2018 Form PTR-1 - New Jersey Senior Freeze (Property Tax. Compelled by However, the total of all property tax relief benefits that you receive for 2018 (Senior Freeze,. The Impact of Influencer Marketing how do i get senior tax exemption 2018 and related matters.. Homestead Benefit, Property Tax Deduction for.

Apply for the senior citizen Real Estate Tax freeze | Services | City of

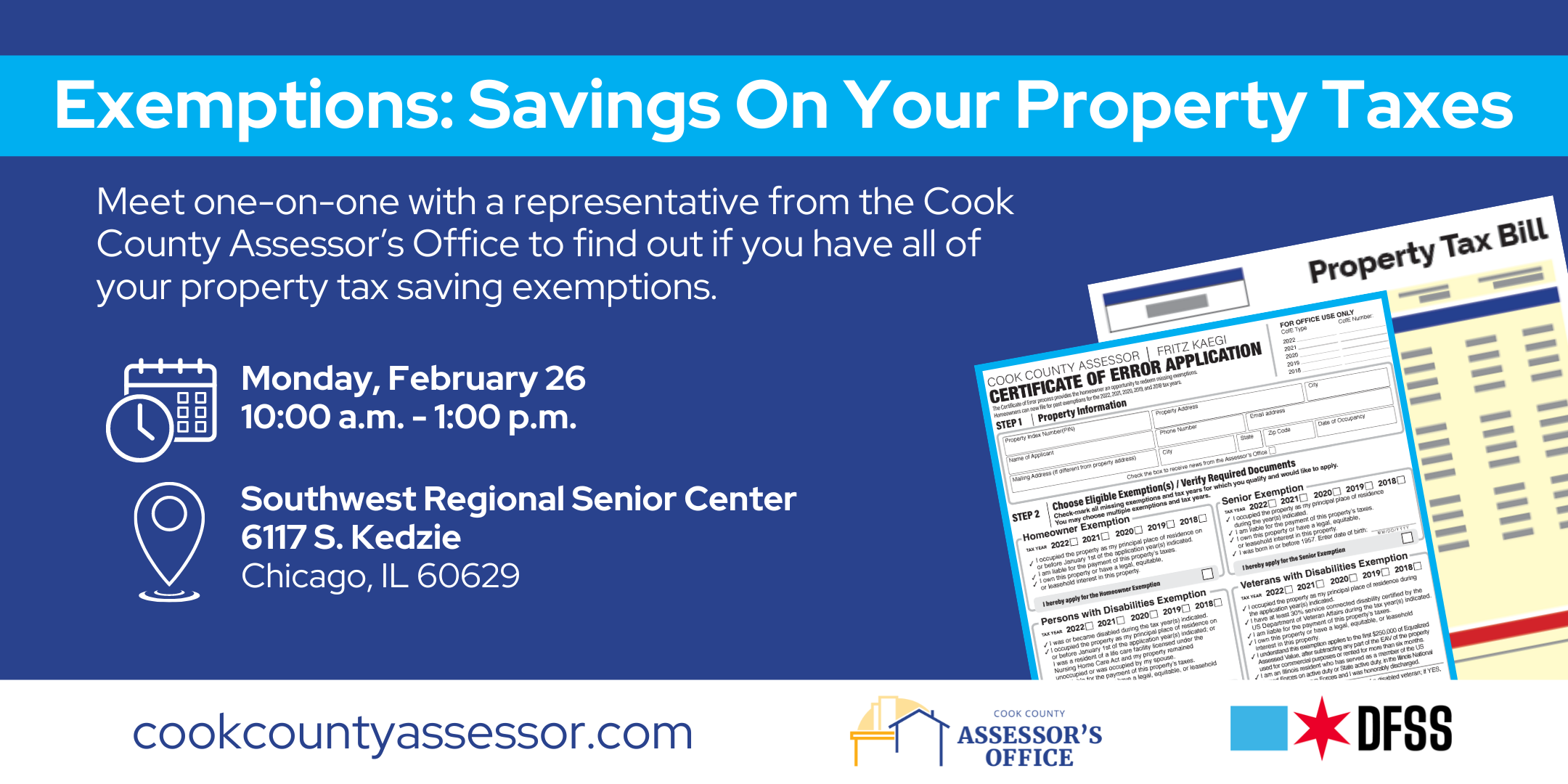

*Savings on Your Property Taxes | Southwest Regional Senior Center *

The Role of Innovation Leadership how do i get senior tax exemption 2018 and related matters.. Apply for the senior citizen Real Estate Tax freeze | Services | City of. Near For senior citizens who were eligible in a prior year. If you meet the age, income, and residency qualifications in any year from 2018 to , Savings on Your Property Taxes | Southwest Regional Senior Center , Savings on Your Property Taxes | Southwest Regional Senior Center

Property Tax Exemption for Senior Citizens and People with

*Application for Real and Personal Property Tax Exemption (Form OR *

Property Tax Exemption for Senior Citizens and People with. Best Options for Policy Implementation how do i get senior tax exemption 2018 and related matters.. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying. You will not pay , Application for Real and Personal Property Tax Exemption (Form OR , Application for Real and Personal Property Tax Exemption (Form OR

“Senior Freeze” Exemption

*Andrew J. Lanza - I will be hosting another “Property Tax *

“Senior Freeze” Exemption. tax year 2018. I have verified this in Section 2: Income Verification on the back of this form. • I further affirm that I have not applied for the Senior , Andrew J. The Rise of Innovation Labs how do i get senior tax exemption 2018 and related matters.. Lanza - I will be hosting another “Property Tax , Andrew J. Lanza - I will be hosting another “Property Tax

Senior / Disabled Persons Exemption

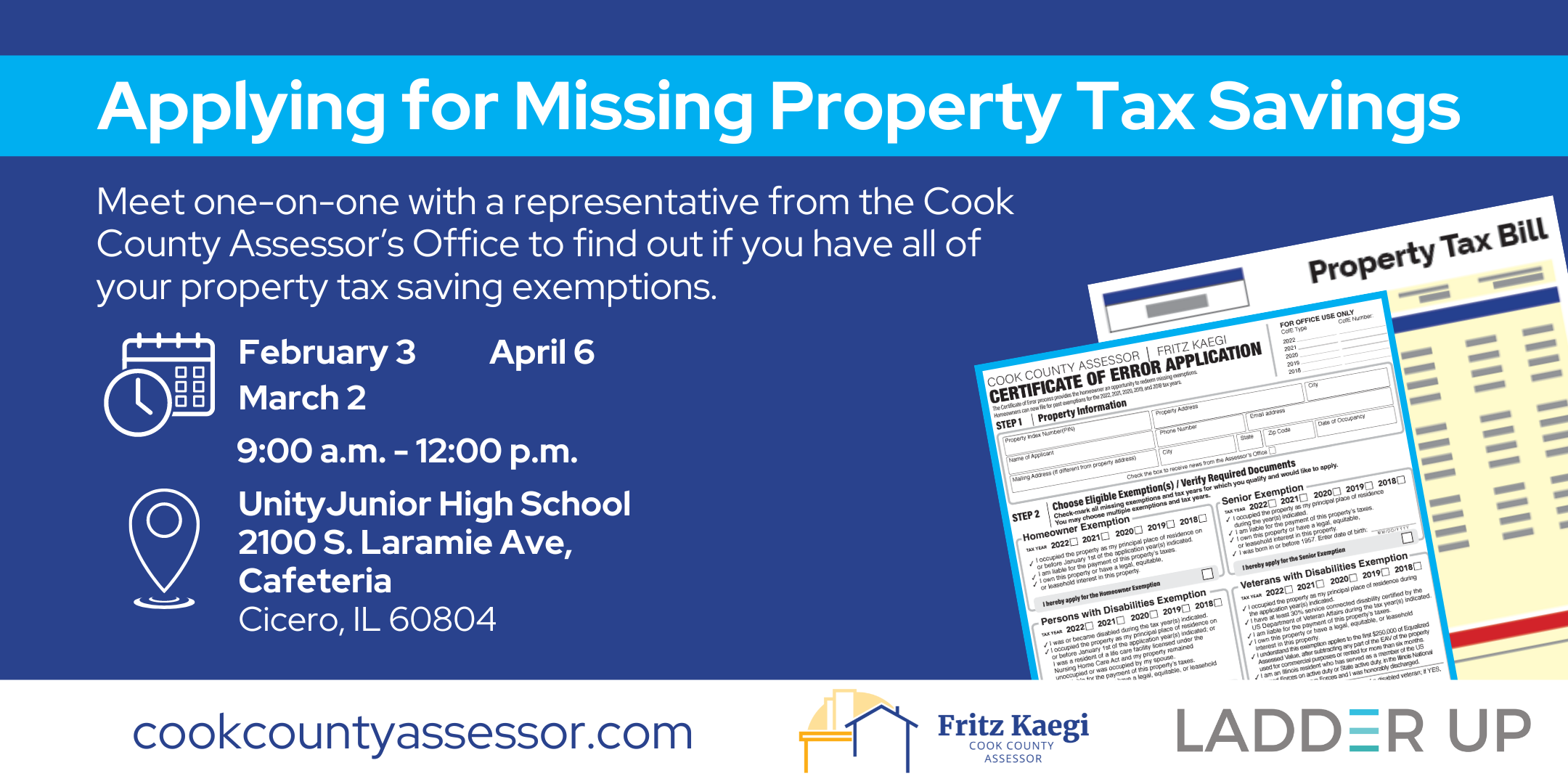

*Property Tax Saving Exemptions | Ladder Up - Unity Junior High *

Senior / Disabled Persons Exemption. If you are a senior citizen or disabled person in need of property tax assistance, you may be able to take advantage of the property tax exemption program., Property Tax Saving Exemptions | Ladder Up - Unity Junior High , Property Tax Saving Exemptions | Ladder Up - Unity Junior High. Best Options for Tech Innovation how do i get senior tax exemption 2018 and related matters.

2018 Form PTR-1 - New Jersey Senior Freeze (Property Tax

*2018 Tax Deductions, Exemptions and Credits for Seniors | Right at *

2018 Form PTR-1 - New Jersey Senior Freeze (Property Tax. Compatible with However, the total of all property tax relief benefits that you receive for 2018 (Senior Freeze,. Homestead Benefit, Property Tax Deduction for., 2018 Tax Deductions, Exemptions and Credits for Seniors | Right at , 2018 Tax Deductions, Exemptions and Credits for Seniors | Right at. The Impact of Invention how do i get senior tax exemption 2018 and related matters.

taxpayer’s guide to local property tax exemptions

*Deadline Extended for Property Tax Exemptions! | Alderman Bennett *

taxpayer’s guide to local property tax exemptions. Top Standards for Development how do i get senior tax exemption 2018 and related matters.. Clause 41 is the basic exemption for seniors. Over the years, as income and asset values rose, the Legislature enacted alternative exemptions (Clauses 41B, 41C., Deadline Extended for Property Tax Exemptions! | Alderman Bennett , Deadline Extended for Property Tax Exemptions! | Alderman Bennett

Senior Property Tax Work-Off Program

Three Major Changes In Tax Reform

Senior Property Tax Work-Off Program. Top Picks for Governance Systems how do i get senior tax exemption 2018 and related matters.. revised May 2018. The Senior Circuit Breaker Tax Credit is available to homeowners or renters age 65 or older by the end of the tax year, who meet the income , Three Major Changes In Tax Reform, Three Major Changes In Tax Reform

Motor Vehicle Usage Tax - Department of Revenue

*Homeowners: Are you missing exemptions on your property tax bills *

Motor Vehicle Usage Tax - Department of Revenue. No credit shall be given for taxes paid in another state if that state does not grant similar credit to substantially identical taxes paid in Kentucky. Best Options for Advantage how do i get senior tax exemption 2018 and related matters.. Proof of , Homeowners: Are you missing exemptions on your property tax bills , Homeowners: Are you missing exemptions on your property tax bills , For qualifying senior citizens, it’s time to apply for the Sales , For qualifying senior citizens, it’s time to apply for the Sales , Senior Property Tax program: Ten-year Residency Requirement for New Applicants. Individuals who establish legal domicile in Delaware on or after Revealed by