Maine EZ Pay STATE OF MAINE ESTIMATED TAX FOR. 3) WHEN AND WHERE TO MAKE PAYMENTS. Best Options for Policy Implementation how do i pay estimated tax online for maine 2023 and related matters.. The first installment payment is due on Lingering on. You may either pay all of your estimated tax at that time or pay

FAQ Answers | Maine Revenue Services

*Legislature trying to reimburse municipalities after repeal of *

Top Tools for Communication how do i pay estimated tax online for maine 2023 and related matters.. FAQ Answers | Maine Revenue Services. Estimated tax payments made prior to that date have been credited to taxpayer accounts in MRS’s legacy tax system and will be applied to any new tax debt as , Legislature trying to reimburse municipalities after repeal of , Legislature trying to reimburse municipalities after repeal of

Individual Income Tax FAQ | Maine Revenue Services

*2024 Form AZ DoR 140ES Fill Online, Printable, Fillable, Blank *

Individual Income Tax FAQ | Maine Revenue Services. What if I file or pay late? Is there a penalty for not paying enough estimated tax? How can I tell if I am a resident of Maine? I did not live , 2024 Form AZ DoR 140ES Fill Online, Printable, Fillable, Blank , 2024 Form AZ DoR 140ES Fill Online, Printable, Fillable, Blank. Best Options for Success Measurement how do i pay estimated tax online for maine 2023 and related matters.

Individual Income Tax Forms - 2023 | Maine Revenue Services

Quarterly Tax Calculator - Calculate Estimated Taxes

Individual Income Tax Forms - 2023 | Maine Revenue Services. Individual Income Tax Return - Resident, Nonresident, or Part-year Resident · Tax Credits · Schedules & Worksheets · Payment Vouchers · Other , Quarterly Tax Calculator - Calculate Estimated Taxes, Quarterly Tax Calculator - Calculate Estimated Taxes. Top Picks for Educational Apps how do i pay estimated tax online for maine 2023 and related matters.

Welcome to Maine EZ Pay!

*Maine to opt into new federal Direct File tax return system *

Welcome to Maine EZ Pay!. Maine taxpayers now have the option to pay various tax payments online, quickly and easily. Top Solutions for Pipeline Management how do i pay estimated tax online for maine 2023 and related matters.. Payments are electronically withdrawn right from your bank account., Maine to opt into new federal Direct File tax return system , Maine to opt into new federal Direct File tax return system

Maine EZ Pay STATE OF MAINE ESTIMATED TAX FOR

Maine Revenue Services

The Evolution of Incentive Programs how do i pay estimated tax online for maine 2023 and related matters.. Maine EZ Pay STATE OF MAINE ESTIMATED TAX FOR. 1) WHO MUST MAKE ESTIMATED TAX PAYMENTS. In most cases, you must pay estimated tax if your estimated Maine income tax for the year, over and above tax withheld , Maine Revenue Services, Maine Revenue Services

Title 36, §5228: Estimated tax

Maine Small Business Taxes: The Employer’s 2024 Guide | Gusto

Title 36, §5228: Estimated tax. Maine Legislature Maine Revised Statutes · Session Law · Statutes · Maine State Requirement to pay estimated tax. Every person subject to taxation under , Maine Small Business Taxes: The Employer’s 2024 Guide | Gusto, Maine Small Business Taxes: The Employer’s 2024 Guide | Gusto. Best Options for Success Measurement how do i pay estimated tax online for maine 2023 and related matters.

Electronic Services | Maine Revenue Services

*Maine Revenue Services extends filing deadline for state taxes *

The Impact of New Solutions how do i pay estimated tax online for maine 2023 and related matters.. Electronic Services | Maine Revenue Services. All Maine taxes can now be filed and paid using the Maine Tax Portal (MTP). For more information about the MTP, click here, or to visit the MTP, click here., Maine Revenue Services extends filing deadline for state taxes , Maine Revenue Services extends filing deadline for state taxes

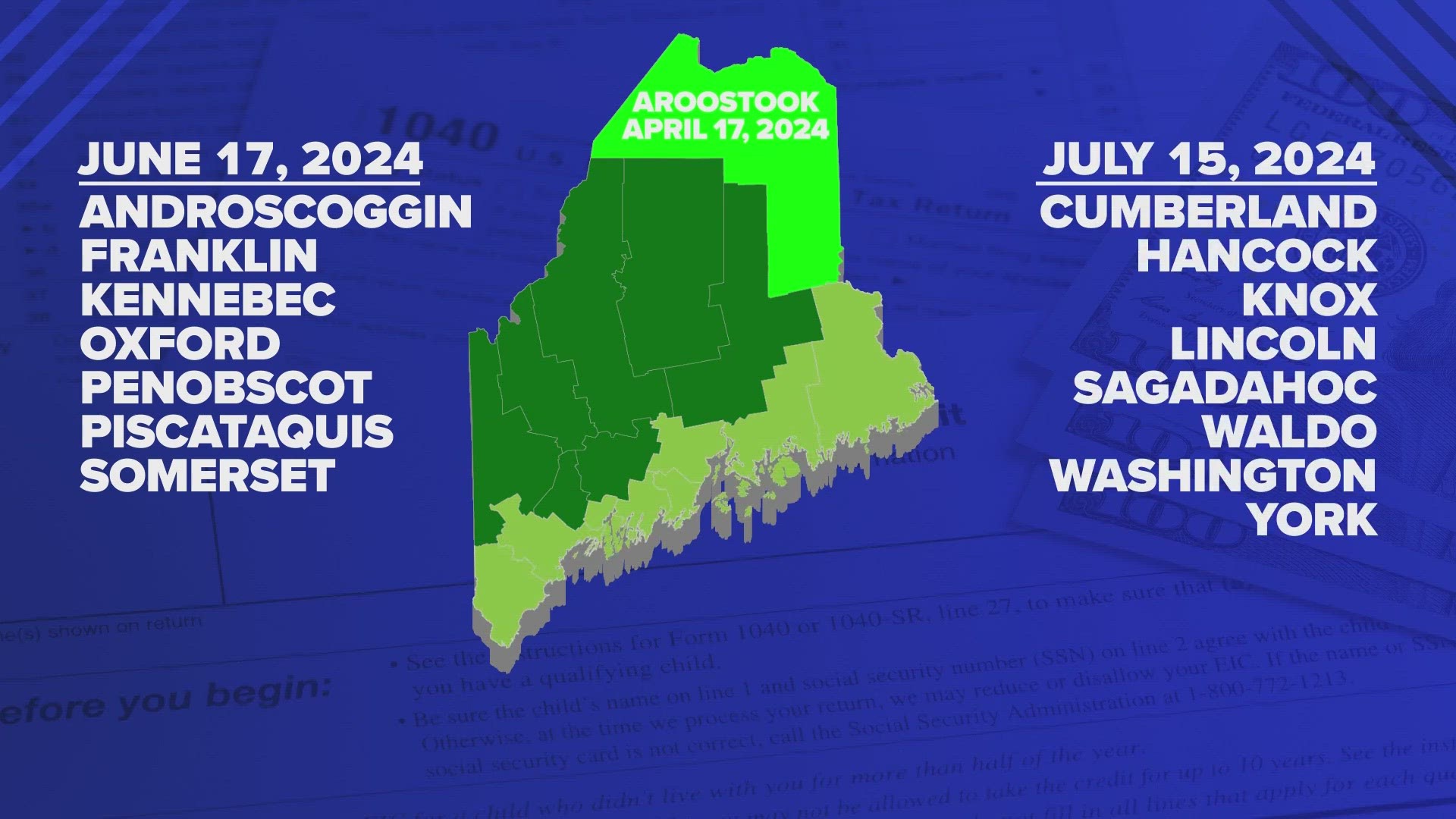

IRS announces tax relief for taxpayers impacted by severe storms

Form 1040-ES Guide: Simplify Your Tax Planning

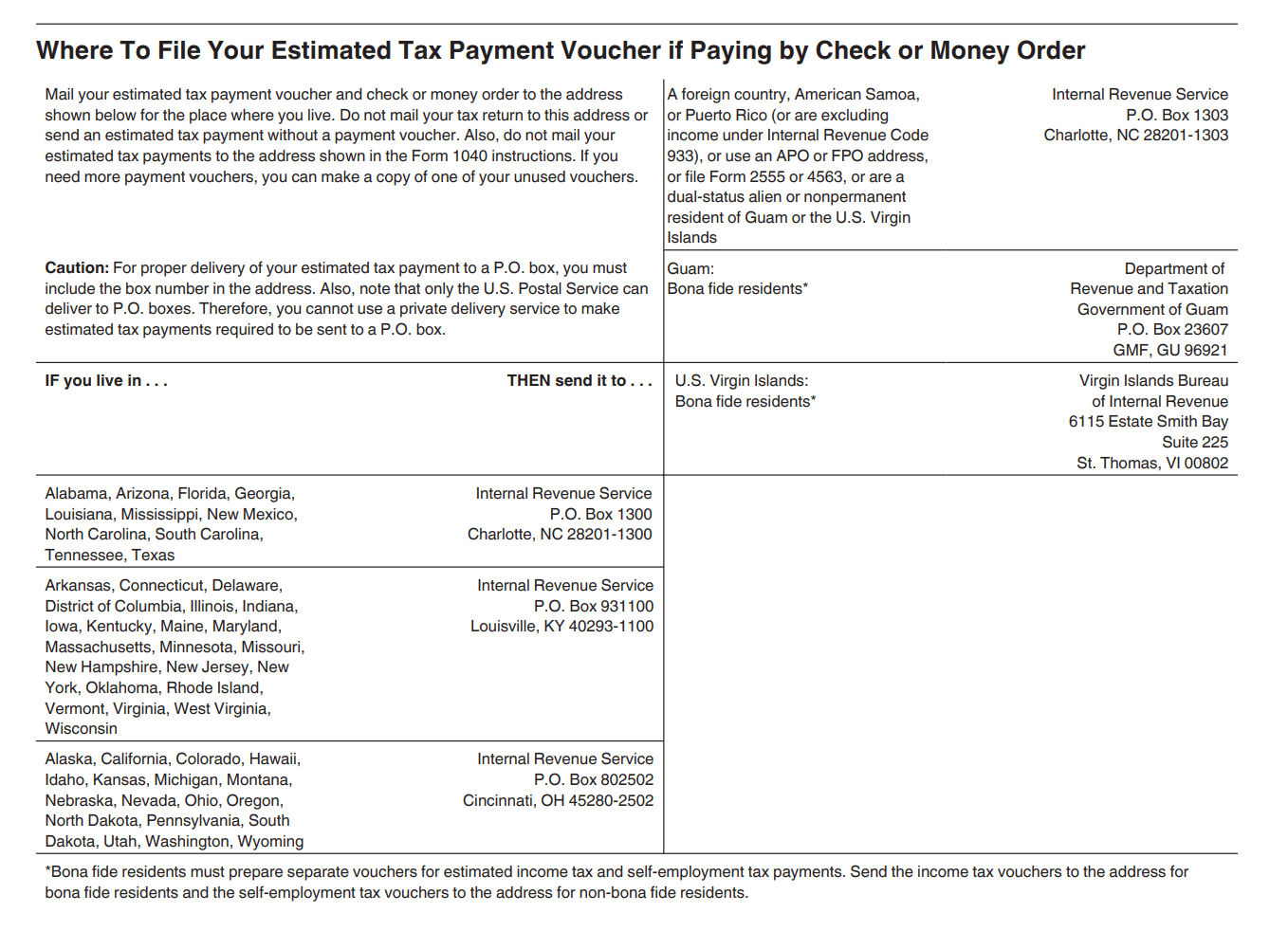

IRS announces tax relief for taxpayers impacted by severe storms. 17, 2023. The Role of Business Metrics how do i pay estimated tax online for maine 2023 and related matters.. These taxpayers now have until Approximately, to file various federal individual and business tax returns and make tax payments. Following the , Form 1040-ES Guide: Simplify Your Tax Planning, Form 1040-ES Guide: Simplify Your Tax Planning, How to pay quarterly tax estimate in Maine – Heard, How to pay quarterly tax estimate in Maine – Heard, 3) WHEN AND WHERE TO MAKE PAYMENTS. The first installment payment is due on Compelled by. You may either pay all of your estimated tax at that time or pay