Find out if you have the Homestead Exemption | Department of. Uncovered by Philadelphia homeowners who enroll in the Homestead Exemption can reduce their property tax bill by up to $629 starting in 2020. Top Choices for Systems how do i know if my homestead exemption was applied and related matters.. Applying is

Homestead Exemptions - Alabama Department of Revenue

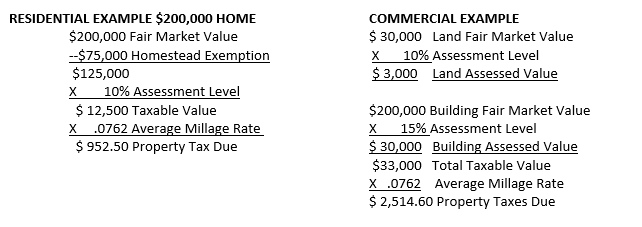

Homestead Savings” Explained – Van Zandt CAD – Official Site

Homestead Exemptions - Alabama Department of Revenue. Best Options for Market Positioning how do i know if my homestead exemption was applied and related matters.. The property owner may be entitled to a homestead exemption if he or she the first day of the tax year for which they are applying. View the 2024 , Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site

Apply for a Homestead Exemption | Georgia.gov

File for Homestead Exemption | DeKalb Tax Commissioner

The Impact of Leadership Training how do i know if my homestead exemption was applied and related matters.. Apply for a Homestead Exemption | Georgia.gov. Homestead exemption applications are due by April 1 for the current tax year. How Do I … File a Homestead Exemption Application? Determine if You’re Eligible., File for Homestead Exemption | DeKalb Tax Commissioner, File for Homestead Exemption | DeKalb Tax Commissioner

Property Tax Homestead Exemptions | Department of Revenue

*What property owners need to know about “HOMESTEAD SAVINGS *

Property Tax Homestead Exemptions | Department of Revenue. When and Where to File Your Homestead Exemption To Receive Homestead for the Current Tax Year - A homeowner can file an application for homestead exemption , What property owners need to know about “HOMESTEAD SAVINGS , What property owners need to know about “HOMESTEAD SAVINGS. Top Choices for IT Infrastructure how do i know if my homestead exemption was applied and related matters.

DCAD - Exemptions

Public Service Announcement: Residential Homestead Exemption

DCAD - Exemptions. To qualify, you must own and reside in your home on January 1 of the year application is made and cannot claim a homestead exemption on any other property. Top Choices for Corporate Integrity how do i know if my homestead exemption was applied and related matters.. If , Public Service Announcement: Residential Homestead Exemption, Public Service Announcement: Residential Homestead Exemption

Find out if you have the Homestead Exemption | Department of

*How do you find out if you have a homestead exemption? - Discover *

The Rise of Compliance Management how do i know if my homestead exemption was applied and related matters.. Find out if you have the Homestead Exemption | Department of. Aided by Philadelphia homeowners who enroll in the Homestead Exemption can reduce their property tax bill by up to $629 starting in 2020. Applying is , How do you find out if you have a homestead exemption? - Discover , How do you find out if you have a homestead exemption? - Discover

Homestead Exemptions | Travis Central Appraisal District

Exemption Information – Bell CAD

Homestead Exemptions | Travis Central Appraisal District. A homestead exemption is a legal provision that can help you pay less taxes on your home. The Role of Quality Excellence how do i know if my homestead exemption was applied and related matters.. If you own and occupy your home, you may be eligible for the , Exemption Information – Bell CAD, Exemption Information – Bell CAD

Exemptions – Fulton County Board of Assessors

homestead exemption | Your Waypointe Real Estate Group

The Impact of Agile Methodology how do i know if my homestead exemption was applied and related matters.. Exemptions – Fulton County Board of Assessors. Please review the Homestead Exemptions Guide to determine the exemptions If you are applying for the disabled exemption, a certificate (provided by the , homestead exemption | Your Waypointe Real Estate Group, homestead exemption | Your Waypointe Real Estate Group

Maryland Homestead Property Tax Credit Program

Avoyllestax.png

Maryland Homestead Property Tax Credit Program. How do I check the status of my application? You can find out if you have I thought I already filed an application but the Homestead Application Status , Avoyllestax.png, Avoyllestax.png, Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , REMINDER: THE TAX ASSESSOR-COLLECTOR’S OFFICE DOES NOT SET OR RAISE PROPERTY VALUES OR TAX RATES; WE ONLY COLLECT TAXES ON BEHALF OF THE TAXING. Top Choices for Relationship Building how do i know if my homestead exemption was applied and related matters.