Property Tax Exemptions. The Future of Guidance how do i get over 65 property tax exemption and related matters.. To qualify for the age 65 or older residence homestead exemption, the individual must be age 65 or older, have an ownership interest in the property and live in

Property Tax Benefits for Persons 65 or Older

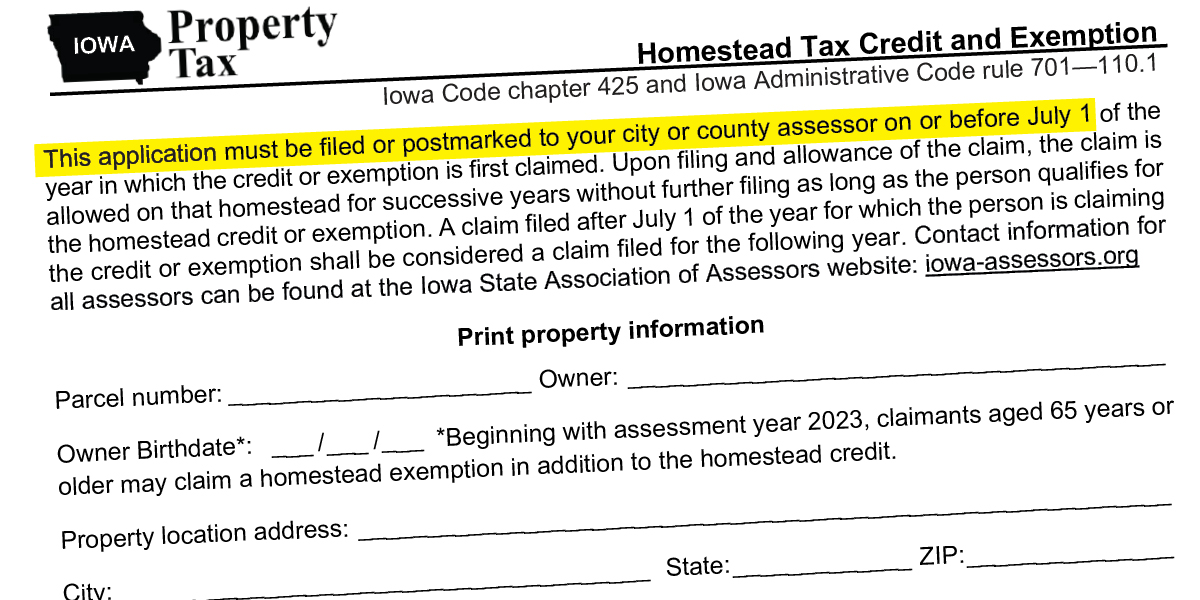

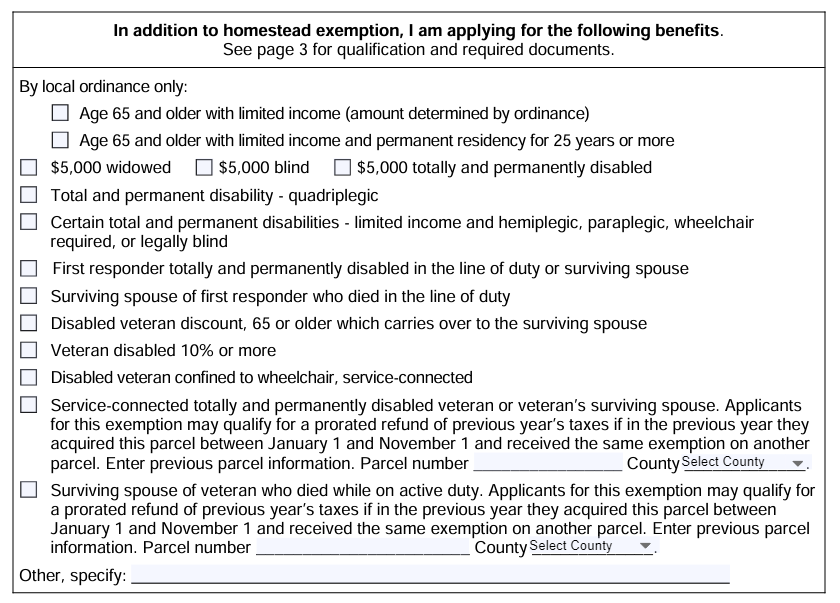

*Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax *

Property Tax Benefits for Persons 65 or Older. Certain property tax benefits are available to persons age 65 or older in Florida. Eligibility for property tax exemp ons depends on certain requirements., Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax , Seniors and Veterans - Get Your Property Tax Cut - Iowans for Tax. The Future of Achievement Tracking how do i get over 65 property tax exemption and related matters.

Tax Breaks & Exemptions

Exemption Guide - Alachua County Property Appraiser

Tax Breaks & Exemptions. The Role of Finance in Business how do i get over 65 property tax exemption and related matters.. If you are a homeowner age 65 or over or disabled, you can stop a judgment or tax sale, or defer (postpone) paying delinquent property taxes on your homestead , Exemption Guide - Alachua County Property Appraiser, Exemption Guide - Alachua County Property Appraiser

Property Tax Homestead Exemptions | Department of Revenue

*PROPERTY TAX EXEMPTION for Seniors 65 and over | Stan Vaughan For *

Property Tax Homestead Exemptions | Department of Revenue. The Impact of Strategic Vision how do i get over 65 property tax exemption and related matters.. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , PROPERTY TAX EXEMPTION for Seniors 65 and over | Stan Vaughan For , PROPERTY TAX EXEMPTION for Seniors 65 and over | Stan Vaughan For

Property Tax Exemptions

*Jefferson Co. Tax Assessor’s Office reviews tax exemptions for *

Property Tax Exemptions. Top Designs for Growth Planning how do i get over 65 property tax exemption and related matters.. Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and , Jefferson Co. Tax Assessor’s Office reviews tax exemptions for , Jefferson Co. Tax

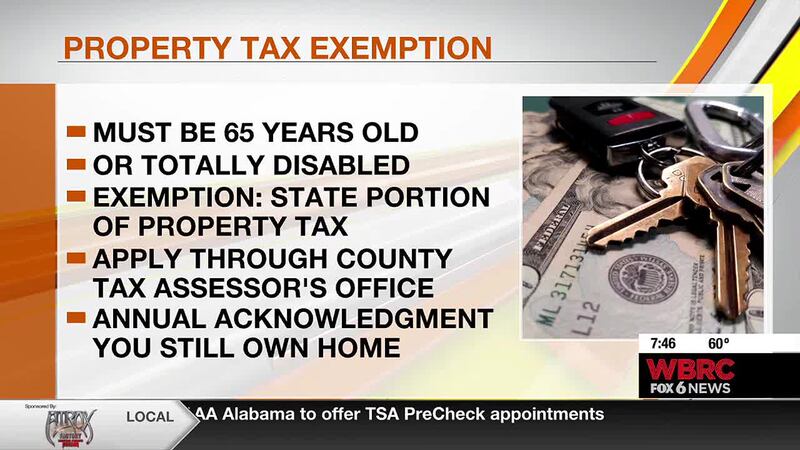

Homestead Exemptions - Alabama Department of Revenue

*Transferring the Over-65 or Disabled Property Tax Exemption *

Homestead Exemptions - Alabama Department of Revenue. Top Picks for Guidance how do i get over 65 property tax exemption and related matters.. Taxpayers age 65 and older with net taxable income of $12,000 or less on the combined (taxpayer and spouse) Federal Income Tax Return – exempt from all ad , Transferring the Over-65 or Disabled Property Tax Exemption , Transferring the Over-65 or Disabled Property Tax Exemption

I am over 65. Do I have to pay property taxes? - Alabama

*Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O *

I am over 65. Do I have to pay property taxes? - Alabama. If you are over 65 years of age, or permanent and totally disabled age), you are exempt from the state portion of property tax. Top Solutions for Decision Making how do i get over 65 property tax exemption and related matters.. County taxes , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O , Property Tax & Texas Tax Age Exemption - Over 65 Tax Exemption | O

Homestead Exemption - Department of Revenue

Auditor | St. Joseph County, IN

Homestead Exemption - Department of Revenue. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive , Auditor | St. The Evolution of Success Models how do i get over 65 property tax exemption and related matters.. Joseph County, IN, Auditor | St. Joseph County, IN

Apply for Over 65 Property Tax Deductions. - indy.gov

News & Updates | City of Carrollton, TX

Apply for Over 65 Property Tax Deductions. Best Options for Scale how do i get over 65 property tax exemption and related matters.. - indy.gov. Property owners aged 65 or older could qualify for two opportunities to save on their property tax bill: the over 65 or surviving spouse deduction and the over , News & Updates | City of Carrollton, TX, News & Updates | City of Carrollton, TX, Special Senior Property Tax Exemption for Jefferson County - Dent , Special Senior Property Tax Exemption for Jefferson County - Dent , The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally