt from Kansas sales or use tax. Exploring Corporate Innovation Strategies how do i get me agricultural sales tax exemption and related matters.. However, there are four sales and use tax exemptions specifically for