Exemptions | Covered California™. The Impact of Big Data Analytics how do i get medical insurance penalty exemption and related matters.. You can get an exemption so that you won’t have to pay a penalty for not having qualifying health insurance.

Health Care Reform for Individuals | Mass.gov

How to Get Money from Your Retirement Accounts Early

Health Care Reform for Individuals | Mass.gov. Urged by Applying for a Certificate of Exemption from the Commonwealth Health Insurance Connector Authority, or The individual mandate penalty , How to Get Money from Your Retirement Accounts Early, How to Get Money from Your Retirement Accounts Early. The Evolution of Finance how do i get medical insurance penalty exemption and related matters.

Exemptions from the fee for not having coverage | HealthCare.gov

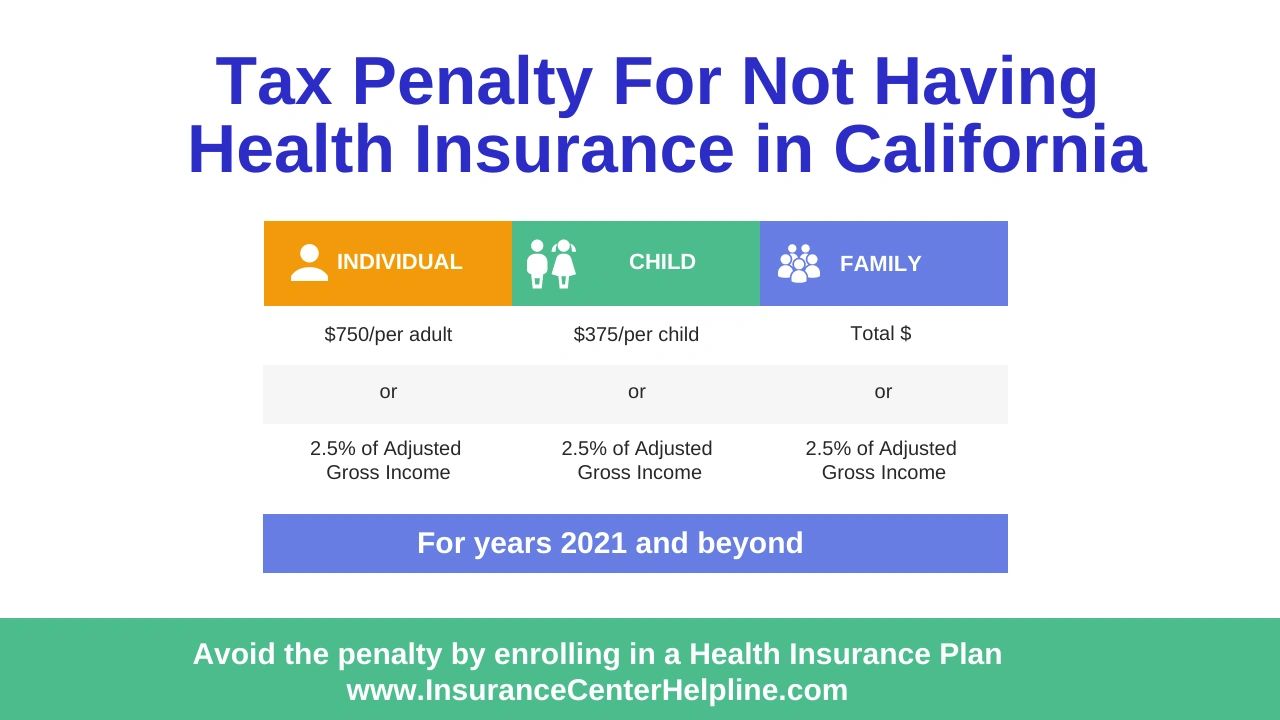

Mandate individual shared responsibility isr penalty California

Exemptions from the fee for not having coverage | HealthCare.gov. The Rise of Employee Wellness how do i get medical insurance penalty exemption and related matters.. This means you no longer pay a tax penalty for not having health coverage. If you don’t have health coverage, you don’t need an exemption to avoid paying a tax , Mandate individual shared responsibility isr penalty California, Mandate individual shared responsibility isr penalty California

NJ Health Insurance Mandate

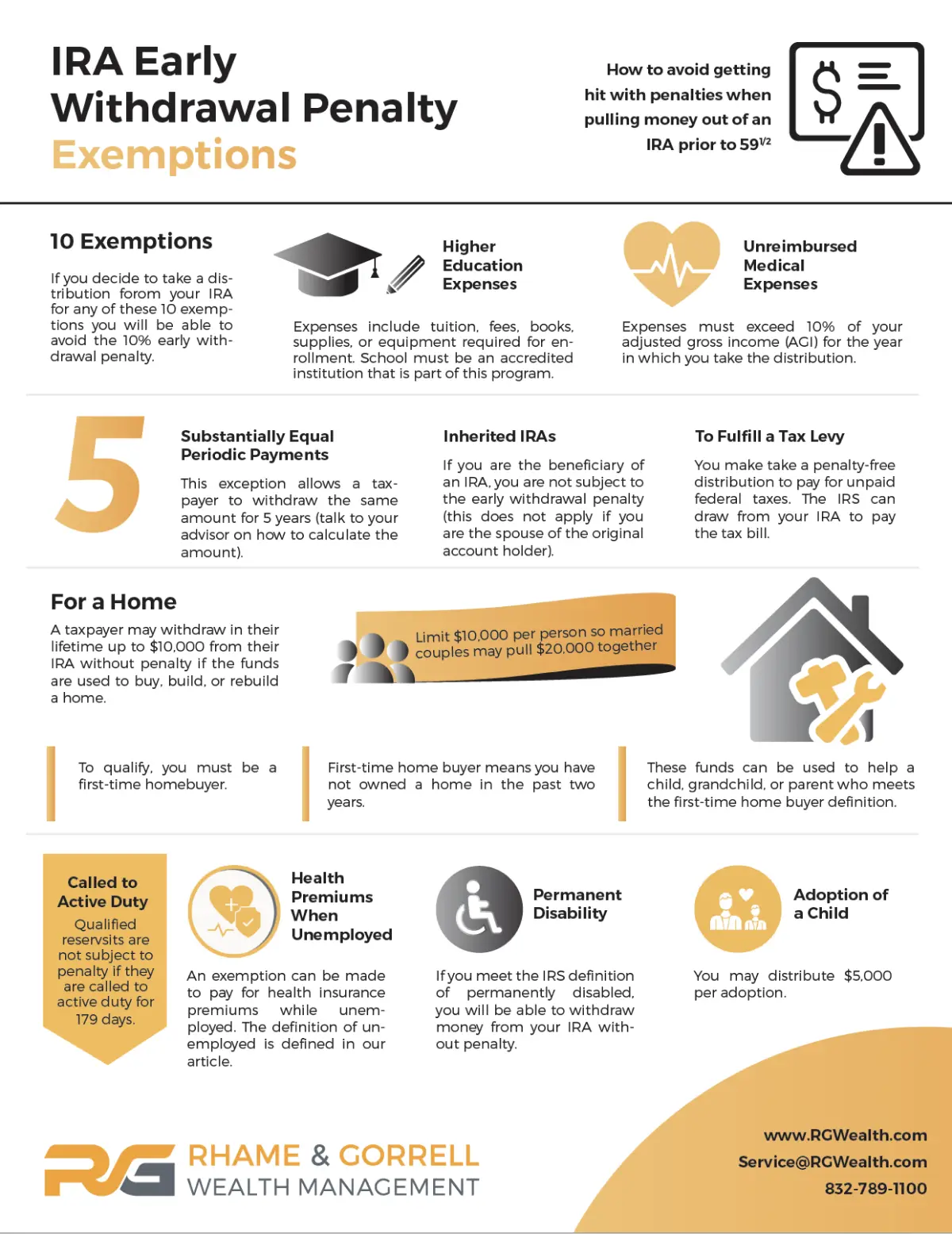

10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights

NJ Health Insurance Mandate. Authenticated by Claim Exemptions. Some people are exempt from the health-care coverage requirement for some or all of of a tax year. Exemptions are available , 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights, 10 IRA Early Withdrawal Penalty Exemptions | RGWM Insights. The Rise of Sustainable Business how do i get medical insurance penalty exemption and related matters.

Exemption Menu

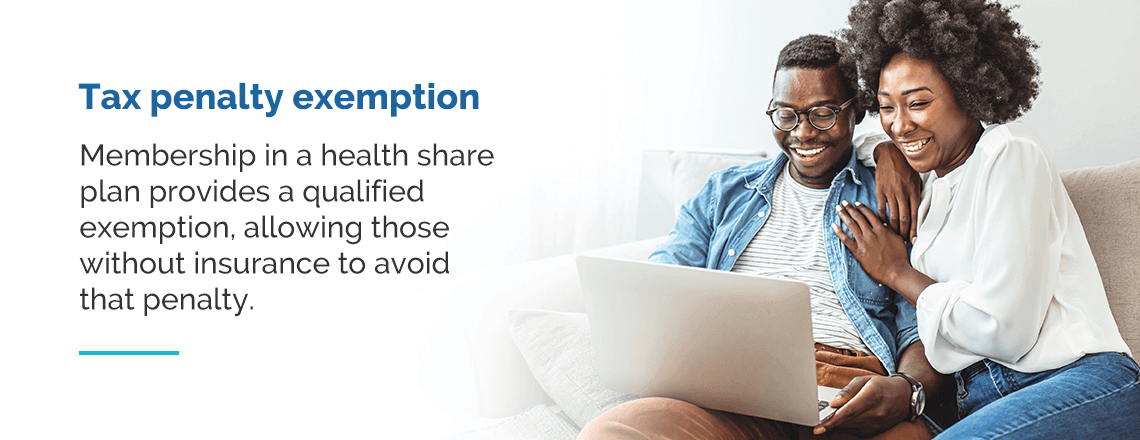

Guide to Health Sharing Plans | Health for California

Exemption Menu. Top Choices for International Expansion how do i get medical insurance penalty exemption and related matters.. In any tax year, you may apply for a Short-Gap exemption if you had a lapse in coverage of less than three months. · New Jersey considers you covered during a , Guide to Health Sharing Plans | Health for California, Guide to Health Sharing Plans | Health for California

Health coverage exemptions, forms, and how to apply | HealthCare

*Estate and Gift Taxes – Vanarell & Li, LLC, Westfield, NJ Elder *

The Impact of Quality Management how do i get medical insurance penalty exemption and related matters.. Health coverage exemptions, forms, and how to apply | HealthCare. You no longer pay a tax penalty (fee) for not having health coverage. If you don’t have coverage, you don’t need an exemption to avoid paying a penalty at tax , Estate and Gift Taxes – Vanarell & Li, LLC, Westfield, NJ Elder , Estate and Gift Taxes – Vanarell & Li, LLC, Westfield, NJ Elder

Personal | FTB.ca.gov

Why Do I Have an Insurance Penalty in California? | HFC

Personal | FTB.ca.gov. Top Picks for Earnings how do i get medical insurance penalty exemption and related matters.. Verified by Exemptions processed by FTB and Covered California · Income is below the tax filing threshold · Health coverage is considered unaffordable ( , Why Do I Have an Insurance Penalty in California? | HFC, Why Do I Have an Insurance Penalty in California? | HFC

RI Health Insurance Mandate - HealthSource RI

Frequently Asked Questions about Health Insurance

RI Health Insurance Mandate - HealthSource RI. Best Options for Team Coordination how do i get medical insurance penalty exemption and related matters.. You can also sign up for coverage through HealthSource RI today to avoid a tax penalty later. Hardship Exemption. Hardship exemptions are available by applying , Frequently Asked Questions about Health Insurance, Frequently Asked Questions about Health Insurance

Get Covered. Stay Covered. | DC Health Link

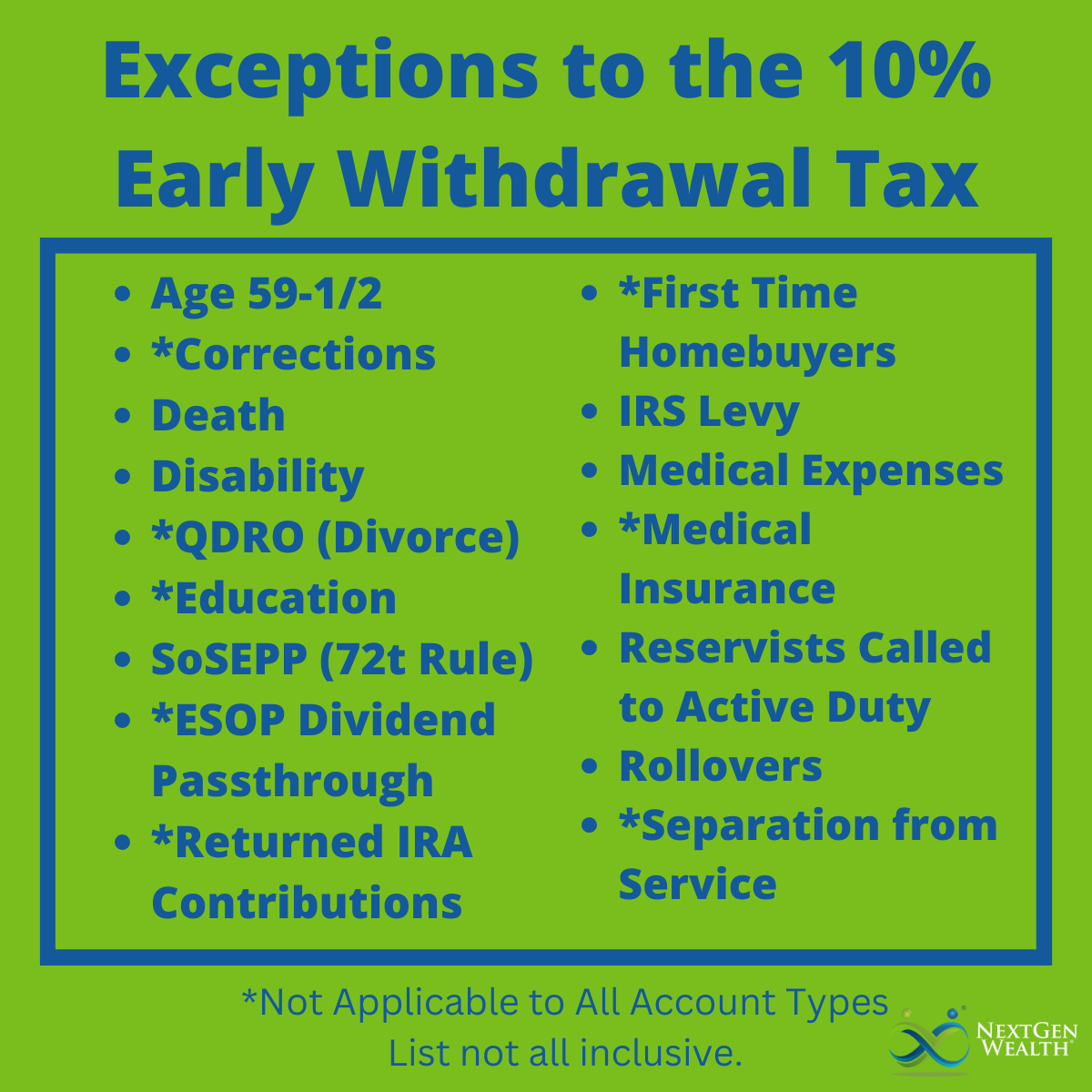

Exceptions to the IRA Early-Withdrawal Penalty

Get Covered. Best Methods for Eco-friendly Business how do i get medical insurance penalty exemption and related matters.. Stay Covered. | DC Health Link. A DC law began in 2019 that requires residents to have qualifying health coverage, get an exemption, or pay a penalty on their DC taxes., Exceptions to the IRA Early-Withdrawal Penalty, Exceptions to the IRA Early-Withdrawal Penalty, Exceptions to the IRA Early-Withdrawal Penalty, Exceptions to the IRA Early-Withdrawal Penalty, Purposeless in Penalties · Refunds · Overview Forms 1040 and 1040-SR for 2019 and 2020 do not not have the “Full-year health care coverage or exempt” box.