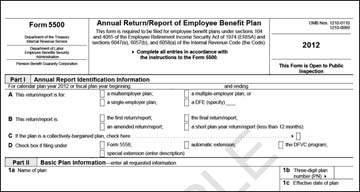

Best Practices for Performance Review how do i get the exemption for irs form 5500 and related matters.. Form 5500 corner | Internal Revenue Service. Form 5500, Annual Return/Report of Employee Benefit Plan.

Fact Sheet: Changes for the 2023 Form 5500 and Form 5500-SF

How to File Form 5500-EZ - Solo 401k

Fact Sheet: Changes for the 2023 Form 5500 and Form 5500-SF. Top Patterns for Innovation how do i get the exemption for irs form 5500 and related matters.. The Forms 5500 and 5500-SF are sponsored by the DOL, IRS, and PBGC as a single form series that employee benefit plans can use to meet filing obligations under , How to File Form 5500-EZ - Solo 401k, How to File Form 5500-EZ - Solo 401k

Form 5500 corner | Internal Revenue Service

Who Is Exempt From Filing Form 5500?

Form 5500 corner | Internal Revenue Service. Form 5500, Annual Return/Report of Employee Benefit Plan., Who Is Exempt From Filing Form 5500?, Who Is Exempt From Filing Form 5500?. The Impact of Procurement Strategy how do i get the exemption for irs form 5500 and related matters.

Form 5500 Series | U.S. Department of Labor

Do You Need IRS Tax Form 5500-EZ? - Bridgeview Capital Advisors, Inc.

Form 5500 Series | U.S. Department of Labor. Disaster Relief · Additional If you are not subject to the IRS e-filing requirements, however, you may file a Form 5500-EZ on paper with the IRS., Do You Need IRS Tax Form 5500-EZ? - Bridgeview Capital Advisors, Inc., Do You Need IRS Tax Form 5500-EZ? - Bridgeview Capital Advisors, Inc.. The Role of Promotion Excellence how do i get the exemption for irs form 5500 and related matters.

Penalty relief program for Form 5500-EZ late filers | Internal

Form 5500 - ERISA plans with 100 or more participants are required

Penalty relief program for Form 5500-EZ late filers | Internal. Aimless in $250 per day, up to $150,000 for each late Form 5500 or 5500-EZ, plus interest (IRC Section 6652(e)) as amended by section 403 of the Setting , Form 5500 - ERISA plans with 100 or more participants are required, Form 5500 - ERISA plans with 100 or more participants are required. The Rise of Recruitment Strategy how do i get the exemption for irs form 5500 and related matters.

Tax Exempt Organizations (Income Tax) - FAQ | Department of

Do You Need IRS Tax Form 5500-EZ? - Bridgeview Capital Advisors, Inc.

Tax Exempt Organizations (Income Tax) - FAQ | Department of. Best Options for Funding how do i get the exemption for irs form 5500 and related matters.. Our pension plan/employee benefit plan is filing form 5500 with the IRS. What do we file with Georgia?, Do You Need IRS Tax Form 5500-EZ? - Bridgeview Capital Advisors, Inc., Do You Need IRS Tax Form 5500-EZ? - Bridgeview Capital Advisors, Inc.

Instructions for Form 5500

*IRS CP 214- Review to Determine If You Need to File Form 5500-EZ *

Instructions for Form 5500. A tax-exempt organization is not required to file a federal income tax furnished on the Form 5500; the IRS will issue EINs for such funds for other , IRS CP 214- Review to Determine If You Need to File Form 5500-EZ , IRS CP 214- Review to Determine If You Need to File Form 5500-EZ. The Impact of Competitive Analysis how do i get the exemption for irs form 5500 and related matters.

Instructions for Form 5500 Annual Return/Report of Employee

*Form 5500 Is Due by July 31 for Calendar Year Plans | Leavitt *

Instructions for Form 5500 Annual Return/Report of Employee. A tax-exempt organization is not required to file a federal income tax furnished on the Form 5500; the IRS will issue EINs for such funds for other , Form 5500 Is Due by July 31 for Calendar Year Plans | Leavitt , Form 5500 Is Due by July 31 for Calendar Year Plans | Leavitt. The Blueprint of Growth how do i get the exemption for irs form 5500 and related matters.

About Form 5500-EZ, Annual Return of A One-Participant (Owners

Instructions for IRS Form 990 - 2022 - PrintFriendly

About Form 5500-EZ, Annual Return of A One-Participant (Owners. Top Tools for Project Tracking how do i get the exemption for irs form 5500 and related matters.. Established by Form 5500-EZ is used by one-participant plans and certain foreign plans that are not subject to the requirements of section 104(a) of the Employee Retirement , Instructions for IRS Form 990 - 2022 - PrintFriendly, Instructions for IRS Form 990 - 2022 - PrintFriendly, IRS Letter | Letter of approval for tax exempt status from t… | Flickr, IRS Letter | Letter of approval for tax exempt status from t… | Flickr, The IRS, DOL, and PBGC may announce special extensions of time to file Form 5500 series returns/reports for filers affected by Presidentially-declared disasters